Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Vyzer is a new investment tracking platform that is designed to help people who have lot of different assets and want to do cashflow planning.

Plenty of people love spreadsheets, but few investors would argue that spending time entering data into a spreadsheet is a great use of time.

However, until now, investors with real estate and private equity either had to spend time with a spreadsheet, pay bookkeepers to do it for them, or risk investing without real insights into their performance.

Vyzer is designed to change that. Vyzer is a unified platform designed to help investors track, plan, and manage their entire investment portfolio. Here’s what you need to know about it.

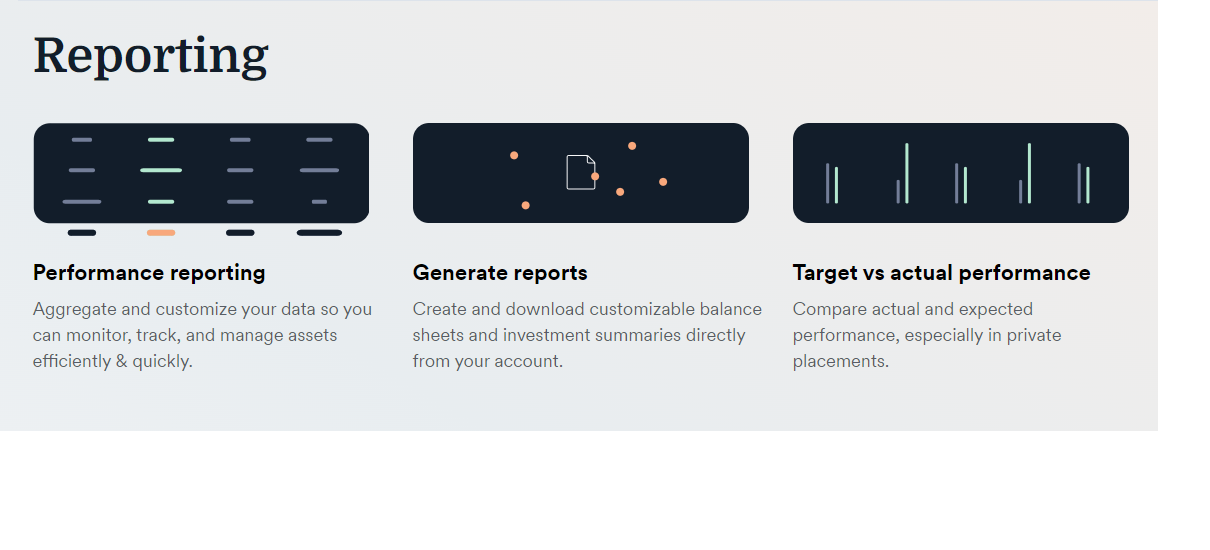

- Reporting and analytics tool designed for investors with complex investments

- Cash flow planning tools

- Peer benchmarks for every type of asset class.

|

|

What Is Vyzer?

Vyzer is a one-stop reporting and analytics hub designed for investors with complex investments including real estate, syndications, venture capital investments, crypto, and other alternative investments.

The founders invested in alternative investments (including real estate syndications) but found they were spending too much time tracking and managing their investment portfolio. Vyzer became the software solution to their problem. In 2023, Vyzer launched for US-based investors.

What Does It Offer?

Vyzer is a portfolio analysis tool designed for investors who want detailed insights about their investment portfolio, but don’t want to spend hours each month managing the details of their investments.

Portfolio And Net Worth Overview

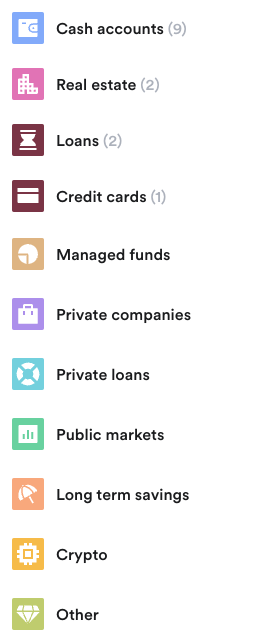

At its basic level, Vyzer is a portfolio and net worth tracker. You can connect your bank and brokerage accounts, as well as manually add assets to track.

Unlike other tools, Vyzer allows a LOT of assets to be tracked – from basic banking and credit cards, to private company investments and cryptocurrency. Their dashboard provides a great overview at the top of your net worth, along with cash flow.

Cash Flow Planning Tools

You can stay on top of your future income based on expected distribution schedules associated with each of your investments. Vyzer also provides updates and alerts for capital calls associated with private equity investments. Finally, it gives you access to cash-flow planning scenarios based on different income and expense scenarios.

It’s important to note that Vyzer does NOT categorize your expenses or income. There is no tracking of expenses, so you can’t plan on using Vyzer for any type of budgeting. For example, if you want to see how much you’ve spent on dining or travel, that isn’t possible.

Real-Time Tracking Augmented with Uploaded Document Analysis

Vyzer allows you to connect to brokerages, online syndication sites, crypto wallets, and more. It is integrated with 17,000 financial institutions.This means that you can get real-time updates on all of these types of investments.

If you have a privately held investment (such as a real estate property) you can upload documents (such as cash flow statements or annual reports) and spreadsheet through Vyzer’s “magic box” feature. This feature will update your portfolio within 2 days of you uploading the newest document. This can create or update your assets.

Note: If you’re looking to sync your crypto wallet, they don’t currently support the use of address-based tracking. This could be a drawback for crypto investors that don’t want to share their wallet login information. If you have a significant crypto portfolio, you might find a tool like Kubera more useful.

Peer Benchmarking For All Asset Classes

It’s pretty easy for stock market investors to compare their investment portfolios to different benchmarks like the S&P 500. Real estate and private equity investors don’t have the same visibility into market performance. Vyzer offers “peer benchmarks” to help investors understand if they are overperforming or underperforming within a given asset class. This type of insight can help investors decide whether to continue investing in that class or whether they are better served investing elsewhere.

Tracks Shared Investments

Many portfolio-tracking apps struggle with shared investment structures. But Vyzer is specifically designed for people who are part of Master Limited Partnerships or General Partnerships where income and expenses are shared among investors.

Are There Any Fees?

Vyzer offers a free version of the tool which is suitable for investors with up to 3 “private” assets such as real estate holdings or private equity deals. Those with more complex portfolios will need to upgrade to one of the paid tiers. Here’s what each tier offers.

|

$348 per year or $36 per month |

$948 per year or $99 per month |

$8,388 per year or $873 per month |

||

|

Investors with up to 3 alternative investments. |

Passive Income Investors with up to 15 investment units. |

Investors with large and complex investment portfolios. |

Ultra-high net worth individuals who want individualized help tracking their investments. |

|

|

|

|

|

How Does Vyzer Compare?

Vyzer is a portfolio analysis tool designed for investors with alternative investments. Snowball Analytics offers superior analysis tools for investors with primarily traditional investments, but Vyzer offers better tools for investors who primarily own alternatives like syndications, private equity, or real estate.

Overall, Vyzer offers the best reporting and analytics tools for investors who invest in a wide range of asset classes. It offers much more than net worth tracking (which is offered by Kubera and Empower). In addition to tracking your portfolio value, Vyzer offers insights that are suitable for cash flow planning, profitability reporting, and peer benchmarking.

Vyzer uses the phrase, “get out of your spreadsheet” multiple times in its marketing, and that makes sense. Vyzer allows investors with complex investment portfolios to free up time that could go to tracking and planning. However, Vyzer’s price could make some investors balk, especially those who need to upgrade to Plus but don’t yet have a large investment income to offset the $348 annual cost.

|

Header |

|

||

|---|---|---|---|

|

Alternative Investment Tracking |

|||

|

Cell |

How Do I Open A Vyzer Account?

Since Vyzer offers a free option, opening your first Vyzer account is quite simple. Select Get Started from the Vyzer homepage. Provide an email (or connect with your Google Account). This immediately allows you to look at a demo portfolio. If you’re interested in connecting your portfolio you can select Start My Portfolio from the screen on the left.

From there, you can select your plan, and begin to connect brokerages or upload financial documents to the Magic Box. If your selected plan requires payment, you will need to enter your credit card information before using the site.

Is It Safe And Secure?

Vyzer encrypts all information (both in transit and at rest) which is especially important because you are uploading sensitive financial documents to the software. It requires multi-factor authentication to access the app, and it doesn’t store any of your access credentials. Vyzer also doesn’t sell your data.

Vyzer uses Plaid as it’s main aggregator tool. You can use the Plaid Dashboard to manage your connections if you’re concerned about security with their tool.

Overall, the steps that Vyzer takes to protect client data are considered standard for data privacy and security.

How Do I Contact Vyzer?

The Vyzer headquarters is located at 651 N Broad St, Middletown, DE 19709. The best way to contact the company is by emailing hello@vyzer.co. They also offer online chat.

Is It Worth It?

Vyzer fills a unique gap in the portfolio analysis market. Most portfolio analyses overlook investors with alternative investments. If you’re an early-stage investor, you probably can’t afford a bookkeeper, so you are stuck spending a lot of time managing your investments.

Vyzer’s tiered pricing approach makes it an easy tool to recommend if you have a brokerage and one or two rental units (or up to three interests in syndicated real estate or private equity). You’ll gain the advantage of unified reporting without paying for the tool.

If you need to upgrade to Plus or Premium, you may worry about the pricing. Many investors will save several hours every month by using Vyzer which makes the price reasonable. However, this is software that you’ll need to use on top of paying for tax software and any other accounting software you use to run your investment business.

All these costs can add up. In general, the cost of Vyzer is low enough that it is still a software we recommend to investors with some alternative investments. But the real deciding factor will be how much you value your time relative to the cost of the app.

Vyzer Features

|

|

|

|

|

|

|

Bank and Broker Integration |

|

|

No phone number listed – email is hello@vyzer.co |

|

|

Web/Desktop Account Access |

|

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps