Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

The tax credit for automatic contributions to your Solo 401(k) plan allows you to earn $1,500 over three years simply by enabling automatic contributions to your Solo 401(k) plan.

Solo 401(k) plans are a type of retirement plan that allows sole proprietors to save on taxes while setting aside money for retirement.

While most people associate 401(k) plans with larger companies, even the smallest businesses with just one employee can create a 401(k) plan for their company.

The rules for the Solo 401(k) Automatic Contribution Credit are quite complex, so we're sharing what you need to know to qualify for up to $1,500 in tax credits. In partnership with My Solo 401k Financial, we're explaining what the Automatic Contribution Tax Credit is and how you can take advantage of it with your Solo 401k plan.

Table of contents

What is a Solo 401(k) Plan? Understanding the Solo 401k Automatic Contribution Tax CreditEligibility RequirementsBenefits of Automatic ContributionsClaim for the Tax CreditIs the Solo 401(k) Automatic Enrollment Credit Worth It?

What is a Solo 401(k) Plan?

A Solo 401(k) may also be called a Self-Employed 401(k), Individual 401(k), or something else. The most important thing to remember is that it is a 401(k), but it is designed for only one person.

If you're new to the concept, Solo 401(k) plans are exactly the same as large employer 401(k) plans, but with only one member. You can open and maintain a Solo 401(k) for free with major brokers like Schwab and Fidelity. However, specialty providers like My Solo 401k Financial make opening and maintaining a Solo 401(k) easier in many cases for a fee.

Most free solo 401k plans don't offer all the features you could have if you opened your own solo 401k. For example, some don't allow Roth contributions or after-tax contributions. And currently, no free plan provider has the automatic contribution feature to enable the tax credit.

If you open your own plan with a company like My Solo 401k Financial, you can continue to hold your stocks and exchange-traded funds (ETFs) with Fidelity or Schwab.

About the Solo 401k Auto Contribution Tax Credit

As part of the SECURE Act 2.0, Congress passed a law that encourages companies to offer 401(k) plans with automatic contributions. Companies can earn tax credits of $1,500, divided into $500 per year for three years.

Freelancers and other entrepreneurs without employees are not excluded from the loan. While other parts of the 401(k) loan program are a little more dubious, the general consensus is that Solo 401(k) plans are eligible for the automatic $1,500 contribution credit.

For example, if you start a new Solo 401(k) plan in 2024, you could receive the following tax credits:

|

2024 |

2025 |

2026 |

|---|---|---|

|

$500 |

$500 |

$500 |

Remember, tax credits are not the same as deductions. While a tax deduction lowers your taxable income, credits directly reduce your taxes. That essentially makes this program worth $1,500 in free money for sole proprietors who choose to take advantage of it.

To receive the credit, you can create a new Solo 401(k) plan with automatic contributions or update your existing Solo 401(k) plan to include automatic contributions. Personally speaking, after researching what's possible, that's exactly what I'm going to do.

Also, keep in mind that just because your plan has automatic contributions doesn't mean it's a feature you personally have to enable. You can turn off your own plan's automatic contribution feature and still get the tax credit.

Providers like My Solo 401k Financial will help you ensure your plan has the appropriate automatic deposit setup and ensure you can opt out if needed.

Participation requirements

Determining which companies are eligible for the automatic 401(k) contribution credit is a little complicated. When I first asked my accountant, he suggested that I might not be eligible. But after some back and forth, we decided that my company, where I am the only employee, is eligible. I verified this with several sources.

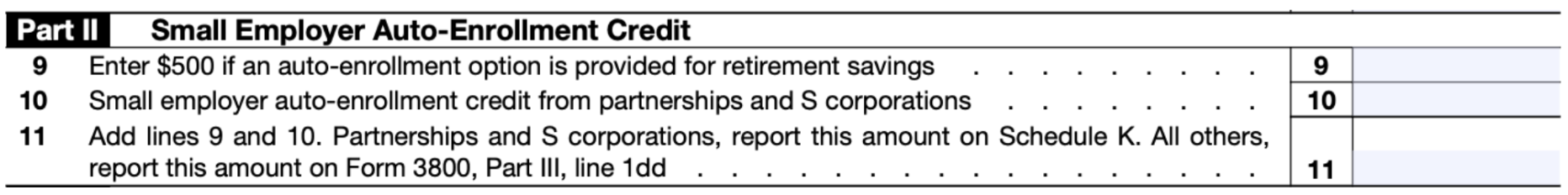

The instructions for Form 8881, the form you must use to receive the credit, mention several different types of retirement savings credits. Not all solo plans can receive all of the credits included in this form, but solo 401(k) plans qualify for Section II, which is devoted to the automatic contribution credit.

If you already have a 401(k) plan with automatic contributions enabled, you may not be eligible. If you are new to automatic contributions, you probably qualify. If you are unsure, consult a trusted tax professional.

Your Solo 401(k) must contain a special clause stating that new employees will be automatically enrolled in automatic contributions to qualify for the credit.

Advantages of automatic contributions

Many workers at large companies don't participate in 401(k) plans. A recent survey found that about 40% of employees aren't enrolled. But with automatic enrollment for contributions, nearly 100% of employees participate.

Social Security alone is usually not enough to maintain the same standard of living in retirement. Most experts expect Americans to save at least 15% of their income for retirement to maintain their standard of living. With automatic enrollment and contributions to a 401(k) plan, they are more likely to stay on track through retirement.

Setting an automatic contribution of 3% is something of an industry standard. Once you enroll, you can increase or decrease your contribution rate at any time.

Applying for the tax credit

To claim the tax credit, you must complete and submit Form 8881. This is a simple, one-page form that you or your accountant can complete in just a few minutes.

The small employer auto-enrollment credit is calculated in Part II of the form. Enter the credit amount of $500 in field 9.

According to IRS guidelines, “An eligible employer that adds an auto-enrollment feature to its plan may claim a tax credit of $500 per year for a three-year tax period beginning with the first tax year in which the employer adds the auto-enrollment feature Registration includes.” ”

Again, if you have any doubts or questions, it is best to contact a licensed tax advisor.

Is the automatic enrollment credit worth it for Solo 401(k) plans?

If you don't already have an auto-enrollment feature in a Solo 401(k) plan, the credit is absolutely worth the effort. Even though it takes some time to fill out the forms, there's a lot to gain and little to lose by setting up this plan feature and receiving the credit.

In many ways, it's like the government subsidizing you $1,500 so you can make tax-deferred contributions to your own retirement savings. This is a big win for your finances if you are self-employed.

Companies like My Solo 401k Financial can help you with this. Whether you're opening a new Solo 401k for the first time or have an existing plan that you need to update (called recharacterization), they can help you.

Check out My Solo 401k Financial here >>

Editor: Colin Graves

Reviewed by: Robert Farrington

The post How to Qualify for the Solo 401(k) Auto-Contribution Tax Credit appeared first on The College Investor.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps