Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

What if you had invested in Nvidia 30 years ago, before its IPO, and held on to the stock?

Venture capitalist Mark Stevens is currently one of Nvidia's largest individual shareholders, second only to CEO Jensen Huang. He invested in the AI chipmaker in 1993 as a new partner at Sequoia Capital. Stevens has served on Nvidia's board for most of the company's history, from 1993 to 2006 and then again from 2008 to the present. Nvidia went public in 1999.

Related: Is it too late to buy Nvidia? Former Morgan Stanley strategist says 'Buy high, sell higher'

“I can think of at least three situations where we almost lost the company,” Stevens told Bloomberg. “Jensen has his famous line, 'We're 30 days away from going out of business,' which is almost laughable today, but in the '90s it was reality.”

Nobody expected Nvidia to go from $8 or $9 million in Series A funding to a $3 trillion market cap today, Stevens said.

According to a Bloomberg report Friday, the more than four million Nvidia shares that Stevens owns are now worth about $4.7 billion and account for more than half of his $8.8 billion fortune. The rest of his net worth comes from his 6 percent stake in the Golden State Warriors and other investments he has made over the course of his venture capital career.

Related: Insiders say Nvidia CEO Jensen Huang turned down a merger offer in the company's early days. Here's why.

Although the AI boom has pushed Nvidia stock to new heights, Stevens says it wasn't easy to stay competitive in the early days. The chip market was full of competitors and it was expensive to retain Silicon Valley's best talent.

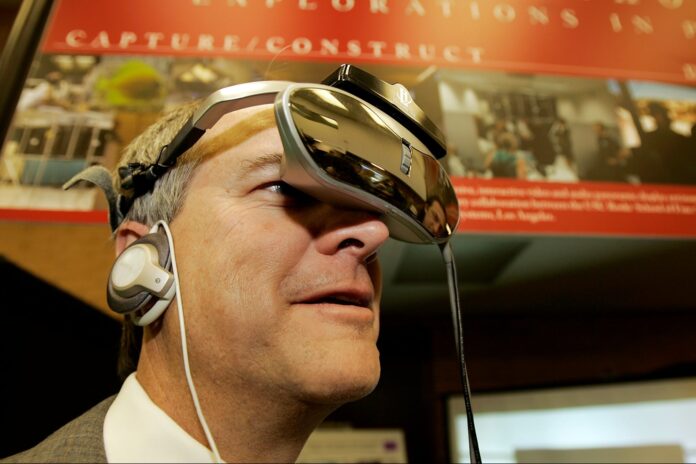

Mark Stevens looks through a 360-degree display. Photo by Al Seib/Los Angeles Times via Getty Images

Nvidia is currently the market leader in AI chips. The company's biggest customers include technology leaders such as Microsoft and Google. These customers could one day become competitors to Nvidia, establishing themselves alongside other chipmakers such as Intel and AMD.

Huang said in June that Nvidia's strategy in response to increasing competition is to make AI chips with the “lowest total cost of ownership.” Tens of thousands of Nvidia chips are the brains of OpenAI's ChatGPT.

Huang owns the largest single stake in the company, with 3.8%, or over 934 million shares. In June, he sold $169 million worth of shares. Other Nvidia executives and directors have sold over $700 million worth of shares since the beginning of the year.

Nvidia has seen its stock gain over 3,000% over the past five years, making early investors rich. Some long-time employees are reportedly in “partial retirement” based on stock grants alone.

Related topics: Elon Musk praises the leadership style of Nvidia CEO Jensen Huang: “Absolutely the right attitude”

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

![How to Build a Social Media Growth Strategy That Works [2024]](https://blog.5gigbucks.com/wp-content/uploads/2024/01/How-to-Build-a-Social-Media-Growth-Strategy-That-Works-100x70.png)