Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Did you know you can start investing with $100 or less? Most people think you need thousands of dollars to start investing, but that's simply not true. In fact, I started investing with just $100 when I started my first job in high school (yes, high school).

It is possible to start investing as early as high school, college, or even your twenties.

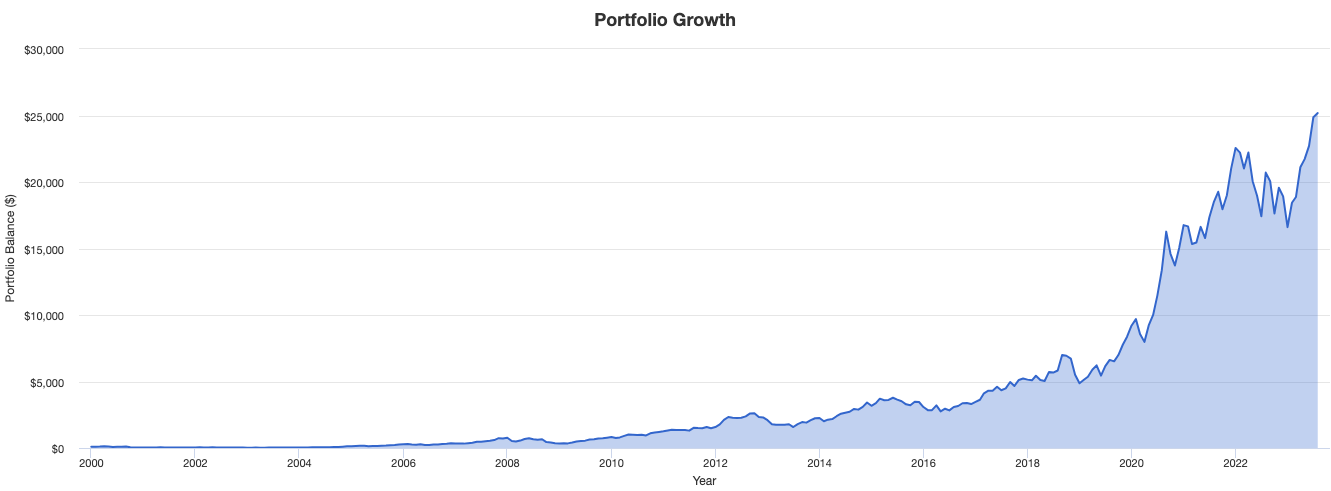

Even more food for thought – If you invested $100 in Apple stock in 2000, it would be worth $25,000 today. Or if you had invested in Amazon stock back then, it would be worth over $3,500 today. And that's just if you had invested $100 once.

Imagine if you had invested $100 in Apple stock every month since 2000? You would have well over $4,000,000 today. Seriously.

Hopefully this motivates you and proves that you don't need a lot of money to start investing. Just look at this chart:

Remember, the hardest part of investing is getting started. Just because you're starting with $100 doesn't mean you should wait. Start investing now!

Let's break down in detail how you can start investing with as little as $100.

How to start investing with just $100

If you want to start investing, the very first thing you need to do is open an investment account and sign up with a brokerage firm. Don't let this scare you – brokers are just like banks, only they focus on holding investments. We even keep a list of the best brokerage accounts, including details of the lowest fees and best incentives: Best Online Stock Brokers.

Since you are only starting with $50 or $100, you should open an account with zero or low minimum deposits and low fees. Our preferred broker to get started with is Charles Schwab. The reason? $0 commissions and you can invest in virtually anything you want – for free!

Keep in mind that some brokers charge $5-20 to place an investment (called a commission), so unless you choose a low-cost account, 5-20% of your initial investment could go to costs. Others (like Acorns or Stash) charge monthly fees – as much as $9 per month! If you only have $100, you could be down to $0 very quickly just because of fees.

There are other places that allow you to invest for free as well. Here is a list of the best places to invest for free. Keep in mind that many of these places have strings attached, meaning you have to invest in their funds or in an IRA to invest for free.

Bottom line: Choose a low-cost broker like Fidelity or Charles Schwab. That's what will make you happiest in the long run.

What type of account should you open?

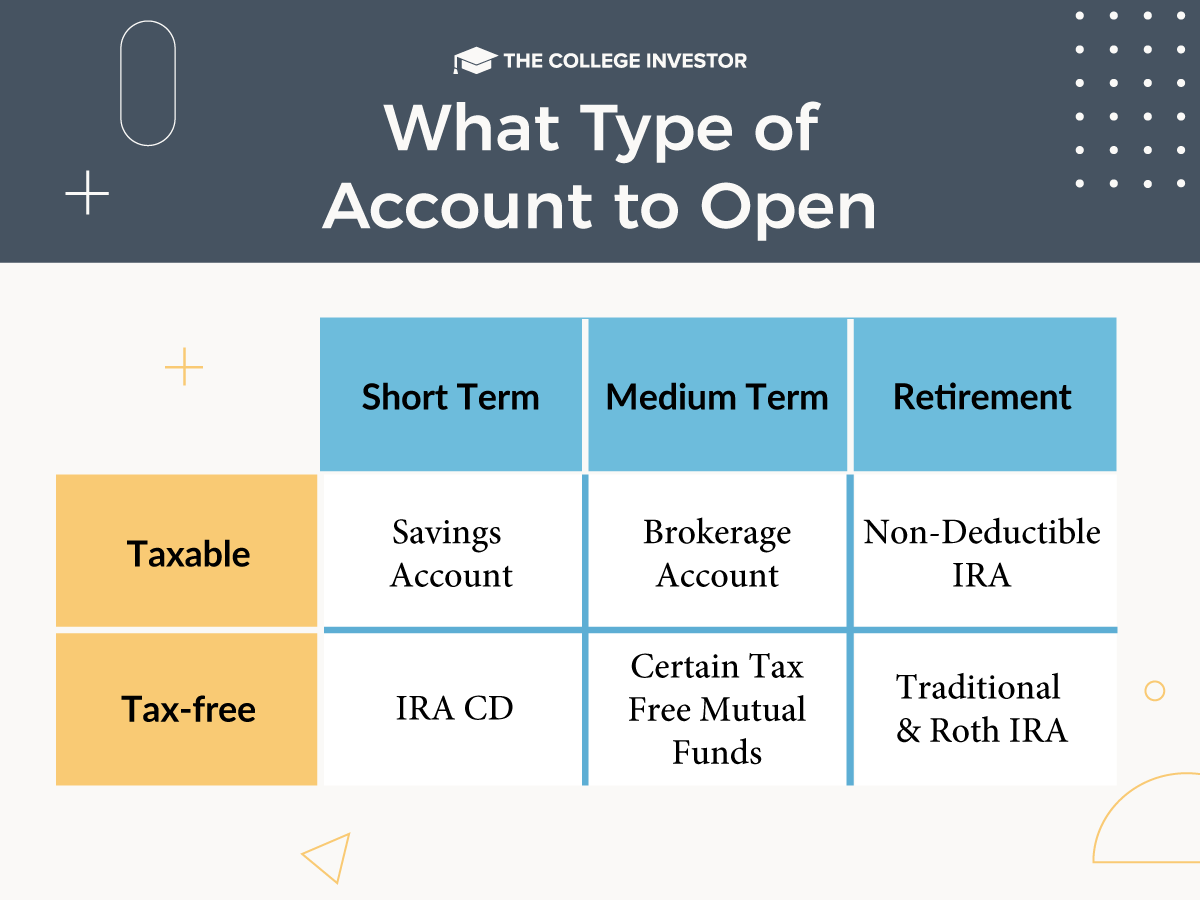

Next, you need to decide what type of investment account you want to open. There are many different types of accounts, so it really depends on why you're investing. If you're investing for the long term, you should focus on retirement accounts. If you're investing for the short term, you should keep your money in taxable accounts.

Here is a table to help you understand this:

Most people want to have both an IRA account and a taxable brokerage account. But you can start with one.

Related: Sequence of processes when saving and investing

How to Invest $100 (What You Should Actually Invest In)

The next challenge is what to invest in. $100 can grow a lot of money over time, but only if you invest wisely. If you speculate on one stock, you could lose all your money. And that would be a terrible way to start investing. However, it is very rare that you lose all your money investing.

To start, you should focus on investing in a low-cost index-tracking ETF. Wow, that sounds like a lot. But it's actually quite simple. ETFs are simply baskets of stocks that track a specific index – and they make a lot of sense for beginners. In the long run, ETFs are the most cost-effective way to invest in the broad stock market, and since most investors can't beat the market, it makes sense to simply mimic it.

A common index, for example, is the S&P 500 – it includes the 500 largest companies in the USA. If one of them fails (goes bankrupt), the 501st company is added to the index. This provides security and diversification. And as far as growth is concerned: as long as the country is growing, the index should also grow in the long term.

This guide will teach you how to invest in the S&P 500 to get ideas.

If you don't know where to start, we've put together a great resource called the College Student's Guide To Investing, where we break down different ETF options for building a starter portfolio.

Consider using a robo-advisor

If you are still not sure what to invest in, consider using a robo-advisor like Asset front. Wealthfront is an online service that does all the “investing stuff” for you. All you have to do is deposit your money (the minimum amount to open an account is $0) and Wealthfront takes care of the rest.

When you first open an account, you answer a series of questions so Wealthfront can get to know you. It then creates and manages a portfolio based on your needs from that questionnaire. Hence, robo-advisor. It's like a financial advisor managing your money, but the computer takes care of it.

There is a fee to use Wealthfront (and similar services). Wealthfront charges 0.25% of the account balance. This is probably cheaper than what you would pay a traditional financial advisor, especially if you're only starting with $100. In fact, almost all financial advisors would probably refuse to help you with just $100.

So if you are looking for a system to help you invest, Check out Wealthfront here.

Related: Discover our selection of the best robo-advisors here.

Alternatives to investing in stocks

If you're not sure about starting investing right away with just $100, there are alternatives. Remember, investing is simply putting your money to work for you, and there are many ways to do this.

Here are some of our favorite alternatives to stock investing for just $100.

Savings account or money market

Savings accounts and money market accounts are safe investments – they are usually insured by the FDIC and held at a bank.

These accounts earn interest, so they are an investment. However, this interest is usually less than the interest you would earn from an investment over the same period.

However, you cannot lose money in a savings account or in the money market – so this is an advantage for you.

The best savings accounts currently offer over 5.00% interest – the highest amount in years!

Investment options to avoid

There are two investment options that are constantly touted and that we advise against using.

Subscription investment apps

There are several companies that will get you started investing for as little as $5. We want to make sure that when using these companies, you have a “buy with caution” mindset and know exactly what you are getting into.

For example, Stash Investing lets you invest as little as $5, but accounts with less than $5,000 have a $1 fee per month. If you only invest $5 per month and pay $1 in fees each month, your portfolio's returns will suffer (or even lose money).

If you invest just $5 per month for a year, you've invested $60. However, you've paid $12 in fees, leaving you with $48. That's 20% of your money spent on fees.

Only in 32 of the last 100 years has the stock market returned over 20% in a year (and that year usually followed a really bad year). The average return was about 11%.

This is why you need to avoid services that charge you high fees for investments. $1 per month may not seem like much, but it is as a percentage of your $100 investment.

Compound interest accounts/insurance products

If you've been on social media over the past few years, you've seen a lot of people promoting “compound interest accounts” or other variations of life insurance products sold as investments.

Please do not “invest” in or buy these index-linked life insurance policies. They may have sexy names and be touted by really convincing salespeople, but the bottom line is that these products are expensive (lots of fees) and tend to underperform the stock market. If you use these products, you will be left far behind in 20 years – and that's assuming you don't miss a payment and lose the policy.

Just avoid these things!

Just start investing

Remember, you are investing to grow your money over the long term, which means you are taking advantage of the power of time and compound interest.

Time is on your side. The sooner you start investing, the better. So even if you only have $100 to invest, just get started.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps