Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Dividend Aristocrats are companies that have consistently increased their dividends over the past 25 years or more.

If you're interested in dividend investing, you've probably heard of the Dividend Aristocrats. These are a special type of dividend stocks that have not only paid their dividends consistently over time, but have also increased their payouts.

If you're interested in investing for dividend growth, these are the companies you should keep an eye on.

But who are the companies? How are they selected?

Here's everything you need to know about Dividend Aristocrats.

What are the Dividend Aristocrats?

The Dividend Aristocrats are a group of S&P 500 companies that have consistently increased their dividends over the past 25 years. The Dividend Aristocrats Index was created and is maintained by the S&P Dow Jones Indices, which uses a special methodology to determine which companies fit into the index.

The index is rebalanced every January. New companies can be added to the index and others that no longer qualify are deleted.

To qualify, companies must also meet the following four criteria, specified in the methodology guide linked above:

- Join the S&P 500.

- Have increased the total dividend per share every year for at least 25 consecutive years.

- They must have a float-adjusted market capitalization (FMC) of at least $3 billion as of the rebalancing date.

- There must be an average daily trading value (ADVT) of at least $5 million in the three months prior to the rebalancing reference date.

Dividends must also be paid in cash and may not be issued in shares or as special dividends. Currently, the minimum number of stocks in the index is 40. In some cases, there may not be enough stocks that meet the annual criteria for inclusion in the index. In this case, stocks that have paid dividends for 20 consecutive years are taken into account.

Which companies are included?

As of January 2024, 67 companies are included in the index. According to Wikipedia they are:

|

Air Products and Chemicals Inc |

|

|

Automatic data processing |

|

|

Cincinnati Financial Corp |

|

|

Expeditors International from Washington |

|

|

Federal Realty Investment Trust |

|

|

West Pharmaceutical Services Inc. |

How do you invest in the Dividend Aristocrats?

One of the easiest ways to invest in the Dividend Aristocrats is with a fund that mimics an index and has the ticker symbol SPDAUDP.

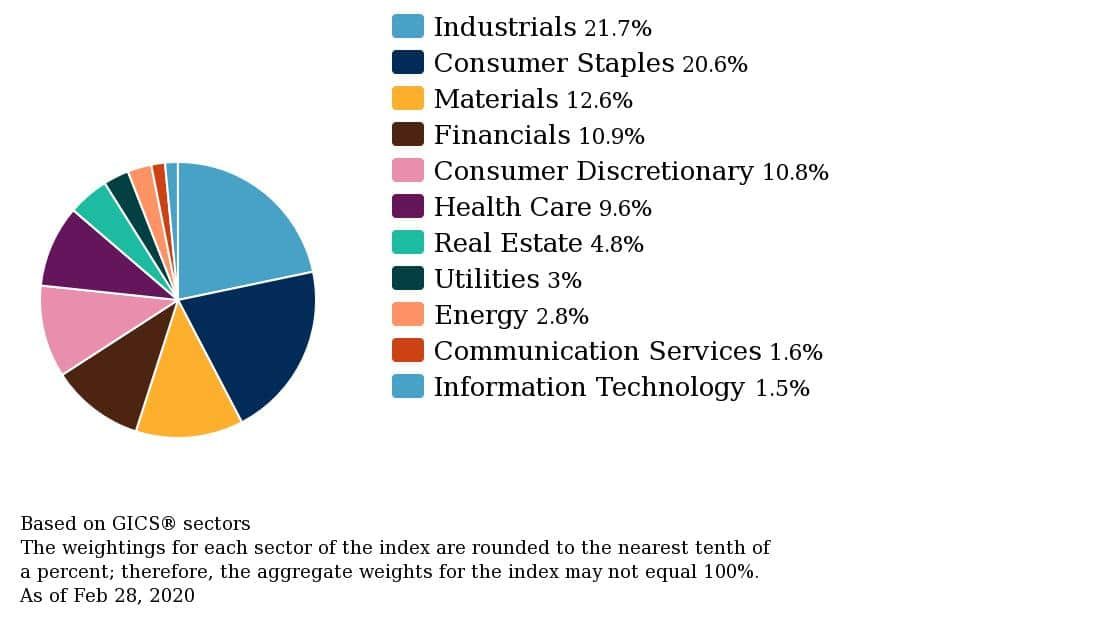

The index consists of 11 sectors:

Source: https://eu.spindices.com/indices/strategy/sp-500-dividend-aristocrats

Here are several funds and ETFs that track the Dividend Aristocrat Index:

- ProShares S&P 500 Dividend Aristocrats ETF (NOBL)

- iShares Selected Dividend Index (DVY)

- SPDR S&P Dividend (SDY)

An alternative approach is to simply own all of the companies in the index directly. This may seem challenging, but using a service like M1 Finance (which offers commission-free investing) makes it really easy. The advantage of this is that you can easily weight the index equally, compared to the cap weighting that most funds use.

You may prefer this option because equal-weighted indices tend to outperform.

Final thoughts

Both fundamental and technical analysis help in deciding which stocks are a good choice to invest in. If you've narrowed your selection to stocks in the Dividend Aristocrats index, you'll have less work researching potential candidates.

Good companies are generally those that have positive earnings, increasing sales and earnings, and good management. But your research shouldn't stop there. If researching a stock seems intimidating, choosing the SPDAUDP index provides diversification across all Dividend Aristocrats stocks.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps