Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Source: The College Investor

When comparing 529 plans, you need to pay attention to both benefits and fees.

Two researchers at the University of Kansas School of Business have found that some states are having problems administering their 529 college savings plans. They suspect these problems are due to conflicts of interest, inadequate oversight and a lack of investment expertise on the part of state sponsors.

According to the College Savings Plan Network, as of June 30, 2024, a total of $508 billion will be invested in 16.8 million 529 college savings plans.

The result is that consumers using 529 plans in certain states may be paying too much in fees (due to these conflicts of interest), which reduces their investment returns over time. When given a choice, consumers should opt for the lowest possible plan fees to maximize returns.

To find your state's plan and fees, see our 529 Plan Guide by State.

Features of 529 Plan Fees

Justin Balthrop and Gjergji Cici of the University of Kansas analyzed 5,339 unique investment options in 86 state 529 college savings plans for their paper “Conflicting Incentives in the Management of 529 Plans.”

Two-thirds of 529 plans are sold directly and one-third through advisors. Only 10% of plans are managed in-house, with the rest outsourced to third-party program managers. One-third have revenue-sharing agreements with the underlying mutual funds.

About half of the total fees from 529 plans go to the government, program managers and various intermediaries.

The asset-based management fees for 529 plans are five times larger than the comparable fees for administering a pension plan.

The Average 529 plan fees include:

- State fees: 0.04%, but can be up to 0.26%

- Program Manager Fees: 0.16%, but can be up to 1.15%

- Distribution fees: 0.23%, but can be up to 1.10%

- Underlying fund fees: 0.38%, but can be up to 1.29%

The total expense ratio – the sum of all asset-related fees – is on average 0.81% with a standard deviation of 0.53%. The expense ratio can be up to 2.49%.

Given that the average return on investment for a 529 plan based on historical performance data is about 6%, Some states and program managers divert a significant portion of investor returns for their own benefit..

In some cases, families would be better off saving in taxable accounts.

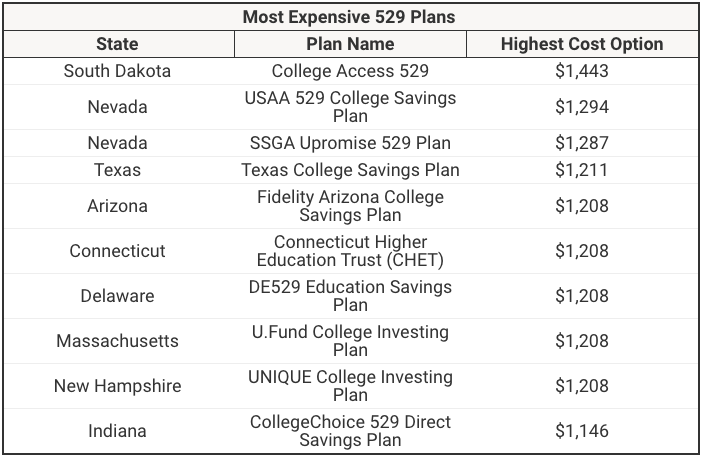

States with the highest 529 plan fees

These are the states with the highest fees, according to the recent Saving For College 529 Plan Fee Study. This study looks at the 10-year cost of a $10,000 investment for plans sold directly. It's important to note that plans sold by advisors can have much higher fees.

Comparing the most expensive plan option to the cheapest option, South Dakota College Access 529 charges over ten times the fees of the Louisiana START Savings Program.

The fees of the ten most expensive 529 plans in the United States are all nearly three times as high as those of the ten cheapest plans in the United States.

Here are the 10 most expensive 529 plans in the United States (remember that each state can and usually does have multiple plan options):

Analysis of the most expensive 529 plans by state. Source: The College Investor

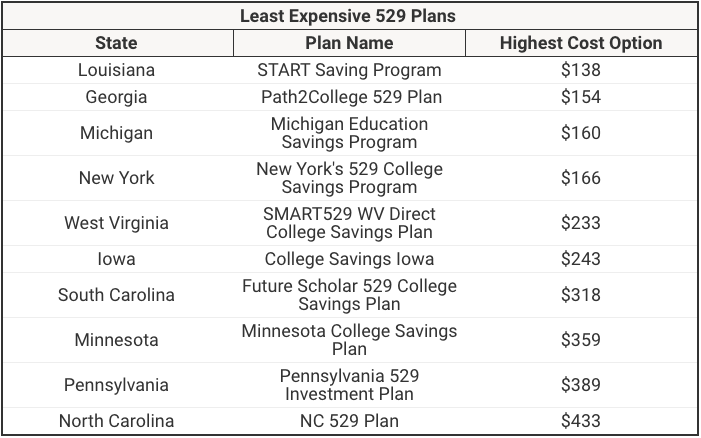

You can compare the states and plans above with the options below. We highlight the HIGHEST cost option in the state. Louisiana offers a $0 cost plan, a fixed income plan administered directly by the state treasurer, but this plan is only available to state residents.

Analysis of the cheapest 529 plans by state. Source: The College Investor

Compromise between government revenue and program quality

Some states charge higher fees than others, but this generally does not lead to an improvement in program quality. Quite the opposite.

The 529 plans in states that collect more revenue from 529 plans offer more limited investment options that charge higher fees and provide poorer net performance. The increase in underlying fund fees is about one-quarter of the average mutual fund fee.

The more expensive 529 plans offer fewer investment options and offer fewer low-cost index funds. These states also do not offer additional or better state income tax breaks.

The University of Kansas researchers found that investment options from plans where states receive the most revenue have an average underlying fund expense ratio of 0.506%, while investment options from states with the least revenue have an average underlying fund expense ratio of 0.219%. So if a state receives more revenue from its 529 plan, the expense ratio is more than double (2.3 times higher).

The researchers at the University of Kansas also used the Sharpe ratios calculated by Morningstar for all 529 plans and showed that Investors in these more expensive 529 plans experience poorer performance.

A Sharpe ratio is a risk-adjusted return on investment. It is calculated as the 529 plan's return on investment minus the risk-free rate of return, divided by the standard deviation of the excess return. A higher Sharpe ratio is better.

The 529 plans from states that generate more revenue from 529 plans have lower Sharpe ratios than the 529 plans from states that generate less revenue, which is a sign that the investment plans are performing worse net of fees. The Sharpe ratios of the 529 plans in the high-revenue states are 20% lower than the Sharpe ratios in the states that generate the least revenue from 529 plans.

Related: The best 529 plans based on performance

Conflicts of interest

Because 529 plans generate revenue for states and program managers, there is potential for conflicts of interest.

Incentives for the government are not necessarily consistent with the interests of plan participants.

In return, states receive higher fees if they give program managers more flexibility to collect more revenue directly and indirectly from plan participants.

529 plans often include investment options from the program manager's own mutual funds and from investment firms with which the program manager has revenue sharing agreements.

529 plans with revenue sharing arrangements have fund fees and total expense ratios that are 0.08% and 0.18% higher, respectively, than other 529 plans.

Some examples the report highlighted were plans that used excess fees to fund other government initiatives, or had an incentive not to negotiate better fees for investors because states enjoyed the extra revenue. In the most egregious form, 529 plan fees can be used to fund advertising campaigns that some critics have called political campaigns rather than investor education.

Lax supervision

There is very little effective oversight of the administration of 529 plans.

529 plans are exempt from the Investment Company Act of 1940 and the Securities Act of 1933. They are not required to register with the Securities and Exchange Commission (SEC), so the SEC is not a source of investor protection. SEC investment disclosure rules do not apply to 529 plans.

529 plans are not subject to a fiduciary standard. However, SEC regulations require investment advisers, such as those that recommend 529 plans sold by advisers, to disclose conflicts of interest and consider costs when recommending products. The SEC's Regulation Best Interest (Reg BI) is not a true fiduciary standard, only a suitability standard. It does not apply to the 529 plans themselves, only to the investment advisers.

States provide some oversight by appointing advisory boards, but politically appointed advisory boards may lack the financial expertise needed to align the 529 plan with the interests of investors.

Program managers often ensure that states with weaker oversight receive higher fee revenues.

Inadequate disclosures make it difficult for investors to make informed decisions. There are no consistent disclosure practices standardized across all 529 plans.

States that impose higher fees that affect the net return on an investment do not provide better benefits to investors.

States provide some oversight by appointing advisory boards, but politically appointed advisory boards often lack the financial expertise needed to align the 529 plan with the interests of investors.

States that impose higher fees that affect net profits do not provide better benefits to investors.

Program managers often ensure that states with weaker oversight receive higher fee revenues.

Inadequate disclosures make it difficult for investors to make informed decisions. There are no consistent disclosure practices standardized across all 529 plans.

Comparing 529 Plans: Tips for Investors

The key to maximizing net income is to minimize costs.

Higher fees do not automatically lead to better net performance after fees are deducted from investment returns. The investment options do not necessarily offer a better return on capital. And even if they do, the higher returns are not enough to offset the higher fees.

Therefore, investors should choose the government 529 plans with the lowest fees.

Often there is a trade-off between low fees in another state's 529 plan and state income tax breaks for contributions to the state's 529 plan. There is a tipping point between choosing low fees and state income tax breaks when the child enters high school. Consider the following when choosing a 529 plan in the future:

- When the child is young, families should focus on 529 plans with lower fees.

- When the child enters high school, new contributions should go to the state's 529 plan if the plan offers a state income tax credit on contributions to the state's 529 plan.

Low fees apply to the entire 529 plan balance, while the federal income tax credit applies only to new contributions in that year.

Morningstar.com and Savingforcollege.com provide ratings of 529 plans that consider the net return on the investment after fees. Savingforcollege.com also publishes a rating that evaluates the impact of the fee range on the investment options of each directly sold 529 plan.

To better understand how to contribute to a 529 plan in your state and the fees involved, check out our complete 529 guide.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps