Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Credit repair is the process of correcting your credit report and, ideally, improving your credit score.

Bad credit can limit your ability to do many things, including buying a car, a house, getting a credit card, and in some cases even getting a job. Being creditworthy certainly has its advantages.

If you don't have good credit, there are steps you can take to fix the problem. The process is called credit repair. You can do it yourself or have someone help you, of course for a fee.

Let's break down what credit repair is and whether it's worth paying someone to help you repair your credit.

How does credit repair work?

Credit repair is often a long-term process that gradually increases your credit score. A credit score is a number that reflects your creditworthiness. The higher the number, the better. If you want a loan or credit card, you need to have good credit.

There are a number of credit repair options, and each is unique and depends on the situation.

Generally, however, credit repair begins with obtaining a copy of your credit history and checking for any errors or problems. Once you know your credit history, you can identify what problems could be leading to a lower credit score.

Note: Make sure you get a copy of your credit report from all three major credit bureaus.

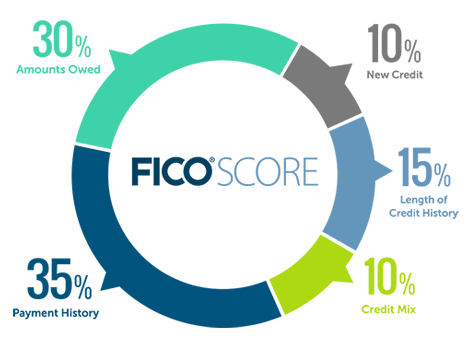

Here's how your FICO score is calculated:

Source: MyFICO

Once you've identified the problems, you can begin to address them – focusing on the areas that have the greatest impact on your credit score.

This usually starts with catching up on any late payments. From there, payments are always made on time. Late payments are one of the worst things you can do to your credit score.

Once the debt is paid off and you have made on-time payments, you should see an improvement in your credit score. The more debt you pay off, the more your score increases.

Can you do it yourself?

Yes! You can definitely repair your credit score yourself.

How successful you will be depends on the complexity of your situation. Loan repair takes time and a lot of research – if you're starting from scratch. But if you're ambitious, you can definitely repair your credit yourself.

The first step is to obtain a copy of your credit report, which you can do at AnnualCreditReport.com. Then go through your report and identify any overdue invoices and anything that may be incorrect. You can contact any credit reporting agency to resolve any errors.

Following the steps mentioned in the previous section is a good starting point:

- Bring any debts current by paying off past due amounts and late payment interest.

- Continue making on-time payments.

From there, access to new credit can also help improve your credit score. If your credit score is low, a credit card company is unlikely to issue you an unsecured credit card. However, you can apply for a secured credit card and probably get approved.

A deposit is required for secured credit cards. You can spend up to the deposit amount. It works just like an unsecured credit card, but with a lower credit limit. Your secured credit card activity will be reported to credit reporting agencies, which is your wish.

On a side note, try setting aside $1,000 in cash for an emergency fund. This will help pay for emergencies with cash instead of charging them to a credit card. Unexpected expenses could include car repairs, a broken water heater, or a medical bill.

The FTC website also offers some DIY (do-it-yourself) tips here.

If you don't want to take on the task of rebuilding your credit yourself, there are plenty of companies that can help you. But are they worth it?

What about credit building apps and tools?

If you want to do it yourself, you should probably get a credit monitoring tool first. These tools are generally free and can at least help you monitor your credit report “live.”

This way, you can see the improvement in your score as you make progress on your credit report.

The most popular free tools are Credit Karma, Credit Sesame and Experian Boost.

If you currently have a Chase or American Express credit card, both companies also offer a free monitoring tool. Chase is called Chase Credit Journey and Amex is called My Credit Guide. Personally, I think the Amex version is better.

Pay a company to help you build your credit score

For those who need more assistance, it may be a good idea to have someone walk you through the credit repair process. It seems that the number of companies willing to exchange your hard-earned money for a higher credit score is endless. You can expect to spend at least $60/month to over $100/month on credit repair services over a period of 4 to 12 or more months. The duration depends on the complexity of your repair.

According to a recent study, 48% of consumers who used a credit repair company saw their scores increase by over 100 points within 6 months.

A credit repair service will review your credit report, create a plan, and have you implement it while reviewing the progress with you each month. There is also someone available to answer any questions you may have.

If your credit repair is complex and you would prefer to talk to someone rather than do the research yourself, it may be worth investing a few months in training and assistance with a credit repair company. If after a few months you have no problem completing the remaining credit repair tasks, you can stop the service and save a few hundred dollars.

Before you hire a company, take a look at this excellent look into the secret world of debt settlement and understand what you may be getting yourself into.

Below are companies that offer credit repair services:

- CreditRepair.com: $14.99 one-time fee plus $99.95/month. They claim to increase your credit score by 40 points in 4 months.

- KeyCreditRepair.com: $139.95/month to $189.95/month, depending on plan. They claim an average increase of 90 points in 90 days.

- SkyBlueCredit.com: $79/month. Claim: “Clean up your credit report. Improve your score.”

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps