Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

A common question we are asked every year is: “Can you take on more student loan debt than you need?“It sounds crazy, but some people want to take advantage of the low fixed costs and loan forgiveness options that will be possible in the future.

With the rising cost of tuition, fees, and living expenses, financing a college education is becoming increasingly difficult.

The fact is that many students apply for student loans. And while loans provide essential financial support, they come with significant responsibility and long-term implications.

So how much do you really need? How much should you accept? And should you borrow more than you need?

Making informed financial decisions now can really set you up for success later, and student loans are a great example of this. So read on to start building good financial habits!

Current Trends in Student Loan Debt

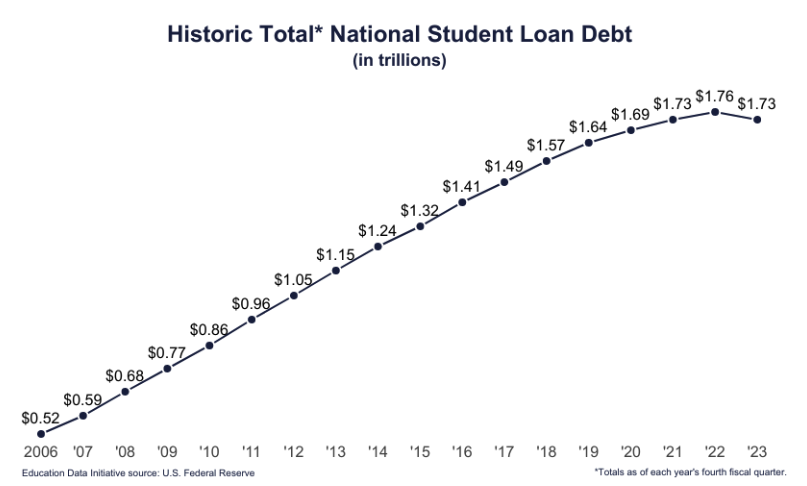

Student loan debt has increased tremendously over the past two decades and is now one of the most common types of consumer debt nationwide. This should come as no surprise, considering that the cost of attending college has more than doubled over the past four decades.

Who actually sets the tuition fees? In many cases, the institution's local governing board sets tuition fees. But demand for higher education has also increased in general. These factors, along with reduced government funding and rising overhead costs, are contributing to the cost of higher education rising.

Student loan debt in the US is $1.7 trillion. And while there has actually been a slight decline in student loan debt in recent years, more than half of our students still have student loan debt. In fact, the current average student debt balance is $37,718, and the average U.S. household owes $55,347 in student debt. Pardon my pun, but it really pays to know what you're agreeing to when you sign your student loan.

Related:

This is how student loans work

Factors that increase student loan debt

Several factors contribute to students taking out more loans than they need. And it doesn't help that lenders often offer more than enough to cover tuition costs. Here are some influencing factors to consider so you can borrow responsibly:

Overestimate your expenses: Students tend to overestimate their college expenses when they don't know the true cost of attendance, misestimate living expenses, or forget to consider additional income or cost-saving opportunities.

Social pressure and peer pressure: Just like other aspects of life, peer pressure can play an important role in your credit decisions as you want to fit in, maintain the same lifestyle as friends, and keep up with new spending habits.

Limited financial support: There may be a number of reasons why you may not be eligible for federal grants, college scholarships, or other forms of financial aid and instead turn to student loans to fill the financial gap.

Misinformation: There are a number of marketing tactics used by lenders to encourage students to borrow more than they need or can afford. I cannot emphasize enough how important it is to improve your financial literacy before taking out a student loan.

Emergencies: Finally, unforeseen circumstances or unexpected expenses can cause students to take on additional loans, which will quickly increase your debt levels if not handled responsibly.

How much can I borrow?

It's true that in some cases you can take on more student loan debt than you need, but should you? Student loans are a start to getting your college degree, but you want to make sure your loans are manageable.

Luckily for your future financially savvy self, there is a limit to how much you can borrow. Your federal loan limit depends on a few things: whether you can be claimed as a dependent, your current school year, and the type of loan you take out.

As of 2024, students can borrow a maximum of $5,500 to $12,500 per year, for a total of $57,500. Graduate students can borrow up to $20,500 each year, for a total of $138,500 (including undergraduate loans). How much you can borrow depends on your status (dependent or independent student), the school year, and the cost of attending school.

You cannot take out a qualified education loan that exceeds the cost of attendance.

A full breakdown of student loan limits can be found here.

The maximum amount that can be borrowed under private student loans varies by lender, and you may even be able to borrow the amount equal to your tuition costs. But again, borrowing the maximum amount available is often not the best choice, especially because student loan debt represents a significant financial burden until it is paid off.

Remember: While subsidized loans come with specific agreements – such as the U.S. Department of Education paying interest on your loans while you're in school and for the first six months after graduation – direct loans start accruing interest when they're paid off. In any case, you should factor in these additional costs over the term of the loan.

Related: How to Take Out a Student Loan (Federal and Private Loans)

Consequences of Excessive Student Loan Debt

Excessive student loan debt can cause undue stress for borrowers even after graduation. It's worth discussing these implications in advance so you have an idea of how your financial well-being might change in the future. Hopefully, understanding these unintended consequences before they happen will help you make informed credit decisions now.

Here are common side effects of excessive student loan debt:

Financial burden: The most obvious consequence of having a lot of student loan debt is the financial burden that comes with it. A high monthly payment quickly drains your overall purchasing power and can make it difficult to meet other financial obligations. Of course, accrued interest on loans often means borrowers end up paying back far more than the amount they originally received, which can further hinder your progress toward other financial goals.

Delayed Milestones: Most of us have other life goals besides school and work, including getting married, starting a family, or owning a home. However, high debt payments can pose a challenge for building savings, covering wedding expenses, or making the down payment on a home.

Financial health: Unfortunately, missed or late loan payments can affect a borrower's credit score overnight. A low credit score in the US signals to lenders that you are a riskier borrower, making it harder to get new loans, credit cards, or even favorable interest rates.

Mental and Emotional Stress: Any of the above is enough to affect your mental and emotional well-being. The stress and anxiety of dealing with debt combined can be overwhelming.

Limited Postgraduate Opportunities: Less critical, but still important to note: high student loan debt can prevent you from pursuing new opportunities for postgraduate study. A common feeling here is the pressure to prioritize higher-paying jobs over other goals or positions you're interested in.

This will help you avoid borrowing more than you need

The prospect of student loan debt can be daunting, but there are several strategies to keep in mind to reduce your total loan amount and allow you to make informed financial decisions. It all starts with planning what you actually need.

Creating your budget is the first step to managing your spending responsibly and avoiding excessive borrowing. Carefully track your expected income and expenses each year to determine how much you need to meet needs. Then look for areas where you can cut costs to prioritize spending on essential educational content. Consider downloading a budget app on your phone to keep track of your goals and spending.

Next, try to maximize your financial aid package by taking advantage of all the options available to you. This includes applying for federal aid, grants, scholarships, and other tuition assistance programs offered by your university, employer, or community organization.

For example, several small banks offer scholarships for local applicants. Simply receiving an additional $2,500 will reduce your overall debt burden.

Another common tactic for reducing loan debt is to find part-time work or enroll in a work-study program. Any additional income balances out the entire financial burden for you – and you gain valuable professional experience at the same time.

Finally, make sure you borrow responsibly. Before accepting a loan offer, read through the terms and conditions, paying particular attention to interest rates, repayment plans and loan forgiveness options. You can take it a step further by assessing your future earning potential and ability to repay loans after graduation. Most importantly, determine what you absolutely need to borrow to meet your current needs and avoid accepting more than that.

Taking that away

Student loan debt is a complex and very personal issue. Obtaining the financial resources to pursue higher education has profound implications for your personal growth, career advancement, and lifelong success. At the same time, taking on excessive student loans can have unintended consequences on your future goals, health, and financial well-being.

With college costs rising, it is critical that you understand the basics of student loan agreements, make informed decisions, and actively manage your loan debt. Prioritizing financial literacy, maximizing financial aid, and seeking alternative financing options are three ways to minimize the impact of student loan debt after graduation.

And most importantly, don't forget to plan for the future! Your future self will thank you.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps