Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Which types of student loans are best?

This question concerns student loans.

There are different types of student loans and many families ask themselves: which is the best? The answer, like so many other things in personal financial planning, is: it mainly depends on that.

There are two main types of student loans: government student loans and private student loans.

Government student loans are offered by the government and are available in several different forms.

Private student loans are offered by private lenders, including banks, credit unions, and government nonprofit organizations.

The type of student loan that is best depends on your needs and situation. Some loans are not eligible for certain types of education. For example, some career and trade schools are not Title IV certified, which means you cannot receive federal student loans.

Other loan types are program-specific, such as Grad PLUS loans, a type of government loan offered exclusively to graduate and professional students.

Types of government student loans

There are four main types of federal student loans and some other nuances. The four main types are:

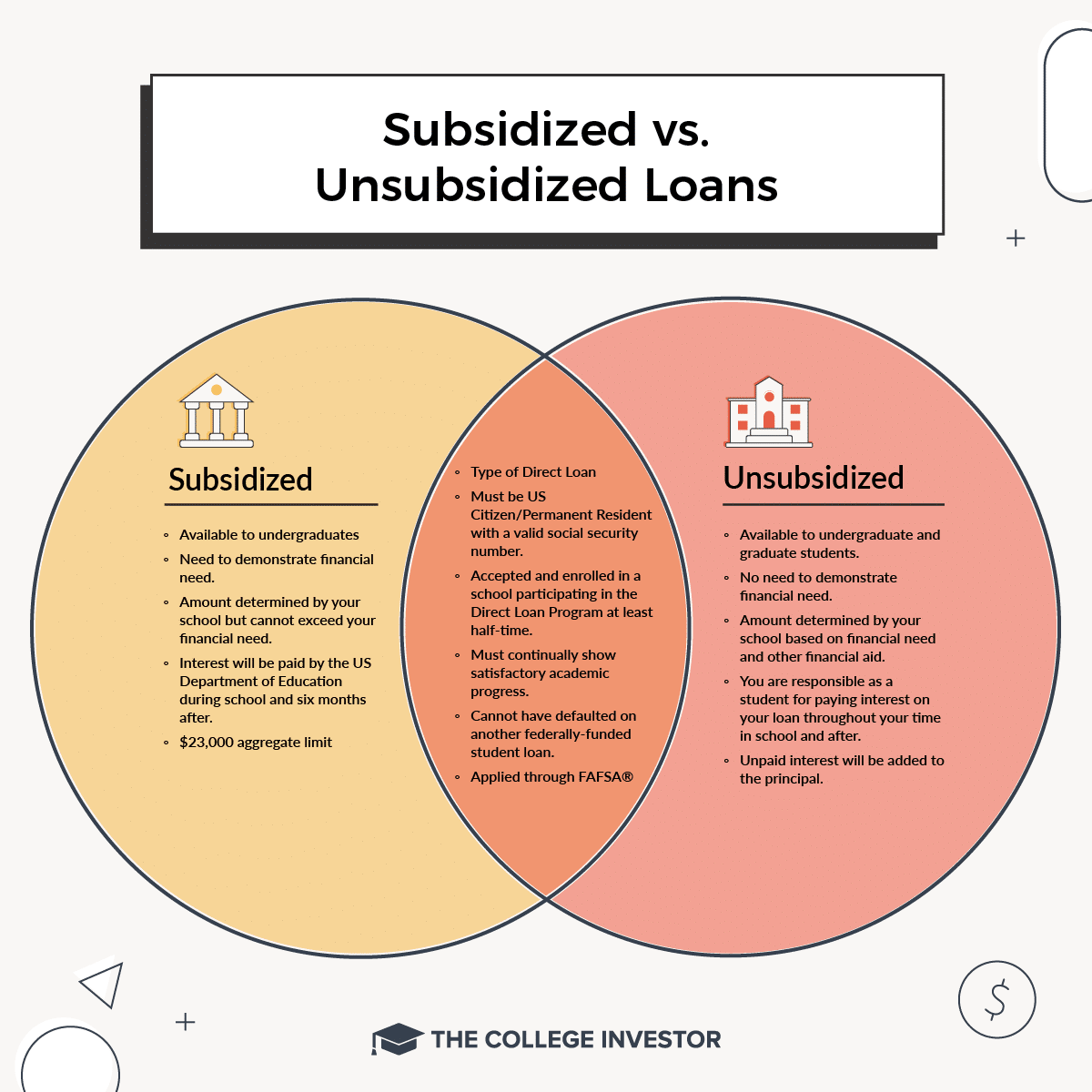

There are some variations within these main loan types. For example, direct subsidized loans are only available to undergraduate students. Direct unsubsidized loans are available to both undergraduate and graduate students, but are subject to certain loan limits.

Learn more about subsidized and unsubsidized student loans.

PLUS loans come in two variants: PLUS loans for parents and PLUS loans for graduates. PLUS loans for parents are loans granted to parents to finance their child's bachelor's degree. PLUS loans for graduates and professional students.

Finally, there are direct consolidation loans. These are loans you get when you consolidate your existing federal student loans.

Types of private student loans

There aren’t necessarily “types” of personal loans, but the option you get will depend on what type of lender is offering your personal loan.

Private loans are offered by banks, credit unions, direct lenders and government nonprofit organizations.

Banks and credit unions are pretty straightforward. One popular lender, for example, is PenFed Credit Union.

Direct lenders are companies like Earnest or SoFi.

State nonprofits are more “unknown” but include brands like Brazos and RISLA. State nonprofits sometimes offer discounts or better repayment terms to residents of their respective states (RISLA is Rhode Island, Brazos is Texas).

Private loans typically have no loan limits other than tuition fees. However, they do require a positive credit history and a solid income—meaning most students will need a parent as a co-signer.

Which type of student loan is best?

Almost all financial experts agree: undergraduate students should always take out direct loans up to the loan limit first.

If you need additional funds, it depends on.

For students, the choice is between parent loans and private loans. Parent loans offer some advantages, such as the possibility of debt repayment programs, but the disadvantages are that it is only a parent loan and the interest rates may be much higher for qualified borrowers.

Private loans can be a good option for parents with good income and good credit, especially considering that nonprofit lenders may have exceptionally low interest rates for borrowers from their own state. The downside is that private loans do not offer debt forgiveness and require parents to co-sign. Some lenders may offer a co-signing waiver, but this is not guaranteed.

For graduate students, both Direct and Grad PLUS loans are great choices, especially because both loans include debt forgiveness if you meet the requirements. It's rare that a student needs private loans for their graduate studies, but it is an option.

People also ask

What are the four types of government student loans?

The four main types of federal student loans are direct subsidized student loans, direct unsubsidized student loans, PLUS loans, and direct consolidation loans.

Which type of loan is best for students?

For students, government-subsidized and unsubsidized loans are usually best.

Which type of loan offers the best conditions?

All federal student loans offer generous terms such as income-driven repayment plans, hardship options, and debt forgiveness programs.

Related articles

Do Credit Unions Offer Student Loans? The 10 Best Private Student Loans The Best Private Student Loans Without Cosigners

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps