Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

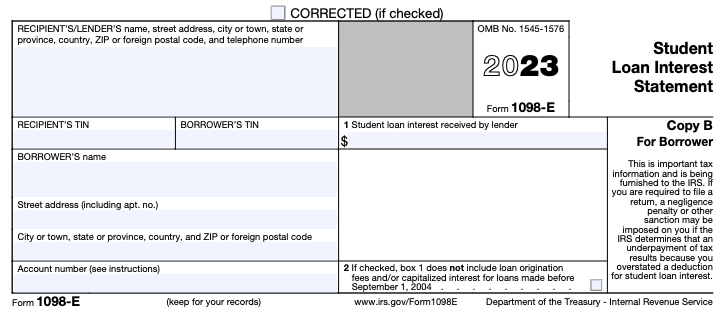

You will receive Form 1098-E for tax season if you paid more than $600 in student loan interest last year.

Individuals who receive their 1098-E student loan interest certificate can deduct student loan interest. If you have a lot of student loan debt, this could save you up to a few hundred dollars.

Today we'll explain what the 1098-E is and how it affects your taxes so you may be able to claim the student loan interest deduction.

Who is eligible to claim the student loan interest deduction?

To qualify for the student loan interest deduction, you must pay at least $600 in student loan interest. You can only deduct up to a maximum of $2,500 in interest paid.

The student loan interest deduction is an adjustment to your gross income. So if you paid $2,500 in student loan interest and earned $60,000, you only pay taxes on $57,500.

For the deduction, it doesn't matter whether your loans are federal or private student loans. Both are eligible for the deduction.

The student loan interest deduction goes to the person who is legally obligated to pay the student loan. This means that if your parents took out loans for you, they get the deduction. This applies even if you make the payments on the loans.

Married borrowers must elect to file their taxes jointly as married taxpayers if they want to be eligible for the deduction.

The student loan interest deduction is also influenced by your income. It is a deduction with a “phasing out period,” meaning you may receive a smaller deduction as your income increases.

The following table shows how your income affects your ability to deduct for 2023 (if you file the tax return in 2024):

|

Deduction in proportion to income |

|

|---|---|

|

Less than $75,000 – full deduction $75,000 to $89,000 – partial deduction More than $90,000 – no deduction |

|

|

Earning less than $150,000 – full deduction $150,000 to $180,000 – partial deduction More than $180,000 – no deduction |

Because the deduction is based on modified adjusted gross income (MAGI), you'll need to do a little math to determine your income. All common tax software packages calculate the interest deduction for your student loans accordingly.

How do I know if I qualify for the student loan interest deduction?

If you meet or exceed the $600 interest requirement, your student loan servicer should send you a copy of a 1098-E form. Box 1 of Form 1098-E lists the total interest you paid on your loans in the previous year.

People with multiple student loan servicers may not receive their 1098-E forms automatically if they paid less than $600 in interest per servicer. In such cases, call your lender for more information and to ask them to issue the form. While you don't need the form to complete your taxes, it's much easier than figuring out the amount of interest you pay yourself.

Effects of the student loan break

The student loan payment pause ended in August 2023. For many borrowers, the first payments were due in October 2023. The implication is that many borrowers may not have paid $600 in interest in 2023 because they would not have made payments until October, November and December.

Additionally, approximately one-third of borrowers were placed in administrative forbearance due to student loan servicer defaults. These borrowers would not have had to make any payments and their interest rate was 0%.

The end result is that many borrowers did not pay enough interest to qualify for the 2023 student loan interest deduction. However, that may change in 2024.

How do I use the 1098-E form?

Form 1098-E is a very simple form that contains your personal information and the amount of interest you paid to the lender. If you receive multiple 1098-E forms, you must add the amounts in Box 1 of the forms to determine the total amount of interest paid.

Remember, the maximum you can deduct is $2,500.

If you use tax software to file taxes, the software automatically calculates your deductions. However, if you file your taxes in person, you must report the total interest paid on your Form 1040.

Because the student loan interest deduction is an over-the-counter deduction, you don't need to worry about a full breakdown plan.

Have you ever taken advantage of the student loan interest deduction?

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

![How to Build a LinkedIn Marketing Strategy [Free Template]](https://blog.5gigbucks.com/wp-content/uploads/2023/11/How-to-Build-a-LinkedIn-Marketing-Strategy-Free-Template-100x70.png)