Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

It can be confusing to figure out if you are a dependent or independent student for FAFSA and financial aid purposes.

Given the current cost of higher education, college students need all the help they can get to pay for their education. There are several ways to finance college, including self-funding, scholarships, grants, and student loans.

Almost all forms of financial aid begin with completing the Free Application for Federal Student Aid (FAFSA) form provided by the U.S. government. And one of the most important sections of the FAFSA form is Determining whether you are a dependent or independent student.

Here's what you need to know.

Filling out the FAFSA form

The FAFSA form is the primary financial aid form in the United States and is administered by the U.S. Department of Education. A common misconception is that the FAFSA form is only for student loans—in fact, many colleges use it as part of their scholarship awarding process. Filling out the FAFSA form each year and sending it to the colleges you're considering can help you figure out which college is the best fit for you academically and financially.

That's why it's important to fill out the FAFSA form every year, even if you don't plan on taking out a student loan. The Department of Education estimates that the FAFSA form takes about an hour to complete because it involves several steps. In the first steps, you create a Federal Student Aid (FSA) ID and enter your demographic and basic financial information. Then, you answer a series of questions to see if you're classified as an independent or dependent student.

Understanding Dependent and Independent Student Status: Key Differences

When looking at different ways to finance your education, it is important to understand the difference between a dependent and an independent student. A dependent student must also have their parents' information completed on the FAFSA form. This parental financial information is also used in the calculations to determine the student's Student Aid Index (SAI).

For an independent student, only your own data will be used to calculate financial aid.

Determine if you are an independent student

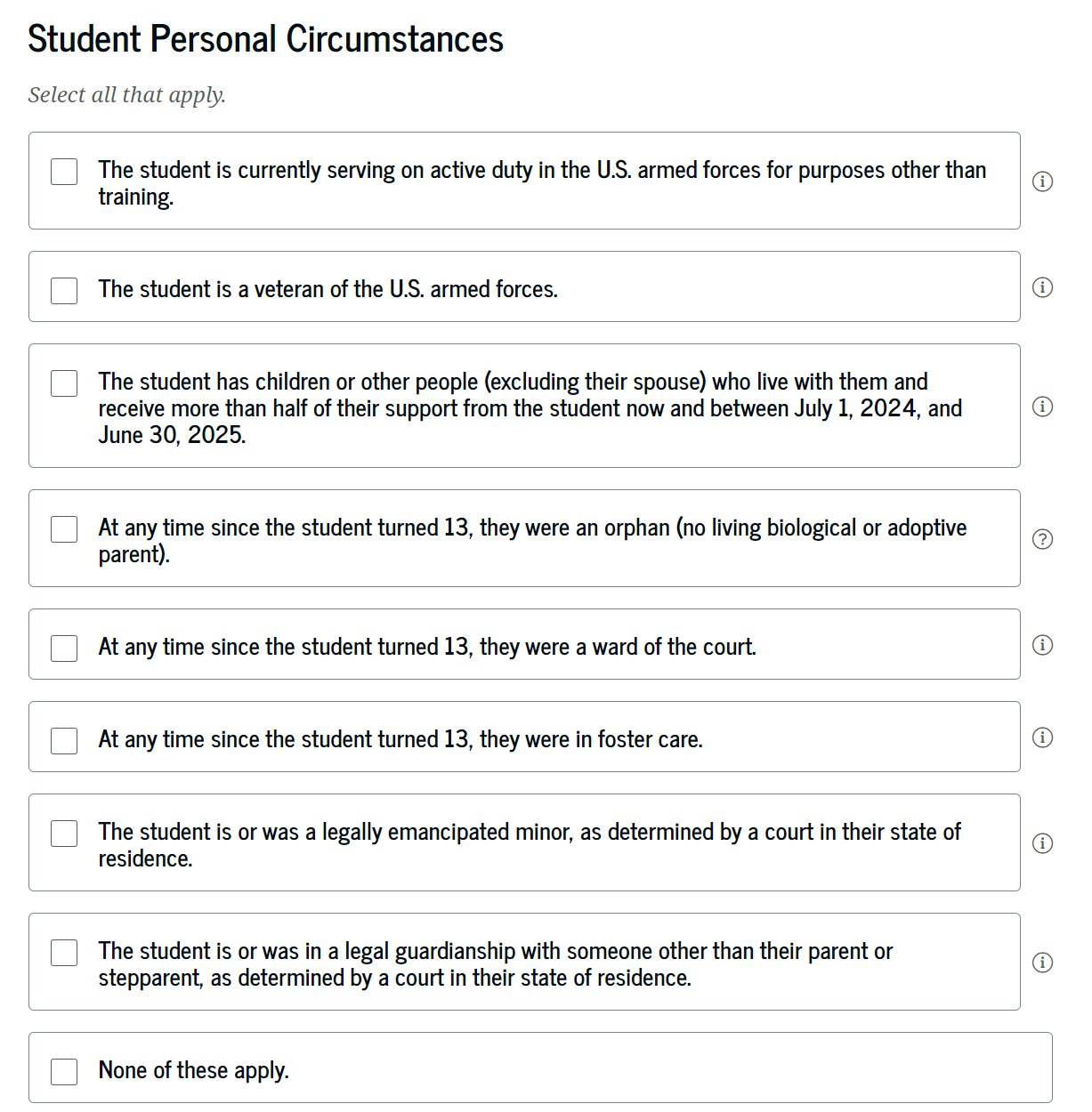

The FAFSA form will first ask if any of the following apply to the student:

- Age 24 or older on December 31 of the award year

- A university graduate or professional student

- Married

If any of these points apply, the student is classified as an independent student. If none of these statements apply, the student will be asked eight questions to which you must answer “yes” or “no” in order to determine the student’s personal circumstances.

- The student is currently serving on active duty in the United States Armed Forces for purposes other than training.

- The student is a veteran of the US armed forces

- The student has children or other persons (other than the spouse) living with him or her who receive more than half of his or her maintenance now and between July 1, 2024 and June 30, 2025

- The student has been an orphan (no living biological or adoptive parent) at any time since his or her 13th birthday

- Since the age of 13, the student was always a ward of the court

- The student had been in a foster family since he was 13 years old.

- The student is or was a legally emancipated minor as determined by a court in his or her state of residence

- The student is or was under the legal guardianship of someone other than his or her parent or stepparent, as determined by a court in his or her state of residence.

If you answer “yes” to any of these questions, you will be classified as an independent student.

If none of these points apply, you are considered a dependent student.

Dependent Students: Basics of Financial Aid

Dependent students must also have their parents or guardians provide their financial information as part of the FAFSA process. There are also rules about how divorced parents must complete the FAFSA form. Generally, a dependent student will qualify for less financial aid than an independent student based on their parents' income. Completing the FAFSA form as a dependent student is also required to determine eligibility for Parent PLUS loans.

Independent students: challenges and opportunities in financial support

If you are an independent student or are funding your education as an adult, you are generally eligible for more grants and loans than a dependent student in a similar situation. That's because independent students are not required to enter their parents' financial information on the FAFSA form. In most cases, that means these students have a lower expected family contribution and therefore have a higher likelihood of qualifying for need-based scholarships, loans and grants.

Because of this, you may be tempted to tell a little too much truth on some of the admissions questions in order to be classified as an independent student. This will most likely not work and may put you at risk for fines or other legal problems. Your college's financial aid department will likely ask for evidence of special circumstances and will easily see through any situation that is not entirely honest.

The conclusion

One of the most important sections of the FAFSA form determines whether you are an independent or dependent student. Dependent students must also have their parents or guardians provide their own financial information, while independent students are not required to do so.

For this reason, independent students typically receive more funding from the FAFSA than dependent students. Regardless of what type of student you are, be sure to research the best student loan rates to find the loan that's best for you.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps