Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Options trading offers interesting opportunities to educated and savvy investors, with the ability to profit from fluctuations in market prices and other strategies can help protect against losses if an investment strategy does not work as expected.

But that's not all you can learn from options trading. By reviewing options trading data, you may be able to spot irregular activity from other traders, providing important insights into others' thoughts and expectations.

Here's how to spot and keep an eye on unusual options trading activity to get a head start on your next options trade.

Many thanks to the investment platform moomoo for making this article possible. Find out more about what you can do with moomoo in our detailed Moomoo review.

Get started with moomoo and earn a Mag 7 fractional share package with a qualifying deposit or a 1.5% cash reward (max $300) on transfers. The general terms and conditions apply >>

What is Unusual Options Activity?

To understand what constitutes unusual options activity, you need to filter out unnecessary information and focus on the market data that matters most. According to NASDAQ data, approximately 40 million options contracts are traded daily. This makes it easy to get caught up in the little things and miss a market-moving trade.

Unusual options activity is any large trade that falls outside of market norms and typical trends. Individual traders making irregular trades are unlikely to move the markets. However, institutional investors and other whales can make massive trades in the markets, indicating that they know something that others do not or that they expect a certain outcome in the markets relatively soon.

Large spikes in volume for a particular asset or asset class can provide insight into possible market movements or insider activity. Although a single small trader entering orders for a particular asset may not be important, many traders buying calls or puts could result in a significant signal.

Stories of unusual options activity

You don't have to delve too far into stock market history to find examples of unusual options activity. Here are some interesting big options trades where traders like you can gain insight into the strategies of insiders and institutional investors.

Michael Burry shuts down the entire stock market

Michael Burry gained notoriety as the trader who shorted the property markets ahead of the industry collapse in 2008. This gave his Scion Capital a huge return and placed him in the elite class of famous investors who bet big to beat the crowd.

In late 2023, Burry made headlines for taking a massive short trade against the entire stock market. Burry shorted an ETF that tracks the S&P 500 and an ETF that tracks the Nasdaq 100 index. He bought 2 million puts each, which was easily enough to attract the attention of other investors and financial media.

He closed the positions later that year, which was another signal that offered insight into Burry's view of future market developments.

NVDA insider trading

Recent insider transactions at Nvidia have caught the market's attention, particularly the sales by CFO Colette Kress and Director Mark Stevens, with notable sales being made at high prices. These transactions are part of a broader trend of insider selling within the company that is affecting investor sentiment and potentially Nvidia's market valuation.

This pattern of insider activity highlights the need for investors to monitor such transactions as part of their investment due diligence. Significant insider sales can serve as a barometer of a company's prospects and require a reassessment of investment strategies.

When insiders make large trades, automated trading systems, including those targeting the options markets, typically respond as soon as the information becomes available. If you pay close attention, you may notice a shift in calls or puts around a particular stock, such as: B. Nvidia, and see an opportunity to potentially profit.

Discover Unusual Options Activity.

Now that you understand what constitutes unusual trading activity and how to interpret the data, you're probably wondering where to find unusual options trades. Here you can see different platforms that you can use for market data insights.

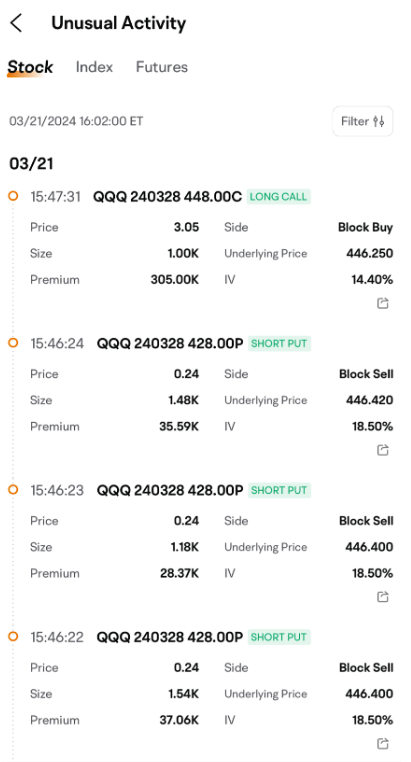

moomoo options Unusual activity

moomoo is a stock and options trading platform that offers commission-free stock, ETF and options trading. Users can unlock free access to Level 2 market data and other analytical tools, informing their investment strategy at no additional cost.

The platform contains a section entitled “Options for Unusual Activities”. The Unusual Options Activity view highlights moments when there is an unexpected, significant increase in trading of a particular option. This increase often reflects the strategies or expectations of major players in the game, such as institutional investors.

The app images provided are not current and the securities shown are for illustrative purposes only and do not constitute a recommendation.

moomoo also provides a capital tracking chart to monitor net inflows and outflows. Combining both factors may give you enough information to make an informed trading decision.

The app images provided are not current and the securities shown are for illustrative purposes only and do not constitute a recommendation.

Ready to get started? Check out Moomoo here >>

Other platforms for unusual activity tracking options

While moomoo's tools are sufficient for many investors (and many are free to use on moomoo), you may want to use multiple tools to get a comprehensive look at trading unusual options.

- Unusual whales: Unusual Whales is a dedicated options tracking platform and offers robust tools for finding unusual whale trades, but you have to pay for access.

- ChatterQuant: The ChatterQuant platform monitors social media activity to determine sentiment for or against a particular investment. It is also a paid tool.

How to take advantage of unusual options activity

Making informed decisions in options trading requires a comprehensive strategy that leverages insights from unusual options activity and other data sources. By correctly interpreting these signals, traders can develop strategies that are aligned with market movements and investment goals. With a good overview of risks and objectives, you can implement trades to reduce risks, speculate on potential profits, or adjust existing portfolios based on predicted market directions.

Successful trading is about more than just recognizing patterns. Risk management is crucial. Understanding and mitigating the risks associated with options trading is crucial to avoiding large losses. Don’t just rely on individual data points. Consider a range of indicators and market data to make decisions. A well-thought-out risk management plan can better protect traders from unexpected market changes and minimize potential losses.

Finally, it is crucial to avoid common pitfalls such as following the herd without due care. Traders should always look at the bigger picture, look beyond individual data points, and avoid making decisions based solely on popular trends.

By maintaining a balanced perspective and conducting thorough research, investors can navigate volatile markets more effectively, make informed strategic decisions, and be less prone to common missteps.

Having a tool like moomoo in your toolbox is a great way to make more informed trading decisions.

Trade with care for options success

Unusual options activity provides savvy investors with a lens through which to view potential market moves.

It's not a magic crystal ball, but with the right approach and tools like moomoo, it can provide valuable insights. Stay informed, stay cautious, and use market knowledge to navigate the complex waters of the stock and options markets.

Get started with moomoo and earn a Mag 7 fractional share package with a qualifying deposit or a 1.5% cash reward (max $300) on transfers. The general terms and conditions apply >>

**Terms and conditions apply. For more information, visit www.moomoo.com/us/support/topic4_410.

Options trading is risky and not suitable for everyone. Before trading, read the options disclosure document (j.us.moomoo.com/00xBBz). Options are complex and you can quickly lose your entire investment. Evidence of any claims will be provided upon request. Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. Securities are offered through Moomoo Financial Inc., member FINRA/SIPC. The creator is a paid influencer and is not affiliated with Moomoo Financial Inc. (MFI), Moomoo Technologies Inc. (MTI) or any other affiliate of them. Any comments or opinions expressed by the influencer are their own and not necessarily the views of moomoo. Moomoo and its affiliates do not endorse any trading strategies discussed or promoted herein and are not responsible for the services provided by the Influencer. This advertisement is for informational and educational purposes only and does not constitute investment advice or a recommendation of any investment or financial strategy. Investing involves risks and the possibility of loss of capital.

Investment and financial decisions should always be made based on your specific financial needs, goals, objectives, time horizons and risk tolerance. Any illustrations, scenarios or specific securities referenced herein are for educational and illustrative purposes only and do not constitute a recommendation. Past performance is no guarantee of future results.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps