Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Threats to your investment portfolio can come from anywhere, including politics, the economy, and even your own psyche. The first step to combating them is to understand the threats to your investments.

Birch Gold, a company that helps investors buy and sell gold, surveyed its investors for their views on the biggest threats to their well-being.

We've combined some of Birch Gold's answers with other sources to present these top ten threats to your investment portfolio.

1. Your own behavior

In modern times, your behavior is the biggest threat to your portfolio. With a 24/7 news cycle, it would be easy to think that it's never a good time to invest. The overly cautious may hoard cash that is guaranteed to lose value over time due to inflation. More reckless investors may buy into meme stocks, invest too much in cryptocurrencies, or speculate on NFTs at the peak of their prices, only to see their investment prices fall like a stone.

Even if you don't suffer from too much or too little caution, you can still make some classic investing mistakes. For example, you may buy when hype and prices are at their peak and sell when public sentiment and prices are at their lowest.

Most people cannot approach their investment portfolio with complete equanimity. Therefore, the best alternative is to set guidelines to keep your behavior under control. If you're prone to reckless investing, take a small portion of your investment portfolio and reserve it for big bets. Invest the rest of your portfolio for the long term.

Investing set amounts at regular intervals, also called dollar-cost averaging, can keep you from buying at all-time highs. It also ensures that you not only save but also invest. A well-diversified portfolio can also keep your behavior in check. If your portfolio includes a variety of investment types, your portfolio is less likely to experience large fluctuations in value. This can save you from panic selling when prices fall.

2. Inflation

Inflation is colloquially defined as too much money chasing too few goods. The United States enjoyed decades of low inflation, but in 2022 inflation rattled consumers while the stock market struggled. This year has been a sobering look at how much damage inflation can do to an investment portfolio.

According to the Federal Reserve, inflation has trended as follows in recent years:

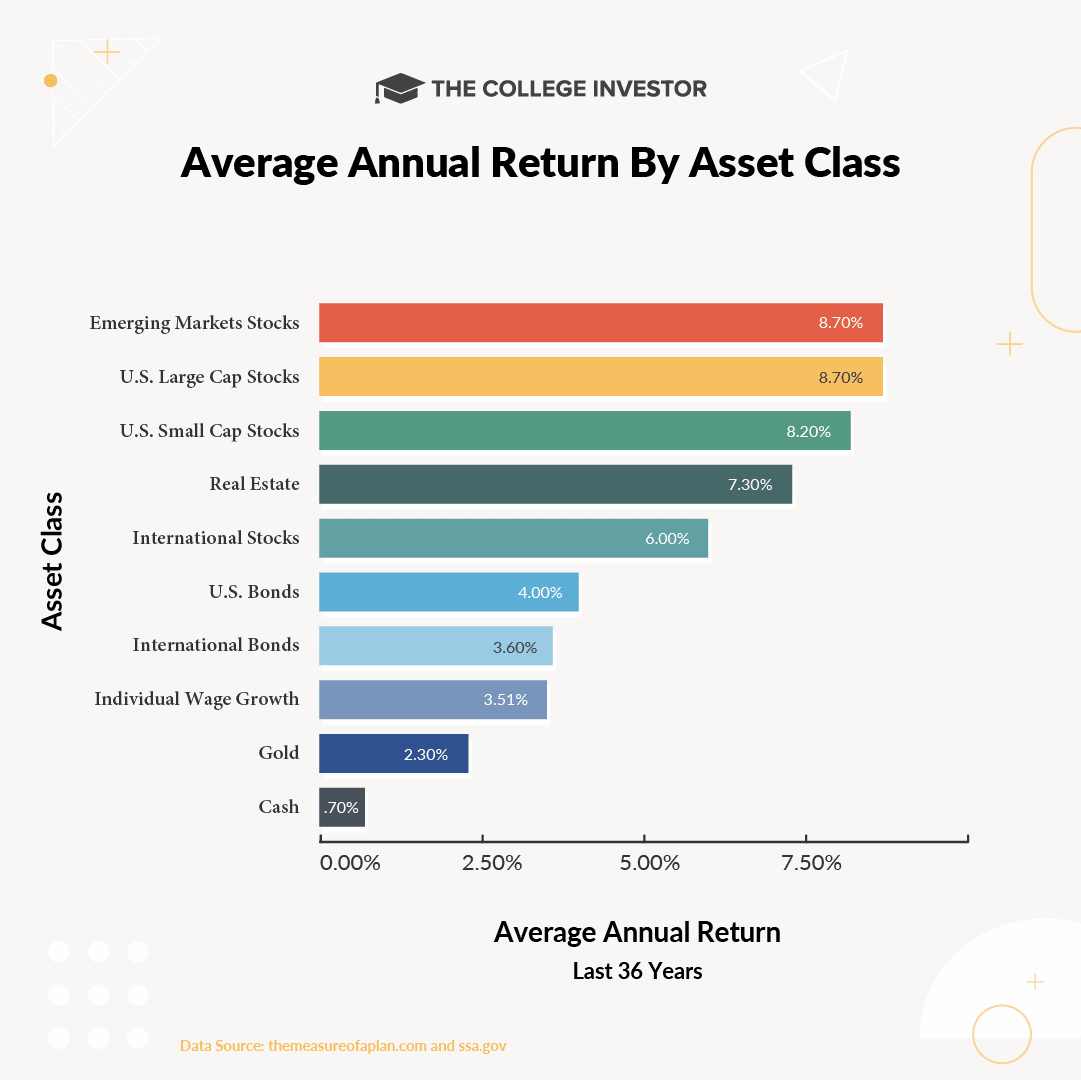

In the long term, your investment portfolio must generate returns that are above inflation, otherwise you will lose purchasing power over time. High inflation rates can quickly reduce the value of your investment portfolio. Since 1960, the average inflation rate in the United States has been 3.8% per year.

To mitigate the effects of inflation, your investment portfolio must include asset classes that typically outperform inflation (like stocks) and assets that act as a hedge against inflation (like real estate and precious metals).

3. Economic downturns

An economic downturn can pose a double threat to your investment portfolio. During a downturn, you are more likely to lose income, so you may need to dip into your investment portfolio to finance your living expenses. Additionally, the stock market is often a “leading indicator” of a poor economy. The value of your investments may decline just before you need to withdraw money from your portfolio.

Most investors understand that the economy goes through cycles that include booms and recessions, but that downturns are never predictable in their length or severity. Selling assets during an economic downturn means you may be selling at low prices rather than high prices. To counteract this risk, many investors seek to invest in defensive stocks or other “countercyclical” assets, whose prices tend to rise when the economy goes into a tailspin.

4. Stock market volatility

Stock prices seem to rise and fall for no reason. Sometimes good news for a company causes stock prices to rise. In other cases, the good news leads to a price drop. This rapid volatility poses a major threat to investors, especially those who buy and sell individual stocks.

While stock market volatility is difficult to manage when saving and investing, it is even more devastating when you need to withdraw money from your portfolio. Retirees who rely on their portfolio to cover their expenses may need to sell assets to cover living expenses, even if stock prices fall.

If you have money that you know you will need in the next five years, consider investing it in more stable investments rather than the stock market. This way, you won't be forced to sell when prices drop.

5. Politically motivated spending bills

Whether you're more concerned about Trumponomics or Bidenomics, politically motivated spending bills can pose a threat to your investment portfolio. When the federal government runs a deficit, national debt increases. This means that more tax money is used to service the national debt.

Although there has been no debt emergency in the United States since the Civil War, debt emergencies have also occurred in other countries in modern times. These countries with modern economies experienced economic volatility, economic stagnation, and other problems because their national debt spiraled out of control. Under the wrong circumstances, the U.S. economy could experience similar problems.

6. High-pressure “investment” sales situations

Many investors save and invest diligently for years, resulting in a decent nest egg. However, when these investors seek financial advice, they could find themselves in high-pressure selling situations.

Financial “advisors” can persuade you to take out life insurance or expensive pension insurance. If you buy a paid product that isn't right for you, you may have to spend thousands of dollars to reverse the decision. If you stick with the product, you may end up owning underperforming assets for years before you can stop making payments on the product.

Always ensure you fully understand any investment before proceeding. If you feel pressured by a fast-talking consultant, tell them you need to think about it and get a second opinion.

7. Job loss

Approximately 6 million people lose or leave their jobs each month in the United States. While many of these job separations involve leaving the workplace for a better job, others involve layoffs or terminations.

If you've lost your job, you may spend weeks or months looking for your next full-time position. During this time, you may need to dip into your investment portfolio to finance your living expenses. If you have a seven-figure investment portfolio, taking a few thousand dollars out of the portfolio won't hurt you in the long run. On the other hand, if you need to liquidate a large portion of your portfolio, it could take years for your portfolio to recover.

Many people can reduce the risk of job loss by developing multiple sources of income, building an emergency fund, and using a simple budget when income is low.

8. Lack of an emergency fund

An emergency fund is your investment portfolio's first line of defense. It can certainly help you if you lose your job, but it can also cover a variety of costs. A large stash of cash can come in handy when you need to cover an unexpected medical bill, a new windshield, or the water bill if you don't have a steady income.

Having cash on hand allows you to pay for unexpected expenses without having to sell assets or take on debt.

9. Rising healthcare costs

General inflation is a relatively new problem for many investors, but rising healthcare costs have been a concern for years. According to Fidelity's estimate of retiree healthcare costs, a 65-year-old retiring in 2023 can expect to pay $157,500 in healthcare costs in retirement. This represents a significant expense for an individual who relies primarily on their investment portfolio and Social Security.

While most people prioritize healthcare expenses over growing an investment portfolio, it is important to plan for healthcare costs that could rise faster than the general inflation rate.

10. Insufficient diversification

Famous investor Harry Markowitz said, “Diversification is the only free lunch in investing.” He said this because well-diversified portfolios are subject to less volatility than portfolios consisting only of stocks, and a well-diversified portfolio may perform better than one that is consists only of shares.

By investing in a variety of asset classes, including stocks, bonds, real estate, precious metals and alternatives, your portfolio can grow even if one or two asset classes are declining.

Final thoughts

Although any of these threats can harm your investment portfolio, you can defend your assets. Developing economic resilience with an emergency fund, multiple sources of income, and the ability to cut back on your expenses will go a long way toward maintaining your investment portfolio.

From an investment perspective, controlling your behavior, maintaining appropriate diversification and using proven investment strategies can help you during economic booms and downturns.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps