Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Source: The College Investor

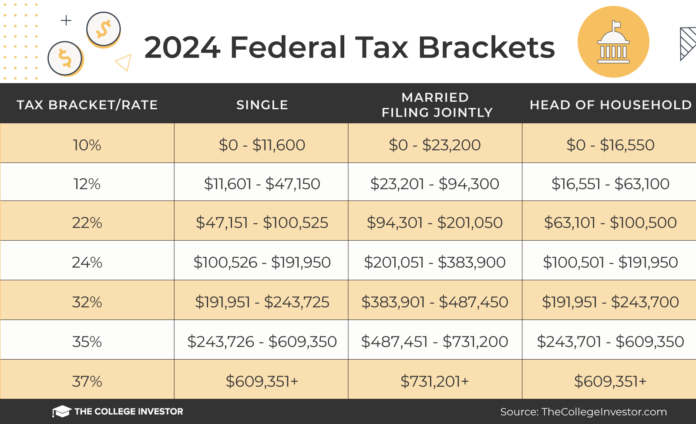

The IRS has announced the tax brackets and tax tables for 2024. Since many people are interested in the changes, we wanted to incorporate the latest tax bracket updates as quickly as possible.

If you're looking for last year's tax brackets, check out the tables below.

There have been a number of changes to tax law in recent years. These include new federal tax brackets, changes to the standard deduction and the elimination of the personal tax exemption. If you also factor in inflation, these tables and tax brackets change dramatically from year to year.

In order to better compare the tax brackets, we have listed the historical ones below.

Take a look here if you are looking for the specific capital gains tax brackets and rates.

Federal tax brackets 2024

Here are the federal tax brackets for 2024. Remember, these are not the amounts you report on your tax return, but rather the tax amounts you will pay from January 1, 2024 to December 31, 2024. These tax brackets have increased significantly for 2024 due to rising inflation.

The following table shows the tax bracket/rate for each income level:

2024 federal tax brackets. Source: The College Investor

|

Federal tax brackets 2024 |

|||

|---|---|---|---|

Standard deduction 2024

The flat rate deduction has also increased significantly for 2024 due to inflation, which you can see in the table below.

|

Standard deduction amount |

|

|---|---|

Federal tax brackets 2023

Here are the 2023 federal tax brackets. Remember, these are not the amounts you report on your tax return, but rather the tax amounts you will pay from January 1, 2023 to December 31, 2023. These tax amounts have increased significantly for 2023 due to rising inflation.

The following table shows the tax bracket/rate for each income level:

Source: The College Investor

|

Federal tax brackets 2023 |

|||

|---|---|---|---|

Standard deduction 2023

The flat rate deduction has also increased significantly for 2023 due to inflation, which you can see in the table below.

|

Standard deduction amount |

|

|---|---|

Tax brackets from the previous year

Looking for some history? The tax brackets and standard deduction levels for previous years are listed here.

For 2020 and 2021, the federal tax brackets are very similar to 2019. There are some minor changes, but nothing major like we saw in 2017-2018 with the Trump Tax Cuts and Jobs Act. However, things started to expand a bit in 2022.

The bottom line is that all upper tax bracket limits have been raised slightly.

The following tables show the tax bracket/rate for each income level:

Here are the 2022 federal tax brackets. Remember, these are the amounts you will pay if you file your taxes in January through April 2023 (for the year from January 1, 2022 to December 31, 2022).

The following table shows the tax bracket/rate for each income level:

Here are the 2021 federal tax brackets.

The following table shows the tax bracket/rate for each income level:

The flat rate deduction has also increased slightly for 2021, which you can see in the table below.

Here are the federal tax brackets for 2020.

Here are the federal tax brackets for 2019.

Here are the federal tax brackets for 2018. This was a year of big change due to the Tax Cuts and Jobs Act.

Calculating your withholding tax

If you want to calculate your withholding tax, you can use the IRS withholding calculator at https://apps.irs.gov/app/withholdingcalculator/.

And remember: In addition to your federal taxes, you also have to pay FICA taxes. These are the payroll taxes that go to Social Security and Medicare. Additionally, depending on your state, you may have to pay state taxes.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps