Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

- Federal judges in Kansas and Missouri have issued preliminary injunctions blocking key parts of the SAVE plan, affecting millions of student loan borrowers.

- These rulings have left more than 8 million borrowers unclear about their repayment terms and their eligibility for student loan forgiveness.

- The legal action follows lawsuits filed by state attorneys general challenging the implementation of the SAVE plan ahead of the key July 1 deadline.

Two Obama-appointed federal judges in Kansas and Missouri have issued preliminary injunctions blocking key elements of the Saving on a Valuable Education (SAVE) repayment plan, a new income-based student loan repayment program. The rulings come at a critical time, as more than 8 million borrowers were set to benefit from reduced payments and debt forgiveness under the plan.

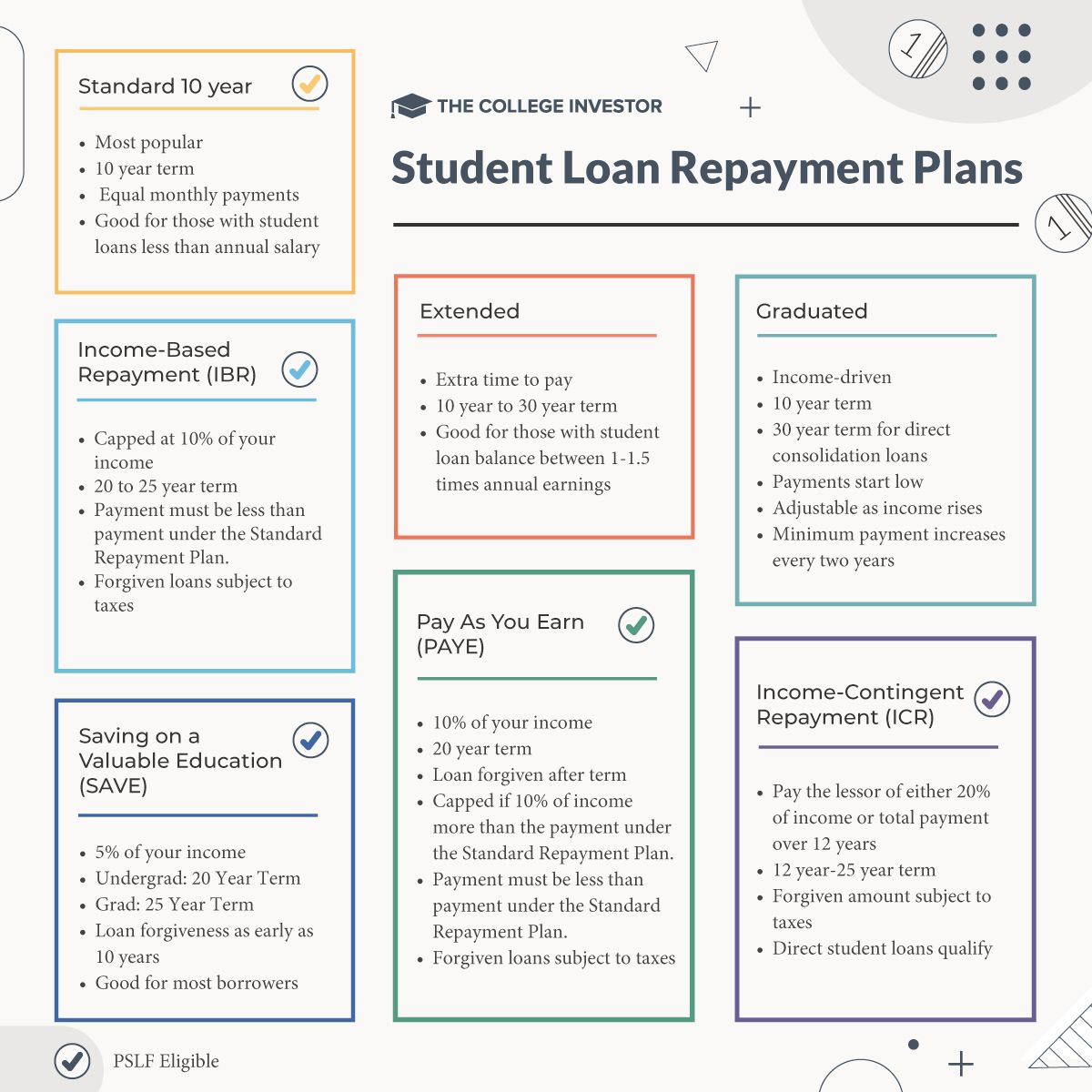

The SAVE plan, introduced by President Biden in August 2023, aims to provide relief to student loan borrowers by reducing monthly payments and offering debt forgiveness after certain periods of time.

July 1 was a key date for the new, lower repayment plan amount to take effect. This injunction leaves borrowers uncertain about the future.

Preliminary injunctions in Kansas and Missouri

In Kansas, a federal judge has issued a temporary injunction that temporarily halts the U.S. Department of Education's efforts to halve student loan repayments for more than eight million borrowers, effective July 1.

Meanwhile, a separate ruling in Missouri prohibits the department from completely canceling debt for borrowers under the SAVE plan.

These legal actions have caused significant disruption to the student loan system, which is struggling to regain stability after a three-and-a-half-year suspension of payments, interest and collections that expired in September.

The Department of Education had already announced that borrowers in the SAVE plan would be subject to an administrative forbearance in July to avoid the chaos that erupted when payments resumed last fall.

The lawsuits that resulted in these injunctions were led by coalitions of state attorneys general. On March 28, 2024, a group of 11 states led by Kansas Attorney General Kris Kobach filed a lawsuit to stop the SAVE plan. A similar lawsuit followed on April 9, 2024, led by the Missouri Attorney General, involving seven states. These states represent about a quarter of borrowers enrolled in the SAVE plan, with over 2.5 million residents participating, but the lawsuits seek to invalidate the plan nationwide.

How does the SAVE Plan help borrowers?

The SAVE plan is designed to ease the burden of student loans by adjusting monthly payments based on borrowers' income up to 5% of disposable income. This results in significantly reduced payments or even zero payments for low-income borrowers.

Currently, more than 8 million borrowers are enrolled in the plan, with 4.6 million of them benefiting from a zero-dollar monthly payment. In addition, the plan offers debt forgiveness after 20 or 25 years, or after 10 years for those who have borrowed up to $12,000.

The SAVE Plan is one of several income-driven repayment plans available to borrowers. The first of these plans was introduced in 1994, and the SAVE Plan will be available to borrowers in August 2023.

Future outlook

Given recent court rulings, the future of the SAVE plan and its benefits to borrowers are at stake.

The Biden administration is likely to appeal these rulings in the coming days, but in the meantime, millions of borrowers are waiting for clarity on their student loans.

Don’t miss these other stories:

5 Legal Ways to Lower Your Student Loan Payment Average Student Loan Debt by State in 2024 List of Student Loan Forgiveness for For-Profit Colleges

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps