Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

If you make $60,000 a year, what are you actually taking home? You know it's not the full $60,000. But if you're in the 22% tax bracket, does that mean you're paying $13,200 in taxes? That seems like the intuitive answer, because $60,000 multiplied by .22 is $13,200.

In reality, you'll probably pay much less income tax. To understand why this is the case, you need to understand the difference between marginal tax rates and effective tax rates, which we'll explain in this article.

However, calculating your income tax payments alone won't give you a true picture of how much tax you'll really pay this year. There are several other things to consider when you want to know how much tax you'll actually pay as a percentage of your net income. In this article, we'll explain how to figure out how much you'll actually bring home as income.

Federal and state taxes

In this guide, we'll use someone who makes $60,000 a year as an example. That's $5,000 a month. We know that's not their net income, but what do they actually bring home when federal and state taxes come into play?

To keep the example simple, we'll only consider the standard deduction. We'll also assume that this is a single, wage-earning person in their mid-30s (i.e. not retired). First, we need to know which tax bracket this person falls into. For 2024, the federal tax brackets are:

You might think that our example taxpayer would fall into the 22% tax bracket because of his income of $60,000. However, effective tax rates are not calculated by simply multiplying income ($60,000) by the tax bracket (22%). No, determining effective tax rates is a bit more complex.

In fact, they would only fall into the 12% tax bracket.

Calculating the effective federal tax rate

First, we need to subtract the standard deduction. For 2024, the federal standard deduction is $14,600 for singles and $29,200 for married couples filing jointly. Since our taxpayer is single, he would deduct $14,600 from his income.

$60,000 – $13,850 = $45,400

So we find that of our example taxpayer's total income, only $45,400 is actually taxable income. Now we can start applying the tax rates. The 10% tax rate is calculated on the first $11,000 of our taxpayer's income.

$11,600 x 0.10 = $1,160

Next, we subtract $11,600 from $45,400 to get the taxable amount for the 12% tax rate (since that's the actual tax bracket you'll fall into if you take the standard deduction):

$45,400 – $11,600 = $33,800

$33,800 x 0.12 = $4,056

This results in a tax bill of $1,160 + $4,056 = $5,216. That is much lower than the $13,200 we would get from a simple calculation of 22% on total income.

If you divide $5,216 by $60,000, you'll find that the effective tax rate in this example is actually only 8.7%.

Addition of state taxes

While most people mean the numbers above when they talk about effective tax rates, the amount you actually pay in taxes this year is much higher.

Currently, all but seven states also impose income taxes. Below are the state tax brackets for single people in New York State:

Let's assume that our example taxpayer lives in New York and take his state's taxes into account when calculating the effective tax rate.

The state standard deduction may be different than the federal one, but for simplicity, we'll use the same amount. So we're still working with $45,400 as taxable income.

We see that this gives us a marginal tax rate of 5.85%. Now let's do the calculations to find the effective tax rate.

First $8,500 x 0.040 = $340

$11,700 – $8,500 = $3,200 x 0.045 = $144

$13,900 – $11,700 = $2,200 x 0.0525 = $115.50

$45,400 – $13,900 = $31,500 x 0.0585 = $1,842.75

Adding together the above figures gives us a total income tax burden of $2,442.25. This is much less than the federal tax burden, which is understandable since state tax rates are lower. When we add together the federal and state taxes, we arrive at a total income tax burden of $7,658.25 ($5,216 federal tax + $2,442.25 state tax = $7,658.25).

Remember that effective tax rates are calculated by dividing the actual income taxes paid by total income, so if you divide $7,658.25 by $60,000, you will find that the The effective tax rate in this example is 12.76% ($7,658.25 / $60,000 = 0.1276).

Side note on state taxes

Tax brackets play a big role in how much tax you pay in each state. But they are also the main source of misinformation. For example, media pundits like to “criticize” California because it has high taxes – the highest tax bracket in California is 12.30%. But that only applies to incomes over $677,751!

For “normal” incomes, California is pretty normal compared to other states. Let's use Alabama as a comparison. Alabama charges 5% income tax on all income over $3,000. California increases income tax from 4% to 6% at $37,700. If you make less than $37,000, you'll basically pay less tax in California than in Alabama.

FICA Taxes

But we're not done yet. To calculate how much we effectively pay in taxes overall, we need to add a few other taxes. First, we need to consider how much you pay in FICA taxes, which goes to Social Security (6.2%) and Medicare (1.45%).

To calculate FICA, we simply take $60,000 and multiply it by 7.65%.

$60,000 x 0.0765 = $4,590

If we add that $4,590 to the $7,658.25 we paid in federal and state income taxes, our total tax bill has now risen to $12,248.25. And that would give us a new effective tax rate of 20.41%.

Note: This is still less than the potential 22% tax rate that someone earning $60,000 might expect to pay.

Sales and consumption taxes

Sales tax is not based on your wages or income. Instead, it is calculated based only on the purchase amount. Find out how much you pay in state and local sales tax in your area.

Excise taxes are taxes levied on certain goods or services, such as gasoline, airline tickets, or your property.

Finally, property tax (which could also be considered a consumption tax) is based on the annual property valuation of your home, which can change from year to year. Again, it is not dependent on your income.

How much tax do Americans pay in total?

Because sales and use taxes vary based on usage and property size, it can be difficult to accurately calculate an individual's total tax liability. In addition, any tax credits and/or deductions you may be eligible for will reduce the amount you actually pay to Uncle Sam.

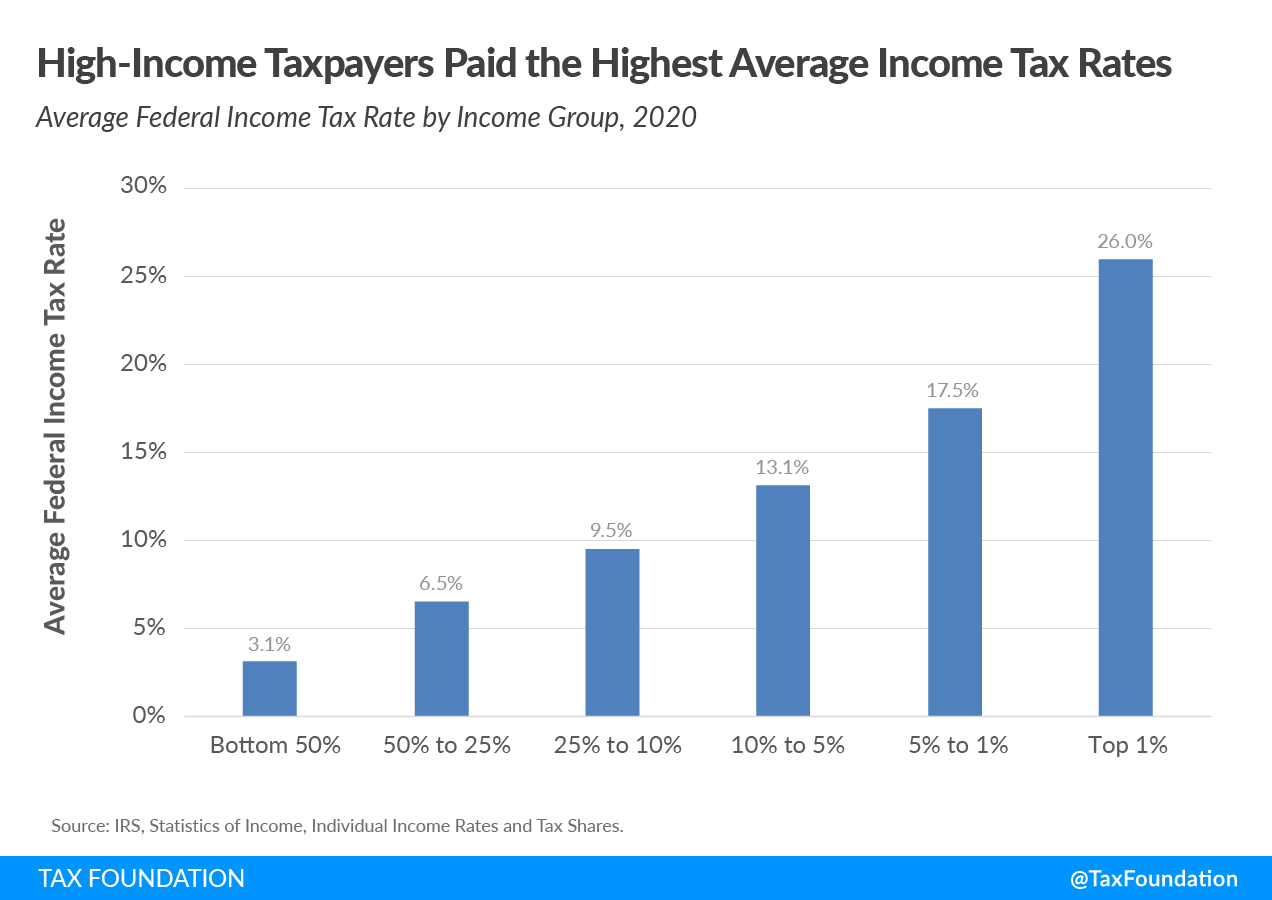

However, a study by the Tax Foundation shows how much the average person pays in total taxes after accounting for income taxes, FICA, corporate taxes, excise taxes, and deductions and credits. These were the average total tax rates for different income levels:

- Less than $10,000: 10.6%

- $10,000 to $20,000: 0.4%

- $20,000 to $30,000: 4.1%

- $30,000 to $40,000: 8.5%

- $40,000 to $50,000: 11.7%

- $50,000 to $75,000: 15.2%

- $75,000 to $100,000: 17.7%

- $100,000 to $200,000: 21.6%

- $200,000 to $500,000: 26.8%

- $500,000 to $1 million: 31.5%

- Over $1 million: 33.1%

Fortunately, this data from the Tax Foundation suggests that effective tax rates for virtually all Americans will still be lower than the highest marginal tax rates (even after accounting for all “additional” taxes).

Final thoughts

Based on the Tax Foundation data shown above, the typical American worker earning $60,000 can expect to pay about 15.2% of their income on taxes each year—or $9,120. That's pretty close to our example, where we calculated state and federal taxes at 13.24%.

So it's clear that taxes still make up a large portion of our take-home pay. And then other needs like healthcare and utilities can further reduce the amount we have available for discretionary spending.

However, if you take advantage of all the tax credits and deductions you are entitled to, you can significantly reduce your effective tax payments this year and beyond. Be sure to check out our list of the best tax software providers that can help you get all the tax relief you are entitled to.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps