Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

If you drop out of a course or leave college, you may have to pay back all or part of the financial aid you received. How much depends on the type of financial aid and when you dropped out of the course or left school.

Although the Federal Pell Grant is a grant that does not normally have to be repaid, under certain circumstances it may be necessary to repay the grant in whole or in part.

And let's face it, even the best students can drop out from time to time. Here's how dropping a course or even dropping out of college will affect your financial aid.

Cancel a course

Dropping a course may affect your enrollment status. Changes to your enrollment status may affect your eligibility for financial aid, depending on when you dropped the course.

If you are no longer enrolled full-time, your Federal Pell Grant amount may be reduced in proportion to your enrollment status. Prorated options include full-time, three-quarter-time, half-time, and less than half-time.

Twelve credit points per semester apply Full-time for the purposes of state student funding. This applies even though you must earn 15 credits per semester within four years to obtain the undergraduate bachelor's degree.

Student loan eligibility is not prorated as long as you are enrolled at least half-time. If you are enrolled at least half-time, you can use the full loan limit. However, if your enrollment falls below half-time, you will lose your eligibility for federal student loans entirely and may be required to repay your existing loans.

Here's why timing is important

If you cancel a course…

- Before the start of the semester and before the grant is paid out: Your financial aid will be adjusted before disbursement and you are not obligated to repay your financial aid.

- After financial aid is disbursed but before your college's registration/withdrawal deadline: Your financial aid will be adjusted and you may then be required to repay all or part of the financial aid you received.

- After payment of financial support and after the registration/deregistration deadline has expired: Your financial aid will not be adjusted. You may still be required to pay tuition. Most colleges will not provide a tuition refund if you drop a course after the registration/withdrawal date.

School is expensive. Here you can find ways to pay for school.

What to do if you drop out of college?

If you drop out of college, a complicated set of rules called Return of Title IV (R2T4) applies, which determines how dropping out affects your eligibility for federal student aid.

The following summary covers only the essentials.

Federal student aid is earned pro rata until 60% of the semester is completed, at which point you are considered to have earned 100% of your financial aid.

Unearned aid must be repaid. If you drop out after reaching the 60% mark, your federal student aid does not have to be repaid to the federal government. Learn more about when you must repay grants.

Federal loans must be repaid before grants can be awarded. The goal is to leave students with as little debt as possible when they leave.

Note that college refund policies do not necessarily reflect R2T4 rules. Many colleges do not provide refunds if a student withdraws after the registration/withdrawal date.

Do you have to pay back your student loans?

If you drop out of college or study less than half-time, you will have to start repaying your student loan. Repayment of your loans begins six months after you graduate, drop out, or complete less than half of your enrollment.

If you re-enroll in college for at least half time, you won't have to make payments on your federal student loans. This is because your federal student loans will again be in forbearance while you attend college. If you re-enroll during the six-month grace period, your grace period will be reinstated.

If you're having trouble repaying your student loans, there are a few options available to you to help you deal with your financial difficulties—some short-term, some long-term.

- Short term: Deferment in the event of economic hardship, deferment in the event of unemployment and general deferment. The deferments and deferrals suspend repayment for up to three years each. Interest may still accrue.

- Long term:

Income-driven repayment plans, where the monthly payment is based on your income rather than the amount you owe. Income-driven repayment plans often result in a lower monthly payment than extended or staggered repayments.

What happens if you have to pay back the financial support?

If you need to repay your Federal Pell Grant, you have 45 days to repay the overpayment or make satisfactory repayment arrangements.

Failure to repay the Federal Pell Grant may affect your ability to return to college or qualify for further financial aid. Some colleges will withhold your academic transcripts and diplomas if you owe the college and have not made satisfactory repayment arrangements.

Satisfactory Academic Progress (SAP)

Dropping courses may affect your future eligibility for federal student aid.

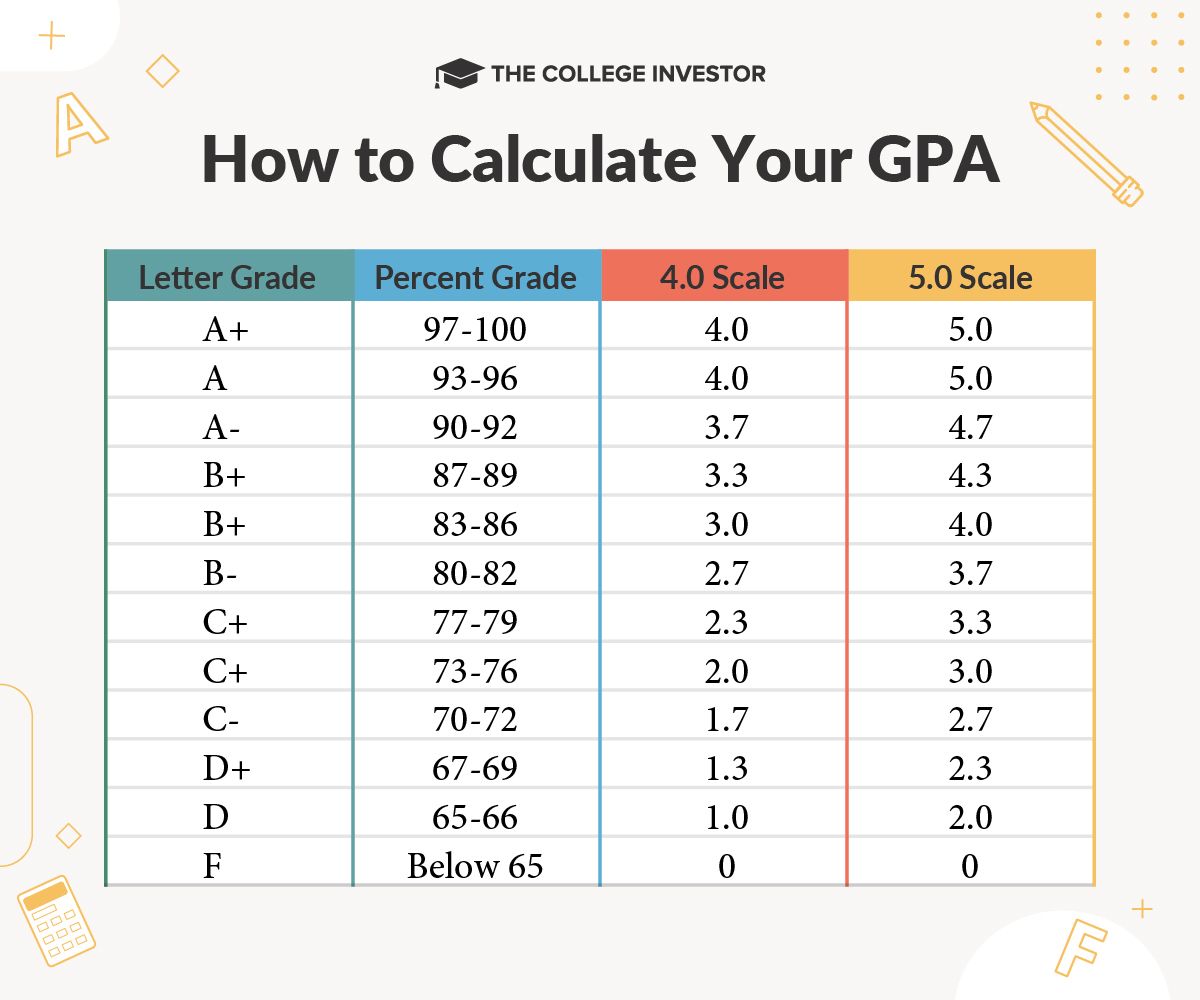

To be eligible for federal student aid, you must maintain Satisfactory Academic Progress (SAP). SAP requires you to maintain a grade point average of at least 2.0 on a 4.0 scale.

It also requires that you take and pass enough courses to be on track to complete your degree within 150% of the normal length of study (e.g., within 6 years for a bachelor's degree and within 3 years for an associate's degree).

Dropping courses may result in you losing SAP benefits and jeopardizing your eligibility for future assistance.

What should you do before you drop out of a course or quit your studies?

Before dropping a course or discontinuing your studies, contact the college's financial aid office and inquire about the impact on your financial aid.

You should also explore options other than dropping a course or quitting college. Most colleges offer academic support services, such as free tutoring, writing centers, and academic counseling centers, that can help you overcome academic challenges.

The financial aid office may also offer emergency financial aid if you anticipate dropping out due to financial problems. The goal of emergency aid is to help you stay in school so that small financial problems do not escalate.

Frequently Asked Questions

What happens if you fail an exam? Do you have to pay back the scholarships?

If you fail a course, you do not have to pay back your scholarships. Only if you drop out of a course or leave college, you may have to pay back your scholarships.

However, if you fail a course, you may lose your eligibility for future grants if you no longer make satisfactory academic progress.

If you fail a course, you will be required to make payments on your student loan after you graduate or enroll less than halfway through the course, just as if you had passed the course. You will not receive a refund if you fail a course.

Can I receive a Federal Pell Grant from more than one college?

You cannot receive a Federal Pell Grant from two colleges at the same time. If you happen to receive a Federal Pell Grant from two or more colleges, you will be required to repay the additional Federal Pell Grants. If a student receives two or more Federal Pell Grants at the same time, it will be noted in a federal database that tracks the federal grants and loans received by each student, and college financial aid administrators will be notified.

What about private scholarships?

Private scholarships have their own rules. Some scholarships follow the rules of federal student aid. Others require you to pay the money back in full if you drop out. Check with the private scholarship provider for the rules.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps