Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

TreasuryDirect is the U.S. government website where you can buy Treasury bonds directly from the government. If you can buy Treasury bonds from the government, is there any reason to use a broker?

In this article, you will learn about the differences between direct processing and processing via a broker.

We'll also show you some other options (like Fidelity or Schwab) where you can invest for free.

- Buy US Treasury bonds directly from the US Treasury

- Commission-free investing in bonds

- You cannot resell here, you must hold until maturity

Buy from TreasuryDirect

The TreasuryDirect website can be found at https://www.treasurydirect.gov. As you can tell by the .gov domain, the website is owned by the government. You can buy Treasury bonds directly from this website. However, you cannot sell them on the same website. More on that later.

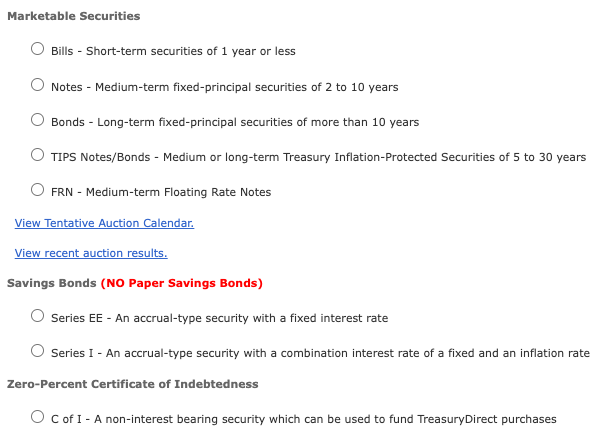

With TreasuryDirect you can purchase the following marketable securities:

- Treasury bills

- Remarks

- Tie up

- TIPS

- Savings bonds

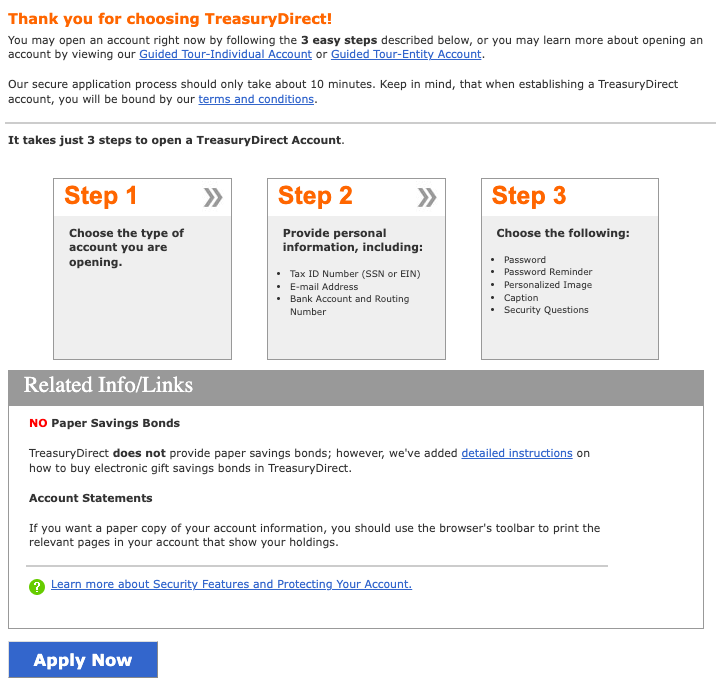

The first step in purchasing marketable securities through TreasuryDirect is to open an account. You will need the following:

- Social security number or tax identification number for companies

- Driver's license number

- Current or savings account number and bank code

- E-mail address

- Have a US address

- Be over 18 years old

With this information, you can open an account as an individual here https://www.treasurydirect.gov/indiv/indiv_open.htm The process is quite lengthy.

Once you create an account, you can buy Treasury bonds. This part is not much different from buying Treasury bonds on broker websites. However, unlike brokers, there is no fee to buy Treasury bonds. To buy, you must wait until an auction is available because Treasury bonds are auctioned.

The frequency of auctions depends on the type of security, but may occur weekly or at a specific time of the month. The Federal Reserve changes auction dates regularly, so you'll need to check the auction calendar to find out when the next auction is available for your particular security.

TreasuryDirect not only eliminates fees, but also all third-party risk. There is less chance of the government going out of business than with a brokerage firm. In addition, you own your Treasury bonds and have full control over them.

Additionally, there is no minimum purchase amount. Some brokers require a certain number or amount of bonds to be purchased per transaction.

How to place a trade

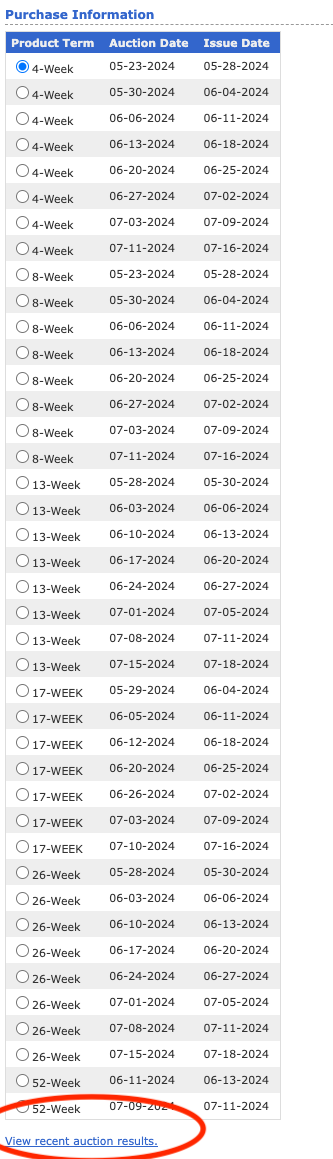

Honestly, it's easy, but not easy, to trade on TreasuryDirect. When you want to trade, you just select the bond you want to buy. But this isn't for beginners – you need to know exactly what you want… it's a bit overwhelming the first time.

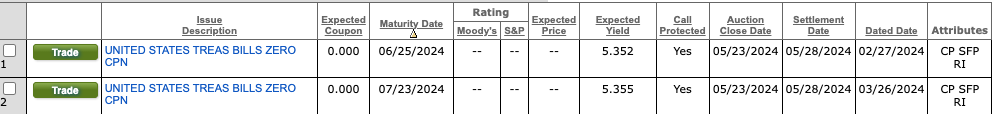

This is what it looks like:

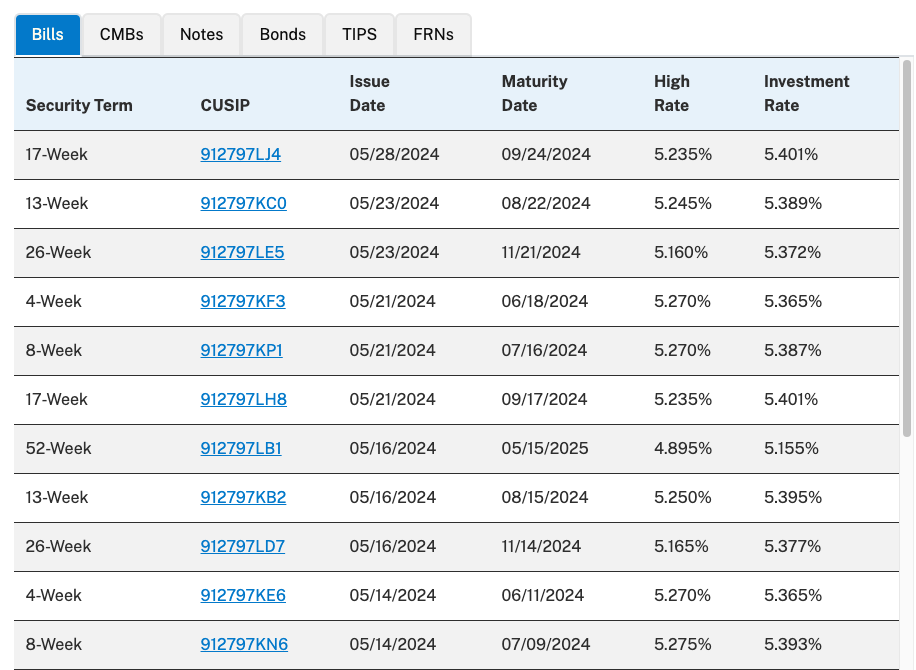

The only way to find out the interest rate of the bond you are buying is to click on “View Recent Auction Results”. This will open a new tab and show you the interest rates.

With this combined data, you can make a decision and buy. It's a little tedious.

Sale of marketable securities acquired through TreasuryDirect

While buying Treasury bonds from TreasuryDirect is similar to buying through a broker, the difference is that you cannot sell your Treasury bonds from TreasuryDirect. In other words, they cannot be redeemed before maturity. That doesn't mean you can't sell Treasury bonds purchased from TreasuryDirect. You can. But to do that, you have to go to the secondary market.

To sell securities you purchased through TreasuryDirect on the secondary market, you must first transfer them to a broker, bank or dealer – a company that can sell Treasury securities. You will likely be charged a commission on the sale.

TreasuryDirect works really well if you intend to buy and hold to maturity, as there is no way to sell your Treasury bonds through TreasuryDirect.

One more thing to note: the security of the TreasuryDirect website is a little over the top. This can make using the site difficult and inconvenient, as security usually always gets in the way. For example, you may be asked to answer your authentication questions more often than you would like. Clicking the back button usually ends your session, meaning you have to log into the site again.

TreasuryDirect Alternatives: Buying from Your Own Broker

Many brokerage houses allow the buying and selling of government securities. The process is a little more complicated than buying and selling stocks, but it's not something that only brokerage houses do. Government securities and bonds must be bought at an auction, choosing specific types, maturities, or even discount rates. It's important to understand the jargon so you know exactly what you're buying.

That's what it looks like at Fidelity, where you can actually see the return and other important information all on one screen.

In addition to new issues, brokers have access to the secondary market. This means greater availability of government securities from others seeking to sell their government securities before maturity.

Since you probably already have a brokerage account, you can save time by not having to set up a TreasuryDirect account.

Who is TreasuryDirect for?

If you don't have a brokerage account and want to hold Treasury bonds until maturity, you're probably the perfect candidate for TreasuryDirect. If you already have a brokerage account and want to buy and sell Treasury bonds, TreasuryDirect doesn't offer much of an advantage.

For those who buy a lot of Treasury bonds, there may be a savings advantage on commissions. Selling before maturity means all securities are transferred out of TreasuryDirect and a selling commission is paid to a broker. However, depending on volume, it may be worth buying your Treasury bonds from TreasuryDirect first.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps