Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps

Over the last few years I've really thought a lot about how to become rich and grow your wealth.

I've spoken to countless millionaires and responded to over 20,000 reader comments on this site. In each case, there are common themes that either help the person increase their wealth or prevent them from becoming rich.

Being rich doesn't always mean having money, but 90% of the time it does. However, there are essentially habits, behaviors and “rules” that allow you to become rich and increase wealth. It's not an overnight process. There are no get-rich-quick programs here.

What you'll read below are my ten rules for becoming rich and growing your wealth – over time.

Rule #1 – You have to earn it (your money, your wealth)

If you want to become rich and increase your wealth, you have to earn it. There is no way to achieve what you want and where you want to be if you don't try to get there.

With money it's pretty easy. You want money? Get out there and start making it. Look for a job. Get a second job. Get a third job. Start side businesses and side projects to make more money. Are you in college? Get a part-time job in college to help pay for tuition.

The bottom line is: If you want to increase your wealth, you have to generate income. There may be thousands of ways to make an income and you need to find the best thing you can do and get to work. There is no one to stop you. There is nothing in your life that prevents you from doing this. The only obstacle standing in your way from earning more is yourself.

So stop with the excuses and start by focusing on rule #1: You must make your fortune.

Rule #2: You have to save until it hurts

The second rule to getting rich is saving. It's not enough just to earn money, you also have to save it. Otherwise you will be like many famous people who have gone bankrupt. Income alone is simply not enough. You have to save.

But the real “rule” to getting rich is here Save until it hurts. How much is this? Well, if it doesn't hurt you yet, it's not enough.

For example, last year I saved about 40% of my after-tax income. Sounds like a lot, doesn't it? But there are plenty of people out there who are saving more – many over 50% of their income, if not more.

The truth is that following rule #1 makes this rule easier. The more income you have, the easier it is to save more. But you can still save even if you have a lower income. Here are 15 ways to save an extra $500 per month. Boom!

Rule #3 – You must optimize your spending

The third rule of increasing wealth is to optimize your spending. I'm not the one to judge your spending – spend more or spend less. My personal belief is that you should buy whatever you want – just make more money so you can afford it.

But no matter what, truly wealthy people optimize their spending. This means they'll find good deals – even if they're looking to buy a Ferrari, you can bet they've shopped around for a deal or negotiated the price.

The trick here is to simply spend wisely – especially on your biggest expenses. For most people, this could include cars, insurance, healthcare, and more. Too many people here just choose “whatever” or don’t think about what the options really are. Wealthy people stop, think, and make a decision that maximizes their utility while minimizing their expenses.

So if you're ready to grow your wealth, start identifying and optimizing your expenses.

Rule #4: You must make your money work for you

The fourth rule is that you must make your money work for you. It's your part of the hard work to earn it. You need your money and the power of compound interest to work together over time to grow your wealth.

What does that mean? This means you have to invest. Why? The average inflation-adjusted return of the S&P500 over the last 60 years has been over 7%.

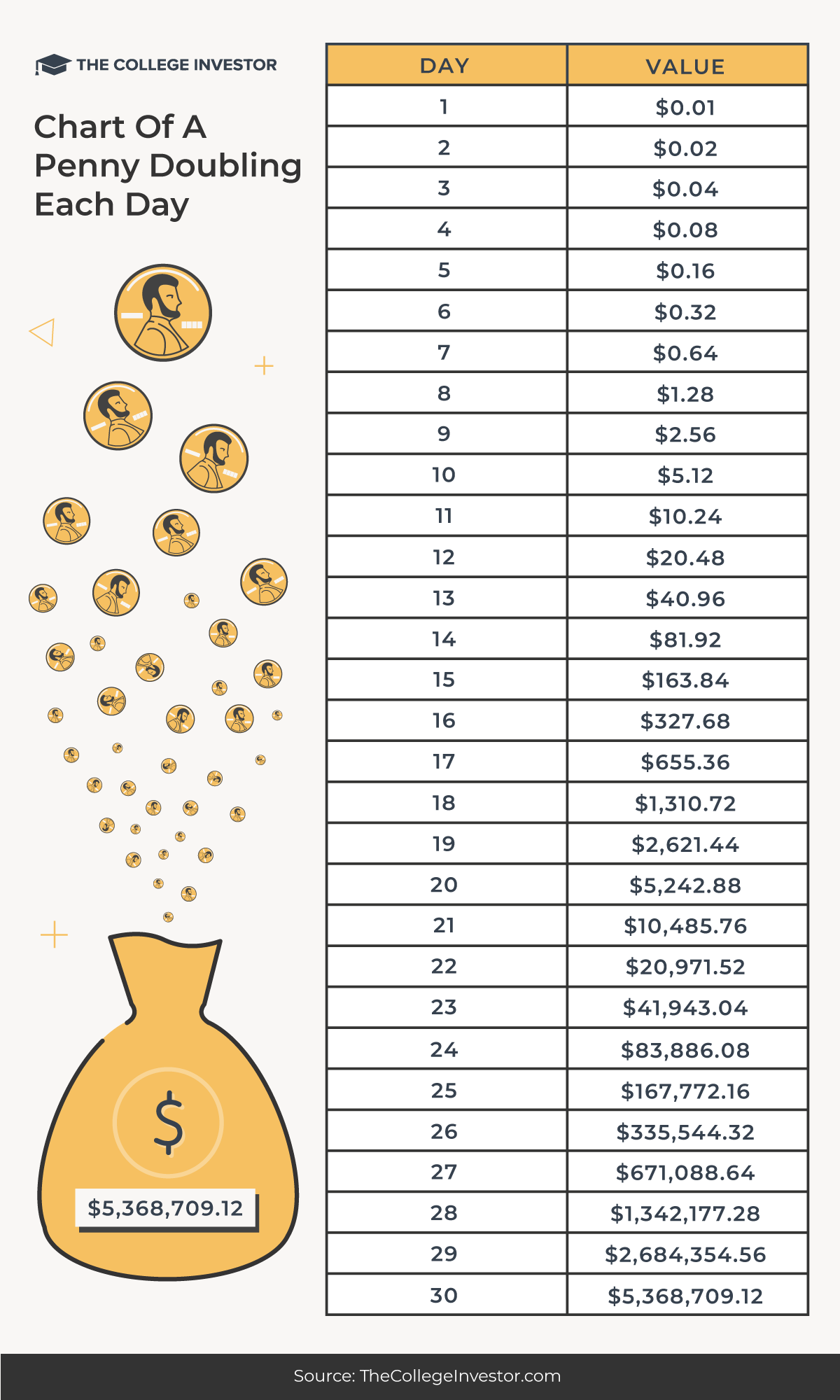

Have you heard the story about whether it's better to have a penny double or a million dollars every day? Well, it's better to have a penny double every day – because of the power of compound interest.

You need your money to grow and make more money. You need to start building income streams with your money. The goal is that your hard work upfront can help you build passive income streams for the future.

Want to make $50,000 a year without working? Here's a simple breakdown of how to make your money work for you. It's about making your money work for you and not against you.

Related: The Rule of 72 for Investing

Rule #5 – You must marry smart

The fifth rule of building wealth is to marry wisely. Why? Because a great spouse can be a huge force multiplier when it comes to building wealth, while at the same time divorce is the biggest wealth destroyer. In fact, a recent study found that divorce destroys 75% of personal net worth.

When it comes to wealth building, a great duo can make money together, accumulate it together, and watch double the income accumulate over time. This is a huge force multiplier for wealth creation. The interest on $2 is always higher than the interest on $1.

However, divorce can ruin your financial life if you didn't marry wisely. Beyond the 50/50 split, legal fees and more may apply. In addition, there is now only a small amount available for compound interest, so it grows more slowly.

But the fact is that, according to the American Psychological Association, 40-50% of marriages in the United States end in divorce. That doesn't mean that a divorce has to be a financial disaster. Hopefully, if you married smart from the start, your ex-spouse will also be financially smart when it comes to the divorce and you can settle things as amicably as possible.

Rule #6 – You must always minimize your taxes

The sixth rule to getting rich is always: Minimize your tax liability. No matter your income level, you always need to think about how to minimize your taxes. Taxes can prevent you from realizing wealth over time because they continually reduce your income and investment returns.

For example, the S&P 500 has delivered an average annual nominal return of 11.09% over the past 30 years. However, taking taxes, fees and inflation into account, an investor's actual return would have only been around 7%. That's 46% of your return eliminated by taxes, fees and inflation.

However, there are many steps you can take to minimize your taxes. First, take advantage of tax-advantaged investment accounts. Max out your 401k or 403b, use an Individual Retirement Account (IRA), and use a Health Spending Account (HSA).

If you don't want to hand over your assets to the state, you should keep taxes in mind when making any financial decisions.

Rule #7 – Insure yourself and protect your family

The seventh rule of becoming rich and building wealth is that you must insure yourself to protect your assets and your family. I'm not even talking about life insurance here – I'm talking about making sure you have health and disability insurance.

Last year I had two coaching clients who were affected by health issues that they were unprepared for, putting them at financial risk because they didn't prepare. I have also seen several cases where people became so severely disabled that they or their family members could no longer work. The result? Financial danger.

The time to insure yourself is when everything is going well. Every person who wants to build wealth and become rich must have at least the following:

Don't watch all the money you've accumulated disappear in one moment.

Related: The essential estate planning documents every family needs

Rule #8: You must take care of yourself first

The eighth rule of building wealth is to take care of yourself first. This is less a money rule than a life rule.

When you fly on a plane, does the flight attendant always give her safety speech reminding you to put your oxygen mask on first before helping anyone else? There's a reason for this: If you're unconscious, you can't help anyone.

When it comes to building wealth, you first have to take care of yourself – including when dealing with your family. This can be very difficult for some people, especially those who didn't have much and now have something to share. And others may recognize it and ask.

If you want to help others, first make sure you are on safe footing and have followed all the rules. I have seen too many times that generosity leads to financial ruin.

Rule #9 – Surround yourself with people who are better than you

The ninth rule of becoming rich is to surround yourself with people who are better than you in all aspects of your life. As for family: If they are holding you back, distance yourself. Married upwards. Don't let your family be the reason you don't achieve your dreams.

Friends? Find the ones that make you a better person. Drop the Moochers. Drop the haters. Drop the lazy ones.

Work? Find a mentor who does what you want to do and makes it happen. If they don't have the bandwidth to get to know you, just observe them and see what they do. You can learn a lot from a distance.

Just like rule #1, you have to earn it. Find people to help you with this. You don't have to settle for the life you were born into if it's not what you want.

Rule #10 – It’s OK to drive slowly

Finally, the final rule of wealth building is: remember that it's okay to go slow. This is especially true for Millennials.

I feel like everyone under 30 today wants the next thing, the next job, the next milestone, the next big paycheck. But they haven't even done this thing, learned this job, and haven't reached the current milestone.

Building wealth takes time. It's about making money today and using your time tomorrow. This is how wealth is created. Even if you get a $150,000 a year job today, you won't be any richer. Your first paycheck at this great new salary could be $5,000. That's not wealth. This is a starting point. You can build on that.

According to The Spectrum Group, the average millionaire in the United States is 62 years old. Only 1% of millionaires are under 35. Keep this in mind as you build your wealth.

What financial rules do you live by?

Create your very own Auto Publish News/Blog Site and Earn Passive Income in Just 4 Easy Steps