Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

In its nearly 250-year history, the United States has experienced more periods of inflation than deflation. The last major period of deflation occurred during the Great Depression.

There was another smaller period during the Great Financial Crisis. Both coincided with a recession. During recessions and deflation, people lose their jobs, demand falls and with it prices.

But what should those who are able to keep their jobs and have investments look for in order to find some of the best investments during a period of deflation? In this article we explain how deflation works and offer some strategies for defense.

What is deflation?

While inflation is an increase in prices, deflation is a decrease in prices.

As mentioned in the introduction, deflation usually occurs during a recession. As layoffs begin, demand begins to decline. This causes companies to lower prices to attract customers. But due to depressed prices and profits, companies are also more likely to cut wages or lay off even more employees.

Even if the products are more affordable, customers can no longer buy like they used to if they make less money or don't have a job at all. Therefore, sales remain low or could even decline further.

The above scenario can lead to a tough supply and demand cycle. When companies lower prices, their profit margins fall. This leads to the need to cut costs, which leads to more layoffs. But more layoffs further reduce demand and fuel the cycle.

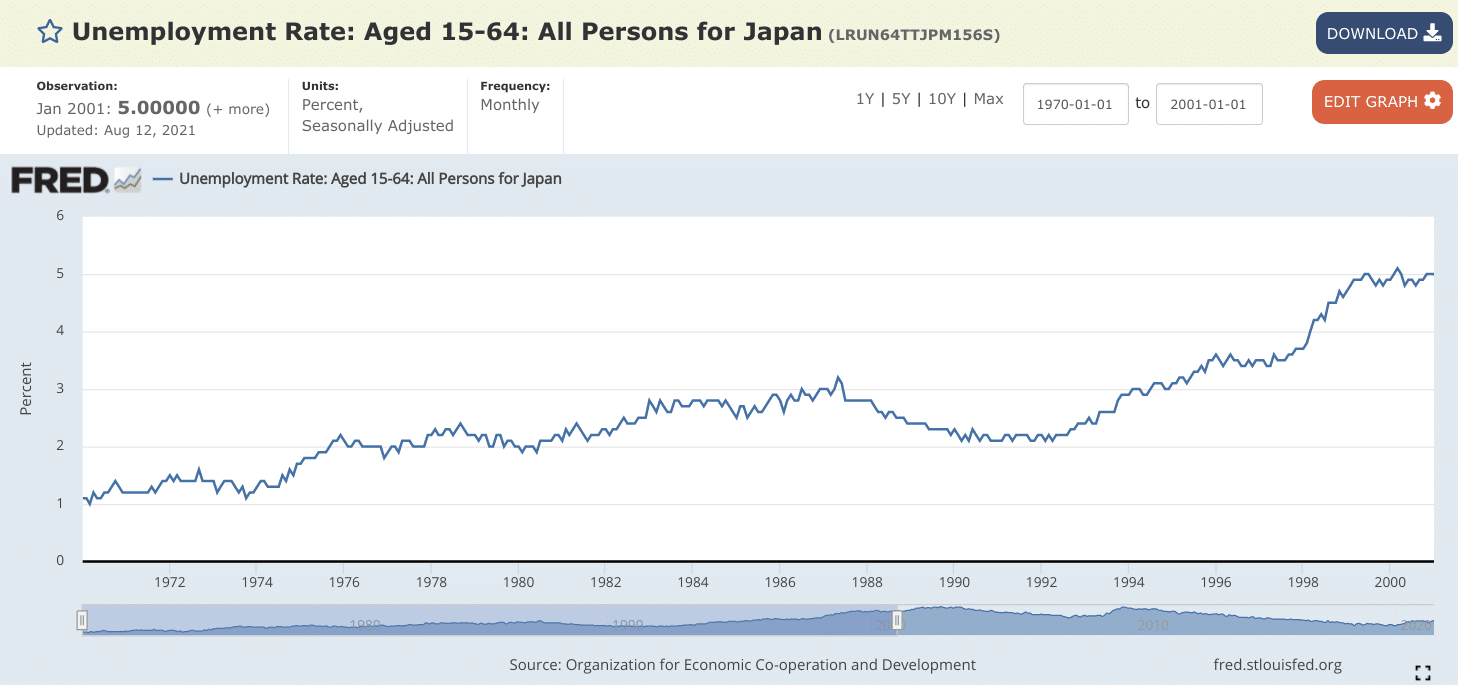

Japan's “lost decade” from 1990 to 2001 is perhaps the best-known example of how deflation can decimate an economy. The following chart from the Federal Reserve Economic Data (FRED) shows the steady increase in Japanese unemployment during these difficult years.

Should US investors worry about future deflation?

Deflation is not currently a problem in the United States. In fact, the Federal Reserve has recently become more focused on containing inflation problems caused by pandemic-related supply chain problems across several industries.

Related: These are the best investments for periods of inflation

But some economists worry that once these supply issues are resolved, demand may still not return to pre-pandemic levels. Unemployment and consumer fear are two of the biggest factors leading to deflation. And both could remain high even if companies produce at full capacity again.

There is still a strong chance that the United States can avoid deflation. And the Federal Reserve will certainly take every action possible to ensure that this happens. Still, it's a potential threat that investors should keep an eye on over the next three to five years.

The 3 best investments for deflationary times

For many, deflationary periods are characterized by preservation and even survival. However, some are able to maintain their investments and move on without significantly restricting their lifestyle.

Deflation seems to be a great time for investors as prices fall. The problem, however, is that prices can continue to fall. There is no way to know for sure when the bottom will hit.

Instead of chasing prices, it may be better to look for investments that will hold their value or at least not fall quickly. Below are three examples of investments that tend to remain durable during deflationary times.

1. Investment grade bonds

Investment grade bonds include government bonds and bonds issued by blue-chip companies. These types of bonds work well in a deflationary environment because of the quality of the company behind them.

The government will not go bankrupt, meaning investors can be confident that they will continue to receive regular payments and ultimately their capital.

The same applies to high-quality companies. These companies have been around for a long time, have great management and solid balance sheets. Your products are in demand. These companies are unlikely to go out of business, even during a recession.

Want to learn how to build a diversified bond portfolio?

2. Defensive stocks

Defensive stocks are stocks of companies that sell products or services that we as humans cannot easily banish from our lives. Consumer goods and utilities are two of the most common examples.

Think toilet paper, food and electricity. Regardless of economic conditions, people will always need these goods and services.

If you don't want to invest in individual stocks, you can invest in ETFs that track the Dow Jones US Consumer Goods Index or the Dow Jones US Utilities Index.

Popular consumer goods ETFs include iShares US Consumer Goods (IYK) and ProShares Ultra Consumer Goods (UGE). Utilities ETF options include iShares US Utilities (IDU) and ProShares Ultra Utilities (UPW).

3. Dividend paying stocks

Dividend stocks remain in demand even during a recession because of their income. Even though the share price may fall, investors can rest assured that the dividends will continue to provide stable passive income.

Investors should focus on companies with high dividend payouts and not simply look for companies with high dividend yields. An unusually high dividend yield can actually be a warning sign, as it could indicate that the share price has recently taken a nosedive.

If you're looking for strong, dividend-paying companies, Dividend Aristocrats can be a good place to start. Dividend Aristocrats are companies that have increased their dividends for at least 25 consecutive years. As of September 2021, there are 63 companies that meet these requirements.

Do you want to invest in the Dividend Aristocrats?

3 more ways to defend against deflation

Investing is not the only way to survive a deflationary event. People who can't invest can make it a little easier for themselves by following two key strategies:

1. Build cash reserves

Holding cash should be at the top of the list during a deflationary period. This is because the purchasing power of cash increases when prices fall. Deflation is a contraction in the money supply and credit. This increases the value of the dollar.

Anyone who has tried to get a loan during a recession knows that it can be very difficult. This makes it all the more important that your emergency fund is fully funded. And you may want to save even more money if you know you have big expenses coming up soon.

Are you earning enough interest on your savings?

2. Maintain liquid assets

Holding liquid assets such as certificates of deposit (CDs) or money market accounts (MMAs) is also important because investors can easily convert these into cash.

Yes, liquid assets also lose value during deflation. But unlike illiquid assets like real estate, cars, and collectibles, liquid assets can quickly become a source of cash in an emergency.

3. Pay off debt

Debt does not lose value due to deflation. In fact, it often only becomes a major burden during deflationary periods.

Typically, wages stagnate or decline during deflation, while debt levels either remain the same or increase due to accrued interest charges. And think about whether someone loses their job and has to become unemployed during a deflationary cycle. Your income will be significantly lower while your debt burden will remain the same.

We would say that deleveraging is always a good strategy regardless of the economic environment. But it's a smart idea, especially in a deflationary environment.

Final thoughts

For many, deflation means tightening the reins and battening down the hatches. And that's okay if it means cutting unnecessary expenses. But investing for your retirement and future goals shouldn't be cut from your budget during deflation if you can help it.

If you continue to invest during the downturn, you will be even better positioned when prices recover. In the meantime, knowing what works and what doesn't can mean the difference between maintaining some level of stability in your investments and seeing them completely crash and decay.

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps