Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Ernst & Young is one of the nation's top five accounting firms with more than 100 years of business experience. While best known in the business world for supporting the accounting needs of Fortune 500 companies, the company has expanded its operations to include personal and self-employed tax returns for the 2020 tax filing season and continues to offer this service through its EY TaxChat service.

The EY TaxChat app provides users with a price quote for tax preparation services. If you decide to move forward, you can chat with your tax advisor via the app or by phone.

If you've been thinking about hiring an accountant to prepare your tax return but don't want to work with a small, local preparer, EY TaxChat could be a good option for your needs. Here's what you need to know if you're considering EY TaxChat.

- Full-service tax returns from tax professionals

- Chat virtually with your dedicated tax advisor at any time

- Higher prices than many similar services

|

The basic fee covers one state |

|

|

Prepared by tax experts (EAs or CPAs). |

|

EY TaxChat – Is it free?

EY TaxChat does not offer a free plan. It is a premium, full-service tax preparation service that all clients pay for. Users can fill out a short interview form to receive a price quote. The cost of the tax return is fixed unless the tax advisor learns of additional complexities that were not covered in the conversation.

Will EY TaxChat make tax returns easier in 2024?

EY TaxChat strives to make tax filing easy. They conduct the onboarding interview in plain English, so you don't need to know a lot of tax jargon. Based on your answers, the tax advisor will request the necessary information and tax forms. Applicants can securely load all of their documents into the TaxChat app or website and communicate with their tax advisor through the app.

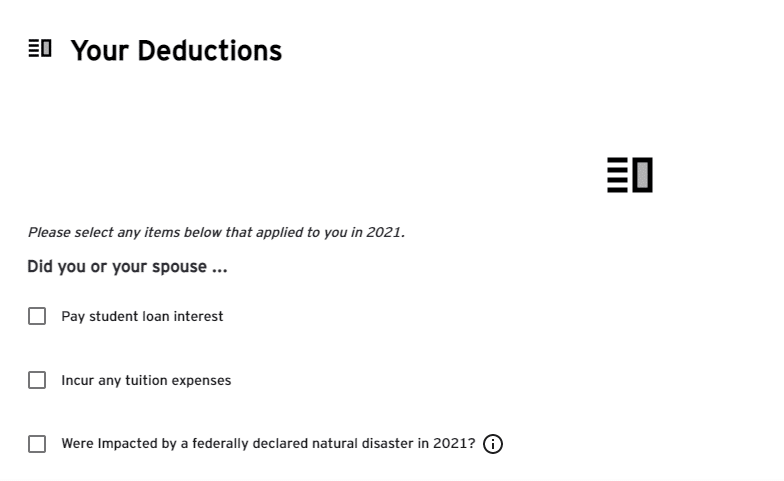

Easy-to-answer questions about tax return situations

Benefits of EY TaxChat

These are some areas where EY TaxChat stands out from other tax consulting firms.

Secure document upload

Users can upload their tax documents via a mobile app or via the TaxChat website. Both the app and website are secured. This secure portal makes it much easier for you to ensure that your tax advisor has the necessary information.

Secure messaging with tax advisors

Applicants can message their tax advisors via the EY TaxChat app. This ensures that the chat information is safe and secure. If the tax advisor needs additional information or you have additional questions, you can schedule a phone call to discuss your taxes.

Disadvantages of EY TaxChat

Although Ernst & Young has a good brand reputation, the EY TaxChat app has some drawbacks worth noting.

High cost compared to alternatives

A tax return via EY TaxChat can cost more than $1,000 for people with complex tax situations. Other companies, like TurboTax Full Service (where a TurboTax professional prepares your tax return) charge less for similar levels of service. Even Picnic Tax, which offers tax returns prepared by CPAs, is cheaper than EY TaxChat.

Tax advisors may not be accountants

EY states that its tax advisors can be either registered public accountants (EA) or certified public accountants (CPA). Between these two designations, the CPA typically has broader expertise and more experience helping clients develop tax plans. While both EAs and CPAs are qualified to prepare tax returns, an EA may not be suited to more nuanced tax discussions.

However, this shouldn't be a disadvantage for you. EY matches individuals with the most qualified preparer – this could mean an EA with crypto experience versus a CPA with no crypto experience. Given the range of different experiences between individuals, it really comes down to preference.

No tax planning advice

EY tax advisors can help claimants maximize their refund, but they cannot provide detailed planning advice. Most accounting firms offer taxpayer assistance year-round. And given Earnst & Young's reputation for providing tax planning for large corporations, it's surprising that you won't receive advice for your personal and small business tax returns.

EY TaxChat Pricing

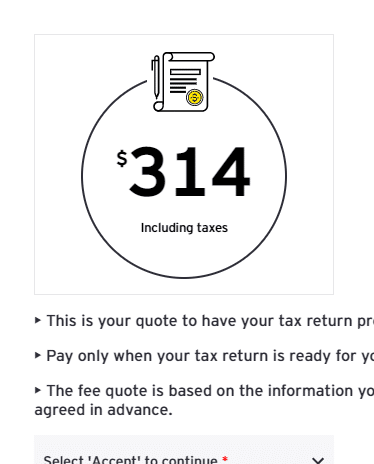

The EY TaxChat app provides customized pricing quotes based on the complexity of the submission. We tested different combinations and found that simple returns (with some deductions and credits) cost starting at $199, while the most complex return costs more than $1,600. According to EY TaxChat, most people pay $199 to $499.

Sample price quote for a simple tax return.

Applicants considering EY TaxChat should take the time to complete the interview. It only takes a few minutes and provides a detailed price quote.

How does EY TaxChat compare?

EY TaxChat has a tax advisor for even the most complex tax situations. The company can help prepare returns for everyone from crypto traders to rental property owners to the self-employed.

EY TaxChat also has an integrated messaging application that facilitates secure communication with your tax advisor. Overall, EY TaxChat offers a similar offering to Picnic Tax or TurboTax Full Service.

The table below compares the prices and services of these companies. EY TaxChat is slightly more expensive than these competitors.

|

Headers |

|

|

|

|---|---|---|---|

|

Varies (starts at $199 for Federal and State) |

$0 (Until February 15th, then $199 |

||

|

$1,600+ federal value, $75 per state added (first state is free) |

Over $1,000 federally, $50 per state |

$389 federal value, |

|

|

The same tax advisor every year |

|||

|

cell |

Is it safe and secure?

As a global company, EY TaxChat has more security measures than most small accounting firms. It has a secure and encrypted app and website where tax documents are stored. Strong passwords are also used to protect user information.

Surprisingly, EY TaxChat does not have multi-factor authentication. If a user's email address and password are hacked, the user's personal information can be stolen. Overall, EY TaxChat offers more security than the typical CPA firm, but still offers ways to improve security for users.

How do I contact EY TaxChat?

EY encourages users to contact their tax advisors using the chat function on the app and website. However, if you prefer to speak over the phone, you can call 1-833 TAX CHAT (1-833-829-2428). You can also email EY TaxChat at taxchat.support@ey.com.

TaxChat customer service team hours are Monday through Friday, 9:00 a.m. to 9:00 p.m. (ET). EY has been accredited with the Better Business Bureau (BBB) since 1952 and currently has an A+ rating.

Why you should trust us

At The College Investor, we have over a decade of experience reviewing tax software and tax preparation services. We personally test the tax services we review and have filed our own tax returns using a wide range of services to provide a comprehensive experience. We review more than a dozen tax filing options each year, paying attention to costs, benefits, and ease of use. Our goal is to provide you with unbiased reviews and help you find the best solution for your budget and individual needs.

Is it worth it?

Not everyone needs a professional tax advisor. Most people can file their taxes themselves if they choose the right tax software. Choosing a service like EY TaxChat costs most people a lot of money but doesn't save much time.

However, people with highly complex tax returns are welcome to spend the money on professional tax preparation. These complex filers are the best candidates for EY TaxChat, but they should look at Picnic Tax's pricing and take a look at the offerings for comparison. Costs with Picnic Tax tend to be lower for most applicants for a similar service, plus tax planning is available as an additional service.

Frequently asked questions about EY TaxChat

Can EY TaxChat help me register my crypto investments?

Yes, EY TaxChat supports filing all types of crypto activities. Filers who have made money through staking or mining can use EY TaxChat, as can those who have made money by buying and selling cryptocurrencies.

Can EY TaxChat help me file state documents in multiple states?

Yes, EY TaxChat supports multi-state filing. The increased cost of filing in multiple states is included in the interview form price quote.

Does EY TaxChat offer refund advance loans?

EY TaxChat does not offer cash advance loans.

EY TaxChat features

|

The basic fee covers one state. $75 for each additional state |

|

|

Deduct charitable donations |

|

|

Refund early loans |

|

|

Customer service phone number |

1-833 TAX CHAT (1-833-829-2428) |

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps