Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

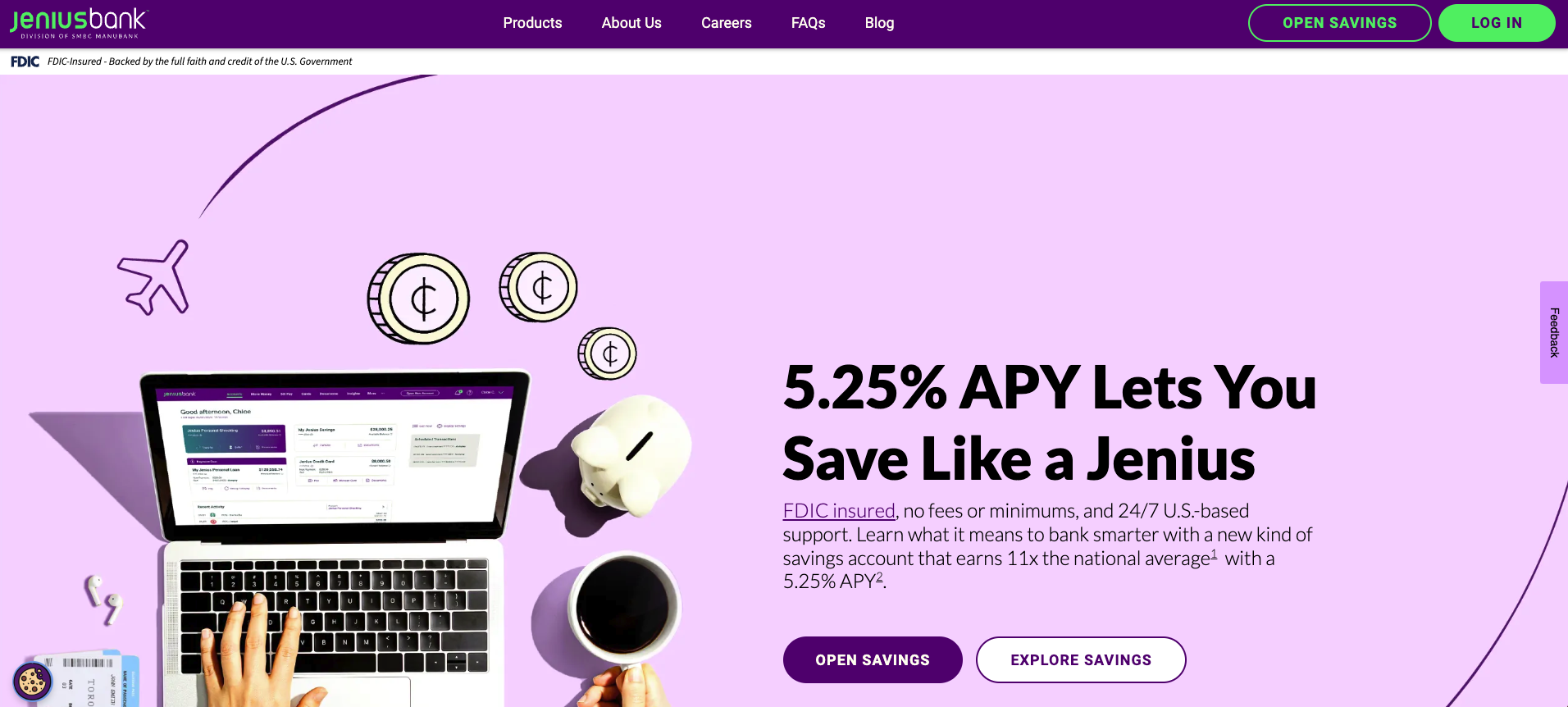

Jenius Bank is an online bank that offers personal loans and a high-interest savings account with an attractive APY.

If you are looking for a place to keep your savings, Jenius is ideal with its high interest rate. However, Jenius does not allow you to apply for a personal loan directly and the digital bank does not offer access to ATMs.

We take a closer look at Jenius Bank to find out how it compares to the best online banks.

![]()

- Jenius Bank offers a high-interest savings account and personal loans.

- The savings account currently offers a 5.25% APY.

- Jenius Bank’s personal loans range from $5,000 to $50,000.

What is Jenius Bank?

Unlike many fintechs that offer banking products and services, Jenius is a real bank. In fact, it is the digital banking division of Sumitomo Mitsui Banking Corporation, Inc. (which is actually one of the oldest banks in the world – its history dates back to at least the 19th century, with some reports saying it’s almost 600 years old).

However, since it is an online bank, you do not have access to physical branches, but you can always contact an agent for customer service.

Deposits at Jenius Bank are insured by the FDIC up to the maximum amount allowed by law. If you are also a customer of SMBC MANUBANK, please note that all deposits you hold at Jenius and SMBC are combined when calculating FDIC insurance limits.

What does it offer?

Jenius Bank offers personal loans and a savings account. Below we take a closer look at each product.

savings

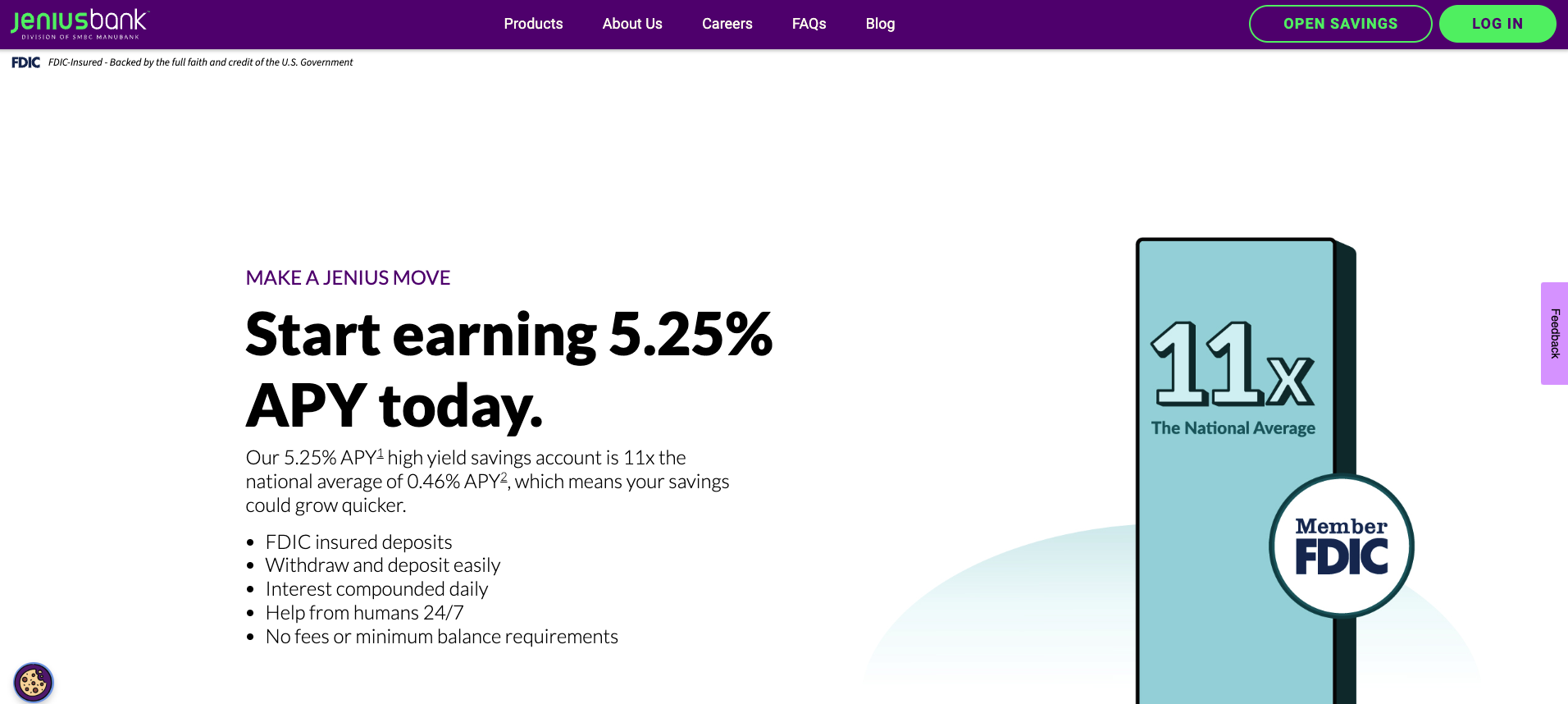

Jenius Bank offers a high-interest savings account with a 5.25% APY. Since interest is compounded daily, you'll be surprised at how quickly your savings grow. Plus, there are no monthly fees or minimum balance requirements to slow down your savings trajectory.

If you want to open a savings account with Jenius Bank, you can start with $0. Although you can't make withdrawals at a branch, you can easily do so online. The bank offers joint accounts, so you can easily save with a partner.

Personal Loans

Jenius Bank offers personal loans that can help you save on borrowing costs, especially if you plan to pay for the purchases with a high-interest credit card. Unfortunately, you cannot apply for a loan directly from Jenius Bank. You must apply through Intuit Credit Karma, meet their eligibility requirements, and receive a loan offer from Jenius Bank.

With that in mind, Jenius Bank loans range from $5,000 to $50,000. You can use the funds for any purpose, including covering unexpected expenses, consolidating debt, and financing a wedding.

As of June 2024, the available APRs for loans will range from 8.49% to 22.49%. These are fixed rates that do not change throughout the life of the loan. The available terms range from 36 to 72 months.

If you can lock in a relatively low interest rate, you can pay off your debt faster than if you add the purchases to a growing credit card balance. Approved borrowers may receive their funds as soon as the next business day.

Are there any fees?

Jenius Bank does not charge any account maintenance, transaction or account opening fees for its high-interest savings account. And if you take out a personal loan from Jenius Bank, you will not be charged any loan processing fees, prepayment penalties or late payment interest.

How does Jenius Bank compare?

Jenius Bank is not the only financial institution that offers savings accounts and personal loans. Here is a comparison.

Jenius Bank’s savings account offers an undeniably attractive APY. But if you’re looking for the best APY on the market, Western Alliance Bank currently offers 5.36% APY. For savers looking for a banking platform that includes both a savings account and a checking account, CIT Bank or Discover the bank might fit better.

When it comes to personal loans, Jenius Bank offers limited access (see details above), but is far from the only option available, so it's best to compare offers before taking out the loan.

Discover Bank also offers personal loans with similar interest rates and terms as Jenius Bank. At the time of this writing, Discover advertises APRs ranging from 7.99% to 24.99% and loan terms ranging from 36 to 84 months. Their maximum loan amount is slightly lower than Jenius Bank at $40,000.

How do I open an account?

If you want to open a savings account, you can visit the Jenius Bank website.

You can open an account if you are at least 18 years old and have a social security number and a permanent US address. However, residents of New Mexico and Hawaii cannot work with Jenius Bank. To fund your account, you can link an external bank account or send a physical check endorsed to Jenius Bank.

Notably, you cannot apply for a personal loan directly through jeniusbank.com. Instead, you can only apply for a loan from Jenius Bank if you are offered an application through Intuit Credit Karma.

Is it safe and secure?

The savings account offered by Jenius is FDIC insured, so your deposits are safe up to $250,000. The bank also offers 24/7 fraud monitoring to protect your money.

How do I contact Jenius Bank?

If you need to contact Jenius Bank, you can call 844-453-6487 at any time.

Since Jenius Bank is still relatively new on the market, there is little information available from existing customers. However, Trustpilot has rated the company with an average of 2.4 out of 5 stars, although the rating is based on only eight reviews.

Is it worth it?

Jenius Bank's top-notch APR makes it an attractive option for savers who want to invest their money while not needing ATM access or having to deposit cash. If you don't mind keeping your savings in a financial institution other than your checking account and other financial products, Jenius Bank could be a great choice.

Jenius Bank's personal loan products have a similar offering to other online lenders, including Discover and SoFi. However, you can't apply directly through Jenius; you must get a quote through Intuit Credit Karma, which is a major drawback.

Check out Jenius Bank here >>

Features of Jenius Bank

|

High-interest savings accounts, personal loans |

|

|

Yes; must be applied for through Intuit Credit Karma |

|

|

Web/Desktop Account Access |

|

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps