Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Upright is a fintech company that offers accredited investors the opportunity to invest in individual and pooled fund real estate offerings.

While a few Crowdfunded real estate platforms

Although it is now possible to get real estate loans online, the hard money market remains underserved.

Upright is a small but growing startup creating a more efficient hard money lending market. It brings together borrowers with high-risk projects and investors who want to make handsome profits in addition to investing in real estate. This is how Upright works.

- Invest in real estate loans, including pre-financing lines of credit, hard money loans, and a home loan REIT

- Available to accredited investors only

- Nearly a decade of strong repayment history

|

Crowdfunded real estate investments |

|

What is upright?

Upright is a real estate fintech company that helps accredited investors provide real estate loans to borrowers who cannot obtain financing through traditional banks.

Upright uses investor funds to issue individual hard money loans (loans secured by real estate), a pre-funding note fund (a line of credit that Upright uses), or a fund that manages short- and medium-term loans. You can invest through Upright as an individual, jointly, as a company, trust or as part of an SDIRA.

Upright was founded in 2014 after recognizing that capital markets for real estate projects were slow and inefficient. By focusing on hard money loans, Upright creates a more efficient market for risky but potentially profitable real estate loans. Upright offers a unique type of alternative investments that can add diversity to your investment portfolio.

What does it offer?

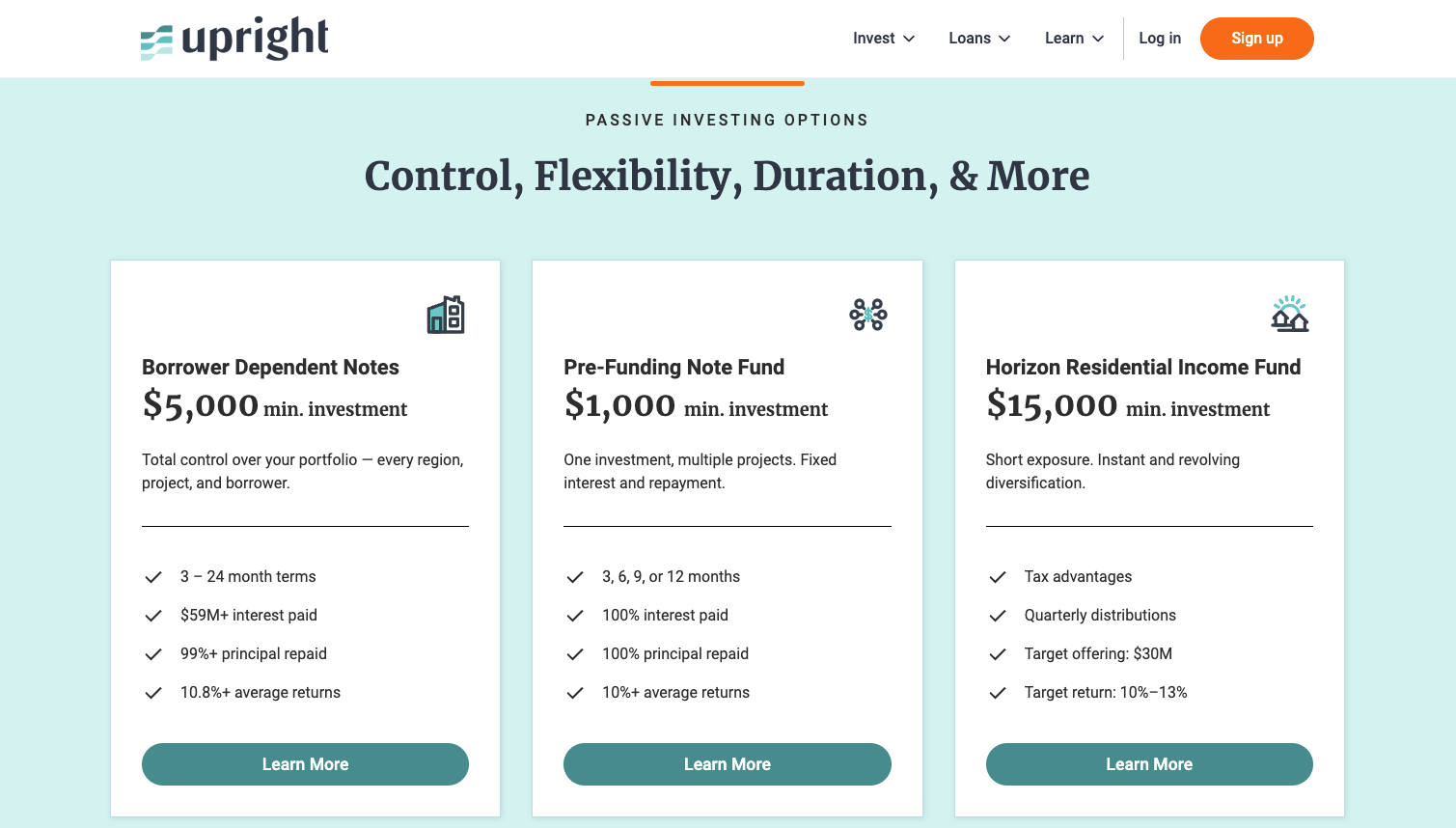

Currently, Upright offers three main offerings for investors. You can invest in one or all three.

Borrower Dependent Notes

Upright's original offering is borrower-linked notes. These are short-term hard money loans made to real estate investors seeking financing for three to 24 months. Most of these loans go to investors who need financing for new construction or home renovation projects. As an investor, it's up to you to consider the fundamentals of every deal.

According to Upright, 99% of all invested capital was returned to investors, along with an average return of 10.8% per year. However, each note you invest in will perform differently and each loan has a minimum amount of $5,000. This means you may need a multiple six-figure loan portfolio to build a fully diversified portfolio.

Pre-financing bond fund

As an alternative to individual bonds, you can invest in Upright's line of credit. Upright uses the Pre-Funding Note Fund as a line of credit to underwrite each of its loans. As an investor, you can choose between fixed terms of 3 to 12 months with a low minimum investment of $1,000. Upright claims an average return of 10%, but the actual return depends on the APR quoted at the time of investment. The current advertised rate is 10.5%.

This pre-funding note fund appears to be very similar to a certificate of deposit (CD) in that it pays fixed interest rates. But make no mistake, this is still a risky investment, even though Upright has a strong track record of returning capital.

Horizon Residential Income Fund

Horizon Residential Income Fund is a private REIT that invests in short and medium-sized real estate loans. There is a one-year lock-in period during which you cannot request a refund of funds. After that, you can request a refund of the funds, and the funds are usually paid out within 90 days. Investors in this fund receive a preferential return of 8%. If the fund returns more than 8%, the additional profits are distributed 80% to investors and 20% to fund managers.

Are there any fees?

There are no investor fees for the Borrower Dependent Notes or the Pre-Funding Note Fund. All associated fees are paid by the borrower and not the investor.

The Horizon Residential Income Fund has a fee structure modeled after a typical hedge fund. An annual management fee of 1% is charged regardless of the fund's performance. Each year investors receive a “preferred return” of 8%. Once the preferred return is paid out, any additional profits are split, with 20% going to the fund manager and 80% going to investors.

How does Upright compare?

Upright is not typical Crowdfunded real estate platform. Instead of providing direct exposure to real estate, investors can invest in real estate debt.

He froze is another platform that focuses on real estate loans but offers both short-term and short-term loans long-term offers. Concreit also has more liquidity options and is open to all investors instead of just accredited investors.

Like Concreit, Fundraiser is a popular crowdfunding real estate platform open to non-accredited and accredited investors. You can invest in a taxable private real estate investment trust called an eREIT for as little as $10. Other investment options include goal-based portfolios, Private equity investmentsand more recently venture capital funds.

Overall, Upright has an impressive selection of offerings with a proven track record of returns. It is a platform that may be suitable for accredited investors looking to add a high-yield debt product to their investment portfolio.

How do I open an Upright account?

To get started, select the “Sign In” button in the top right corner of the Upright website. Before you can create an online account, you must confirm your accreditation status. You also provide your full name, email address and phone number.

At this point, you will receive an email with a temporary password that you can use to log in to the Upright platform. Once on the platform, you can read private placement memorandums, browse offers, and more.

Before you can start investing, you must verify your identity. This includes providing your name, social security number, date of birth and US address. You will then need to agree to the website terms and conditions and link your bank account. You can then select investments and proceed with financing them.

Is it safe and secure?

From a technology perspective, Upright uses best practices including multi-factor authentication, verifying your identity before connecting bank accounts, and using encryption and secure money transfers. It's great to see an alternative investment company taking digital security seriously. Although there is always the risk of identity theft, Upright's multiple layers of digital security are top notch.

On the investment side, Upright's investments should not be viewed as “safe.” The loans offered are rigorously vetted, but hard money loans are generally risky. Your investment is not guaranteed and may lose value if one or more projects fail.

How can I contact Upright?

Upright's headquarters are located at 1300 E 9th Street, Suite 800, Cleveland, Ohio. You can email the team at info@upright.us or call 646-895-6090. If you have investment-specific questions, you can email invest@upright.us.

Is it worth it?

While it's exciting to see a fintech company like Upright entering the hard money lending space, it hasn't changed the fundamentals of hard money lending. Hard money loans are a risky and lucrative business. You could lose every dollar you have invested or face long delays in withdrawing your money.

However, there was double-digit growth in investments. Accredited investors who add some of Upright's offerings to increase the diversity of their portfolio can enjoy excellent returns with volatility they can handle. This is a great way to add passive real estate income to a well-diversified portfolio.

Check out Upright here >>

Upright functions

|

Individual, Community, Corporate, Trust, IRA |

|

|

|

|

Minimum investment amount |

|

|

1300 E 9th Street, Suite 800, Cleveland, Ohio |

|

|

Web/Desktop Account Access |

|

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps