Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Ownwell is a service that helps you appeal and reduce your property taxes.

The costs of owning a property go far beyond the purchase price. Even if you pay off your mortgage, you will still have to pay property taxes. Unfortunately, an unfair assessment can drive up your property tax costs and put a big strain on your budget.

As a property owner, you have the right to appeal the assessed value of your home, which can help you reduce your property taxes. But the time-consuming process forces homeowners to overcome many hurdles. This is where Ownwell comes in to negotiate for you and help you save on your property tax bill.

We explore how Ownwell works, so you can decide if it is a good fit for your situation.

- Ownwell works to reduce your property taxes.

- You don't pay any upfront fee. Instead, you share the savings with Ownwell.

- Ownwell takes 25 to 35% of the amount saved.

|

Texas, California, Washington, Georgia, Florida, Illinois and New York |

|

What is Ownwell?

Ownwell is an Austin-based company that works with property owners to reduce their property taxes. The company leverages a team of experts supported by technology to help homeowners successfully appeal unfair assessments.

Despite being a relatively new company, they have filed over 170,000 property tax appeals in 2023.

What does it offer?

Ownwell will appeal the value of your home on which your property taxes are based. You only pay if the appeal is successful.

They claim to have an 86% success rate and expect to file between 400,000 and 500,000 appeals in 2024, saving the average customer over $1,100.

Appeal your property taxes

Property taxes are an unavoidable cost. But that doesn't mean you should overpay. When the tax office determines the value of your home, it can directly affect how much property tax you have to pay that year.

The good news for property owners is that you have the right to appeal your assessment. The bad news is that doing this alone can be a tedious and time-consuming process. Ownwell offers to handle the appeals process for you.

When you work with Ownwell, the process occurs by providing the company with details such as a picture of your property tax bill. From there, Ownwell creates a case for you and submits it to the appropriate tax authority. A dedicated real estate tax advisor will support your case as an on-site expert throughout the entire process. Depending on the situation, Ownwell may meet with county assessors or attend appeals board hearings.

If successful, you will be notified of your savings and pay a percentage of the savings to Ownwell as a fee.

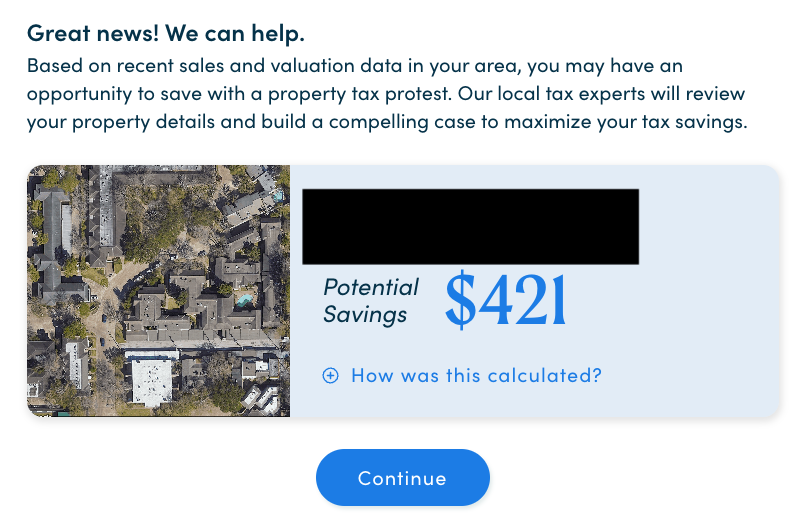

This is what it looks like when you enter your address:

Big savings possible

According to Ownwell, at the time of writing, single-family homeowners save an average of $1,148 per year when working with Ownwell. Additionally, the company claims that over 85% of customers see a reduction in their property tax bill. But of course, the amount you could save varies from place to place.

It's worth noting that property owners in Washington and Georgia could see an increase in their taxable value following an audit, which would result in higher property taxes. However, if Ownwell deems this a risk, your appeal will be waived.

limited availability

The biggest downside to Ownwell is that it is not available everywhere. The company currently operates in Texas, California, Washington, Georgia, Florida, Illinois and New York.

Additionally, even in places like California, there are only a limited number of options due to policies like Prop 13 that cap your property tax rates.

Are there any fees?

There are no upfront fees when you work with Ownwell. If the company can't save you money, you pay nothing. However, if the company saves you money, they will take 25% to 35% of those savings.

For example, let's say Ownwell saves you $1,000 in property taxes. You would pay them $250 to $350 for their service.

How does Ownwell compare?

If you're looking for a streamlined property tax reduction service with no upfront costs, Ownwell is a top choice. It's true that you could do the paperwork yourself. However, if you don't have the time or energy to commit to the process, it might be worth forgoing 25% of the savings. And remember: if you don't save anything, you don't pay anything!

Another option is to hire a local property tax attorney. Depending on the situation, these professionals may be able to help you with the appeals process. However, with this option you have to expect higher upfront costs. And you'll likely pay for this service whether it saves you money or not.

After all, you can always do it yourself. This would require you to fill out certain forms, determine the value of your property, and then cooperate with the county at any hearings.

How do I open an account?

According to Ownwell, the sign-up process takes less than three minutes. First, enter your address and answer some basic questions about your property. You will also need to upload a copy of your property tax bill. Ownwell will take over from there.

Is it safe and secure?

Ownwell protects your personal information through “a system of organizational and technical security measures.” Unfortunately, the privacy policy is a bit vague when it comes to protecting your data. However, most of the information they need is publicly available through your accountant's office, so they don't have access to much of what the general public can't see anyway.

How can I contact Ownwell?

If you would like to contact Ownwell, you can call their help team. Here are the numbers for each state they work in:

- California: 310-421-0191

- Georgia: 678-890-0767

- New York: 516-518-3334

- Washington: 206-395-8382

- Florida: 305-901-2905

- Illinois: 312-500-3131

- Texas: 512-886-2282

Is it worth it?

If you are a property owner, Ownwell can help you save on your property taxes. This is an especially good service if your home's appraised value has increased recently. However, since you don't have to pay an upfront fee, those who live within the company's service area could find great value in Ownwell.

I would like to use Ownwell as my primary residence. Unfortunately it is not available in my region. But if it's an option for you, consider saving with Ownwell today.

Ownwell features

|

Texas, California, Washington, Georgia, Florida, Illinois and New York |

|

|

|

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps