Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Pocketsmith is a popular budgeting app that also helps you plan for the future and make more informed financial decisions.

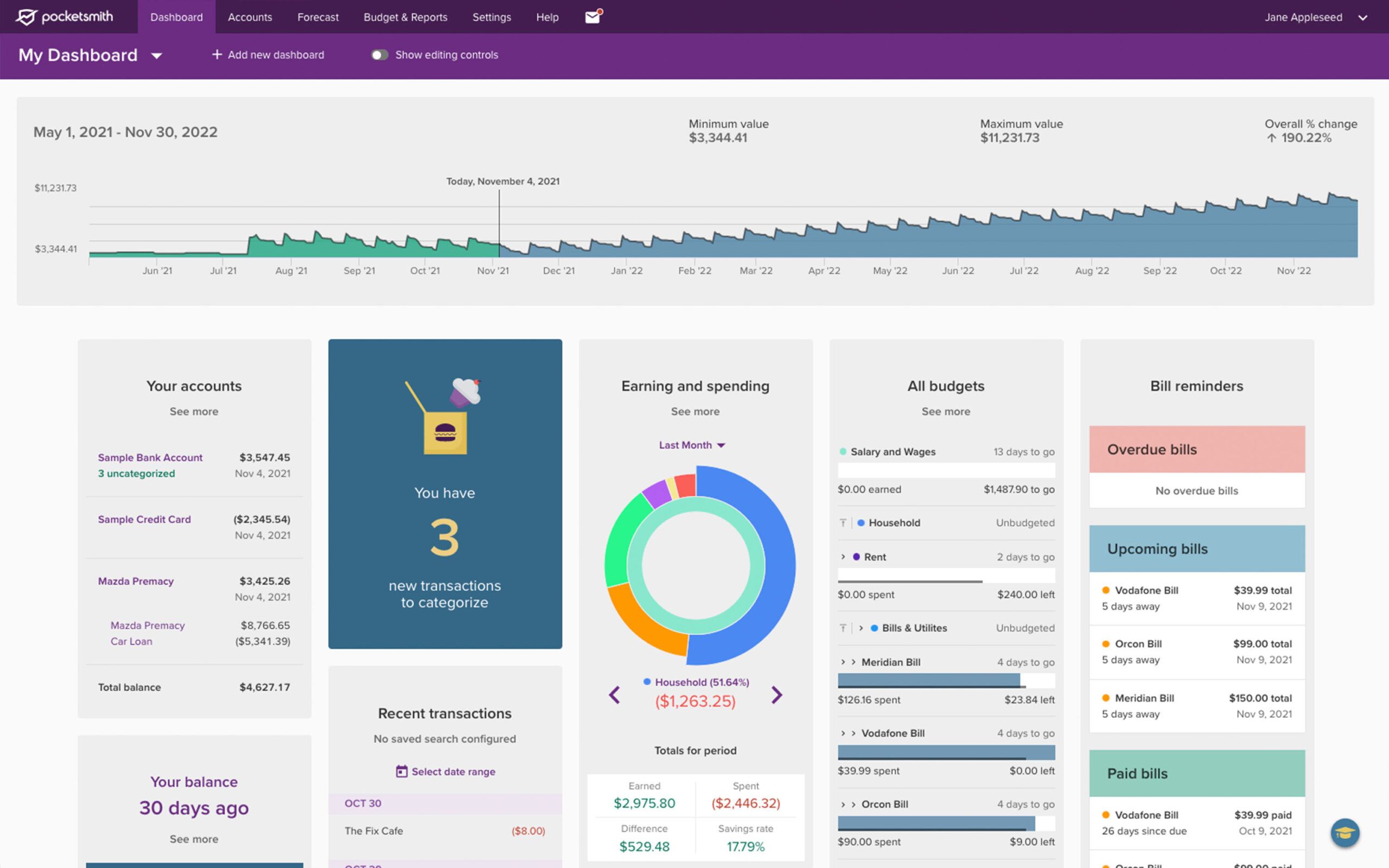

The built-in visualization tools can help you get a better handle on your money habits.

But with a limited free plan and priced at up to $39.95 per month, how does Pocketsmith compare to other budgeting apps like YNAB and Copilot? We explore what PocketSmith has to offer so you can decide if it's a good fit for your wallet.

![]()

- PocketSmith is a financial management app that focuses on your behavior.

- You can access useful visualization tools to better understand your money habits.

- Costs range from free to $39.95 per month.

|

|

What is PocketSmith?

Based in New Zealand, PocketSmith is a personal finance app that not only helps you create a budget and track your spending, but also plan for the future.

In addition to the standard features you expect from a budgeting app, PocketSmith comes with expanded multi-currency support, with live bank feeds for 49 countries. It also offers powerful forecasting tools that allow you to create what-if scenarios and cash forecasts for up to 30 years into the future.

What does it offer?

Here's a closer look at Pocketsmith's key features.

Automated data collection

PocketSmith allows you to automatically import your transactions. Since the platform is compatible with over 14,000 financial institutions, you should have no problem getting your transactions seamlessly transferred into the system.

While PocketSmith can categorize all of your transactions itself, you also have the option to set up your own rules. For example, you have the option to move all transactions of a specific store from the grocery category to the entertainment category.

Personalized budgeting

Pocketsmith can help you fine-tune a custom budget so you can break down your budget in a time frame that works for you. For example, you can plan your expenses over a period of two weeks, a whole month, or several months.

While using the tool, you can access the visual reports and dashboards to monitor your progress.

Financial forecast

PocketSmith allows you to predict how your current financial decisions will affect your financial future. You can visualize your financial future with graphs, calendars, and cash flow views for various financial scenarios. Not only can you see how your current money behavior will change, but also how different decisions could affect your future net worth.

Multiple currencies support

PocketSmith can help you track your finances in multiple currencies. After you set a local currency, the platform automatically converts your assets and liabilities into a single net value in your base currency. However, you can still monitor other accounts in their own currencies.

For example, you could set your base currency to US dollars. However, if you have a bank account that holds euros, you can monitor this balance in euros. And PocketSmith converts the value of that account into USD and includes it in your total net worth.

Customized dashboard with detailed information

PocketSmith provides detailed information about your financial situation. For example, you can see how much you have left for each budget category, which can help you avoid overspending. Other details include bill reminders and the number of days remaining in your budget.

While these details can be helpful, it's easy to become overwhelmed. The good news is that you can customize the dashboard to highlight the information that matters to you and put it front and center.

Are there any fees?

PocketSmith offers both a free version and paid tiers. The free version is very limited and doesn't even offer automatic bank debits. This means that you must be comfortable with entering your details manually if you want to use the free version of the platform.

The paid options are divided into three plans: Foundation, Flourish and Fortune.

Foundation: $14.95/month or $119 annually

The Foundation tier should satisfy anyone looking for a simple budgeting tool that supports automatic bank deposits with some limited forecasting tools. You can connect 6 banks from one country and create unlimited accounts and budgets.

Flourish: $24.95/month or $199 annually

Flourish is Pocketsmith's mid-range plan. I'll let you add 18 banks from all countries and create 30-year cash forecasts. You can also create 18 dashboards.

Asset: $39.95/month or $319 annually

Fortune is the most powerful tier of Pocketsmith, but also the most expensive. If you need comprehensive multi-currency support, this is the plan for you. With Fortune you can connect unlimited banks from all countries, create unlimited dashboards and cash forecasts for 60 years. You can also access priority customer support.

How does PocketSmith compare?

PocketSmith is a robust financial management app. But it's not the only option out there. This is how it stacks up.

YNAB (You Need A Budget) is a comprehensive budgeting tool that automatically tracks and categorizes your spending. It takes a zero-based budgeting approach and assigns every dollar a job so you can make progress toward your financial goals. Priced at $99 per year, YNAB is a cheaper option than PocketSmith.

However, YNAB relies on a third-party service called “Multi-Currency for YNAB” to create a single budget from multiple currencies. If you want to track accounts in multiple countries, Pocketsmith is probably a better option.

Copilot is another comprehensive app that helps you track your spending, monitor your budget, check your investments, and build your credit score. The platform offers helpful visualizations that make it easier for you to manage your finances. In terms of price, it is more on par with YNAB at $95 per year.

|

|||

|---|---|---|---|

|

$14.99 per month or $99 per year |

$13 per month or $95 per year |

||

|

2 month free trial with promo code TCI2024 |

|||

|

iOS, Android, Web, Alexa and more |

|||

|

cell |

How do I open an account?

If you want to open a Pocketsmith account, first select your service plan. From there you will be asked to provide a username, email address and password.

And of course, you'll need to provide your credit card information. Once you create the account, you can start linking your financial accounts and get the most out of the platform.

Is it safe and secure?

PocketSmith takes protecting your privacy very seriously. Your data is fully encrypted in transit and at rest. Additionally, all Pocketsmith plans offer the option to add two-factor authentication to further protect your data.

How do I contact PocketSmith?

You can contact PocketSmith by email at help@pocketsmith.com.

Pocketsmith Customer Service

The app has received 3.3 out of 5 stars in the Apple App Store and 3.4 out of 5 stars in the Google Play Store. Plus, the few people who have rated it on Trustpilot give it 2.6 out of 5 stars. The mediocre reviews may not bode well for a smooth customer experience.

Is it worth it?

PocketSmith seems like an amazing piece of technology, but the high price could be a concern. Unless you can get by with manually entering the free plan, simpler tools appear to be in the $5 to $7 per month range.

However, some people will love Pocketsmith's visualization tools, and for them the $9.99 monthly price might prove worth it.

If PocketSmith isn't the right solution, consider one of our best budgeting apps.

|

|

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps