Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Let's talk about how to apply for and take out a student loan. Whether you need a government or private student loan, there are certain things you need to know about taking out a student loan.

While it would be great to cover all of your college costs through a combination of savings, help from family members, scholarships, and your personal income, these funds are not always enough. Many students who go to college must take out student loans to bridge the gap between college costs and their limited funds.

This guide explains how to apply for a student loan and how to choose the loan amount when taking out the loan.

A good starting point: How to find the best student loan interest rates >>

How to apply for a government student loan

For US citizens applying for student loans in the US, the FAFSA application is the starting point for federal student loans. How to apply for federal student loans.

Criteria and requirements for a government student loan

If you want to take out a government student loan, the following criteria apply:

- Do you have a valid social security number?

- Men must register for military service. Male students between the ages of 18 and 25 must register with the Selective Service to receive loans.

- Be a citizen or an eligible non-citizen. Undocumented immigrants are not eligible for state or federal assistance. Permanent residents with green cards can apply for assistance. Immigrants with T-1 status, abused immigrant status, or refugee status may also be eligible.

- You must have a high school diploma or its equivalent, such as a GED or a certificate from a homeschooling program.

- Enroll in a suitable school. Students at unaccredited schools may not be eligible for federal aid. Some schools also choose not to receive federal aid.

- Fill out the free application for state student funding. Every high school student interested in financial aid must fill out the FAFSA form, which asks for your family's financial information to determine how much you qualify for. Even those who have demonstrated little or no need may be eligible for student loans, so officials encourage everyone to apply. Without the FAFSA form, you will not receive any federal loans, scholarships or grants.

- You must have a good record of receiving government financial aid. Students must not be behind on repayment of other federal loans or have debt for a federal grant.

- Maintain a grade point average of 2.0. Students must maintain a cumulative grade point average of 2.0 or risk losing financial aid until their grades improve.

- Work part-time or more. To be eligible for a loan, students must be considered part-time students. Each college defines what part-time and full-time status means, so ask your financial aid officer how many credits you must take.

Fill out the FAFSA form

Applying for a federal student loan begins with completing the Free Application for Federal Student Aid (FAFSA). To complete the application, you'll need your and your parents' information from two years ago's tax returns (for the 2024-2025 school year, you'll need 2022 tax returns), as well as information about your parents' net worth, assets, and other financial details.

Once you submit the FAFSA form, your school (or schools of choice if you haven't decided which one to attend yet) will prepare a student aid report for you. This report will include information about free aid (like grants, scholarships, and more). It will also include information about college and work opportunities, and of course, student loans.

In the United States, almost all schools use the FAFSA form to provide need-based aid to students. Even if you don't plan on taking out student loans, you should fill out the FAFSA form. You may learn that you are eligible for grants or additional scholarships from the school of your choice based on your financial situation.

Check what support your school offers

You can expect to receive a financial aid offer approximately two weeks after you submit the FAFSA form to your school. The offer will include information about all funding sources, including:

In general, you want to take as much money with you as possible. This means you should accept scholarships and grants. If you plan to live on campus, you should also consider being offered a study and work stipend.

However, consider the work-study program as a baseline for your income, not a ceiling. Work-study jobs often don't pay very well. Side jobs like refereeing soccer or basketball games, tutoring, waiting tables and bartending, or any other form of skilled work are usually much better paid.

And of course, starting a business can be the best way to make money while studying.

The final form of assistance is student loans. These include subsidized loans, which have a lower interest rate (and no interest accrues while you are studying), and unsubsidized loans (where interest accrues immediately).

Read our complete guide to financing your studies here >>

Take out the appropriate student loan amount

Once you have reviewed the offer, you can accept any part of the offer you wish. You not have to take out any loans. In fact, I recommend borrowing as little as possible to pay for your tuition and other upfront costs. You also have to be content with the borrowing limits on federal student loans, which are very low.

By saving, living modestly and working, most students can make a living without having to borrow money.

Student loans are not free money. You have to pay them back. It always makes sense to look for alternatives to loans to finance your education.

It may seem smart to borrow a little more now, but I advise against it. After college, you may have a starting salary of $50,000 to $60,000 (or even less in many fields). That sounds like a lot of money, but paying off student loans with a starting salary over $50,000 is a huge challenge.

Think about your future self and limit your borrowing today. You should also make sure you complete student loan counseling first so you have a good understanding of repayment expectations.

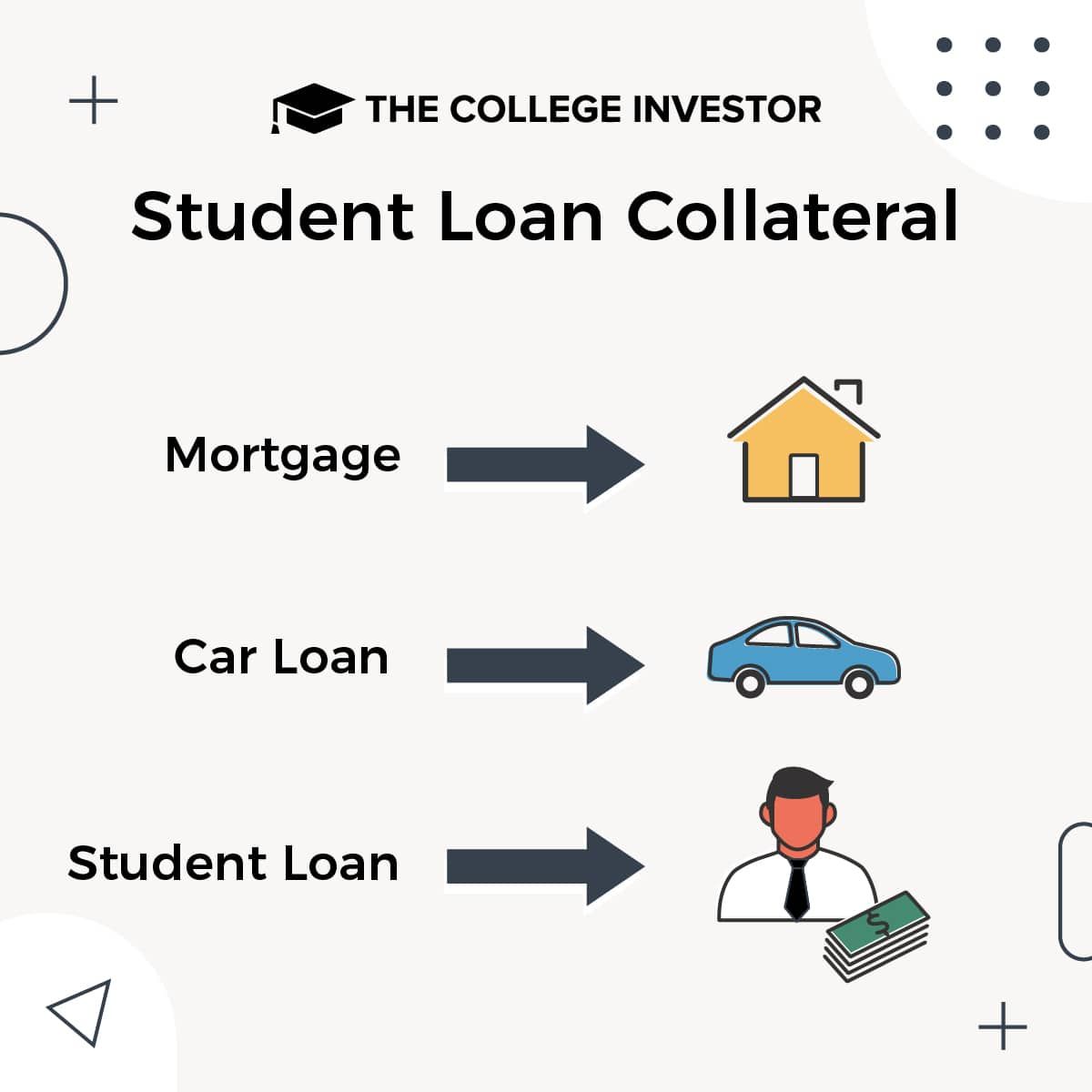

And don’t forget: your future income serves as security for your student loan!

How to apply for private student loans

In some cases, students in the United States may prefer to apply for a private student loan rather than a federal student loan. Some reasons why you might consider a private loan include:

- You want to participate in a non-accredited educational opportunity (e.g. a coding bootcamp).

- You plan to take one course at a time (to qualify for most federal programs, you must have at least half-time enrollment).

- You are not a U.S. citizen and therefore are not eligible for a government loan.

- They have high incomes and good credit scores, so private lenders may offer better interest rates than unsubsidized government loans.

- You refinance your existing student loans to a private lender with a much lower interest rate.

If any of these situations apply to you, follow these steps to apply for a private student loan.

Collect all your documents

When you apply for a loan, you will need documents that prove your income, creditworthiness and assets. Generally, you will need the following:

- Tax returns or W-2 forms from previous years.

- Payroll statements for employment relationships.

- Personal identification data (driver’s license, etc.).

- Bank statements.

- If you are applying for a private loan alongside your studies, you will need information about the study costs.

- If you have a co-signer, you will also need their information.

- Loan documents for existing student loans (in case of debt consolidation).

Compare interest rates from multiple lenders

Once you have all the information you need, you can start your loan search. We recommend the lenders on our Best Places to Find Private Student Loans list.

Many lenders allow you to view interest rates without having to run a credit check. You can also “shop” for interest rates on websites like Credible.

Comparing interest rates using an aggregation site (like Credible) will give you a feel for the rates and terms available to you.

Apply for identical loans from at least two lenders

After comparing interest rates informally, apply for loans from at least two lenders. This will help you choose the best possible rate. The underwriting and approval process can take anywhere from a few hours to a few weeks, depending on the lender.

Remember to also compare important features such as the loan's repayment terms, loan relief options (e.g., disability relief), and more.

Get the best deal on a student loan

If you have multiple loan offers, compare them to find out which loan is best for you. Then sign the loan documents and continue your education or pay off your loans.

If you have a co-signer, you may also want to purchase term life insurance to protect your co-signer if something happens to you. Term life insurance on the balance of the loan (if you are a young adult) can be very inexpensive.

Keep in mind that some private student loans require immediate repayment, so be sure to check your lender and their repayment plans before committing.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps