Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

The end of the year is approaching and now is the time to make plans to save taxes and influence your tax situation.

I'm not talking about doing what Donald Trump did and losing a lot of money to offset your gains. I'm talking about some practical steps you can take today to lower your tax bill for the year.

Here are ten different ways you can save on taxes before the end of the year without losing a lot of money.

1. Increase your 401k contribution

One of the best ways to save on your tax bill today is to contribute to your 401k or 403b plan. These accounts allow you to save tax-free money for retirement. The result? You pay less in taxes today because the money grows tax-free until you withdraw it in retirement.

For 2024, the 401k plan contribution limit is $23,000, but if you are over age 50, you can make an additional catch-up contribution of $7,500.

If you haven't reached the limit yet, boosting your 401k account is a great way to save money AND taxes.

And remember, 401k contribution limits change every year, so check here: 401k Contribution Limits.

2. Maximize your traditional IRA

Similar to a 401k, you can contribute to a traditional IRA, lowering your taxable income. Deciding whether to contribute to a Roth or traditional IRA can be difficult, but if you're only thinking about this year's taxes, a traditional IRA is your best bet.

In 2024, you can contribute $7,000 to an IRA if you are under age 50 and $8,000 if you are over age 50.

And remember: While there are no income limits for contributions to a traditional IRA, there are income limits that may prevent you from deducting your contribution.

Learn about IRA contributions and IRA limits here.

3. Maximize your SEP IRA or Solo 401k

If you work a side hustle, it's important that you take advantage of a SEP IRA or Solo 401k to lower your taxable income. Side hustles are great (and here's a list of 50 you can try), but it's important to remember that taxes aren't withheld on most of that income, so you'll end up paying a hefty tax bill on your side hustle money.

By contributing to a SEP IRA or Solo 401k, you can defer some of that money into the future and avoid paying taxes on it today. This is a great way to not only save, but also lower your tax burden this year.

Contributions to a SEP IRA are easy and can be made until April 15th. Setting up a solo 401k is a little more difficult and you must have your plan set up by year's end to make contributions. But you can also save A LOT more money.

In 2024, a SEP IRA will allow you to save 25% of your income, up to $69,000 per year. A Solo 401k will also allow you to save up to $69,000 per year!

4. Maximize your HSA

We're big fans of using your Health Savings Account to save for retirement. If you have the opportunity to max out your HSA this year, be sure to contribute as much as you can. And remember: If you can afford it, don't get a refund on your payments this year. Keep your receipts and let the money in your HSA grow for you.

As a reminder, the HSA is like your IRA and you can actually make your 2024 contributions until April 15, 2025.

In 2024, you can contribute up to $4,150 as a single person and up to $8,300 as a family. If you're over 55, you'll also get a $1,000 catch-up contribution. Read the full HSA contribution limits here.

5. Save for your children’s college

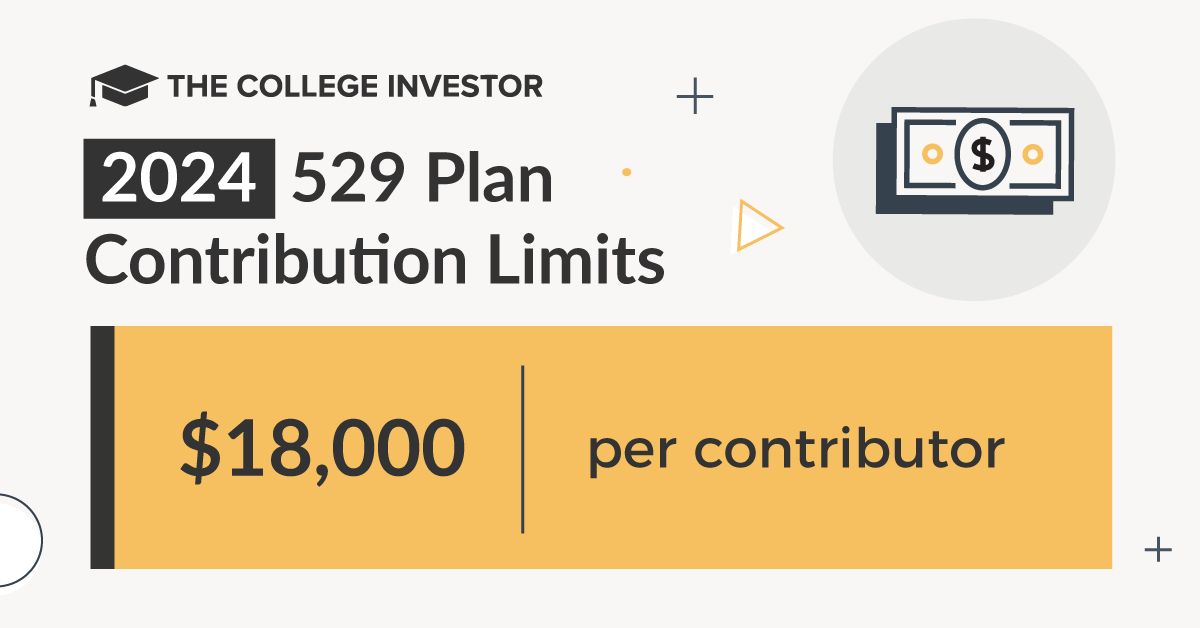

Contributing to your child's 529 plan is a great way to save for college, but it also offers you a potential tax advantage. If you live in one of the 32 states that offer tax-free 529 plan contributions, it can be a great way to lower your state income tax burden.

While the federal government does not offer deductions for contributions to a 529 plan, many states do.

Contributions to a 529 plan are considered gifts and therefore contribution limits are based on the gift tax exemption.

You can give up to $18,000 per child, per year, per donor. So married couples could give $36,000 per child per year. There is also a 5-year contribution rule where you can give a full $90,000 per child in one lump sum, and that counts as a contribution for the next five years.

Learn more about 529 plan contribution limits here.

6. Improve your home’s energy efficiency

If you make your home more energy efficient, you may be eligible for tax credits that can help you save on taxes this year.

In 2024, you could receive up to $3,200 in tax credits, depending on your job.

The maximum credit you can claim this year is:

- $1,200 for property energy costs and certain energy-efficient home improvements, with limitations on doors ($250 per door and $500 total), windows ($600), and home energy audits ($150)

- $2,000 per year for qualified heat pumps, biomass furnaces or biomass boilers

With all of these credits, you can offset your income and make big savings. You can find more information about these tax credits here.

7. Maximize your work-related expense deductions

The fact is, most people are terrible at keeping track of their expenses. I'm not saying you should spend more so you can deduct your expenses – I'm just saying you need to keep track and deduct what's right.

Some work-related deductions you may be able to claim:

- Transport and travel – many people forget or forget to calculate the mileage

- Meals and entertainment

- Trade union and professional contributions

- Uniforms if your employer does not reimburse you for the costs and they cannot be worn outside of work

- Job-related training costs, especially if your job requires further training

The same rules apply if you're self-employed. For example, if you drive for Uber or Lyft, you should keep accurate records of your mileage and related expenses. All of this will offset your income and help lower your tax bill.

So keep an eye on your expenses and save money.

8. Donate to charity

Another great way to save is to donate to charity. Your cash and in-kind donations can be tax deductible. However, for 2024, there is no way to claim charitable contributions without itemizing them on your tax return.

So start your fall cleaning now, get organized and see what you no longer need. Some rules of thumb are:

- Clothes you haven’t worn in a year

- Old children's clothes or toys that they no longer use

- Items that have been lying unused in your garage for a year

Take these items to a local charity, keep the receipt, and deduct your donation from your taxes.

9. Sell your losing stocks…

I know I mentioned above that you shouldn't be a loser like Donald Trump and take big losses just to avoid taxes. But… even good investors have stocks that perform poorly. Now is a good time to review your portfolio and sell some losers to offset the capital loss.

This strategy is called “tax loss harvesting.”

This can be an effective strategy, especially if your portfolio has a lot of capital gains from the beginning of the year.

Please make sure that you comply with the capital gains tax brackets.

But on the other hand…

10. Wait to rebalance your portfolio

This may sound strange, but wait until the new year to rebalance your portfolio. Many mutual funds and ETFs pay their dividends and capital gains in December. If you sell your losing stocks at the end of the year, just wait until January to deploy the money.

If you invest in a mutual fund or ETF shortly before the distribution, you are effectively buying yourself a tax burden. Since the distributions are part of the net asset value (NAV) anyway, you won't miss much by waiting just a few weeks.

Here's our guide to rebalancing your portfolio across multiple accounts.

Things to consider for next year

Some things you just can't change this year (maybe you've already sold some stocks or made other gains), but right now enrollment is usually open for many people. And that means there are changes you can make for next year.

If reducing your taxable income is your goal, consider making the following changes during open enrollment:

- Maximize your 401k contribution

- Choose a high-deductible health insurance plan with an HSA

- Maximize your HSA

- If you have children, use a Dependent Spending Account for childcare costs

- If you commute to work, consider a transportation spending account if you are eligible

What else? What do you do to lower your taxable income each year?

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps